Zynga 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

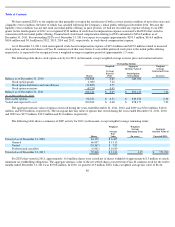

We have granted ZSUs to our employees that generally vest upon the satisfaction of both a service-

period condition of up to four years and

a liquidity event condition, the latter of which was satisfied following the Company’s initial public offering in December 2011. Because the

liquidity event condition was not met until our initial public offering, in prior periods, we had not recorded any expense relating to our ZSU

grants. In the fourth quarter of 2011 we recognized $510 million of stock-based compensation expense associated with ZSUs that vested in

connection with our initial public offering. Unamortized stock-based compensation relating to ZSUs amounted to $454.0 million as of

December 31, 2011. For outstanding ZSUs as of December 31, 2011 we expect to recognize approximately $293.5 million, $116.0 million,

$40.4 million and $4.1 million in 2012, 2013, 2014 and 2015, respectively, in stock-based compensation expense.

As of December 31, 2011, total unrecognized stock-based compensation expense of $15.4 million and $125.0 million related to unvested

stock options and unvested shares of Class B common stock that were Series Z convertible preferred stock prior to the initial public offering,

respectively, is expected to be recognized over a weighted-average recognition period of approximately 1.5 years.

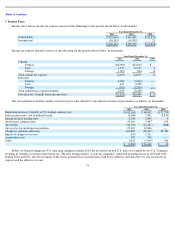

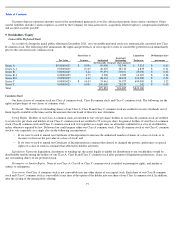

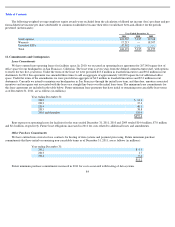

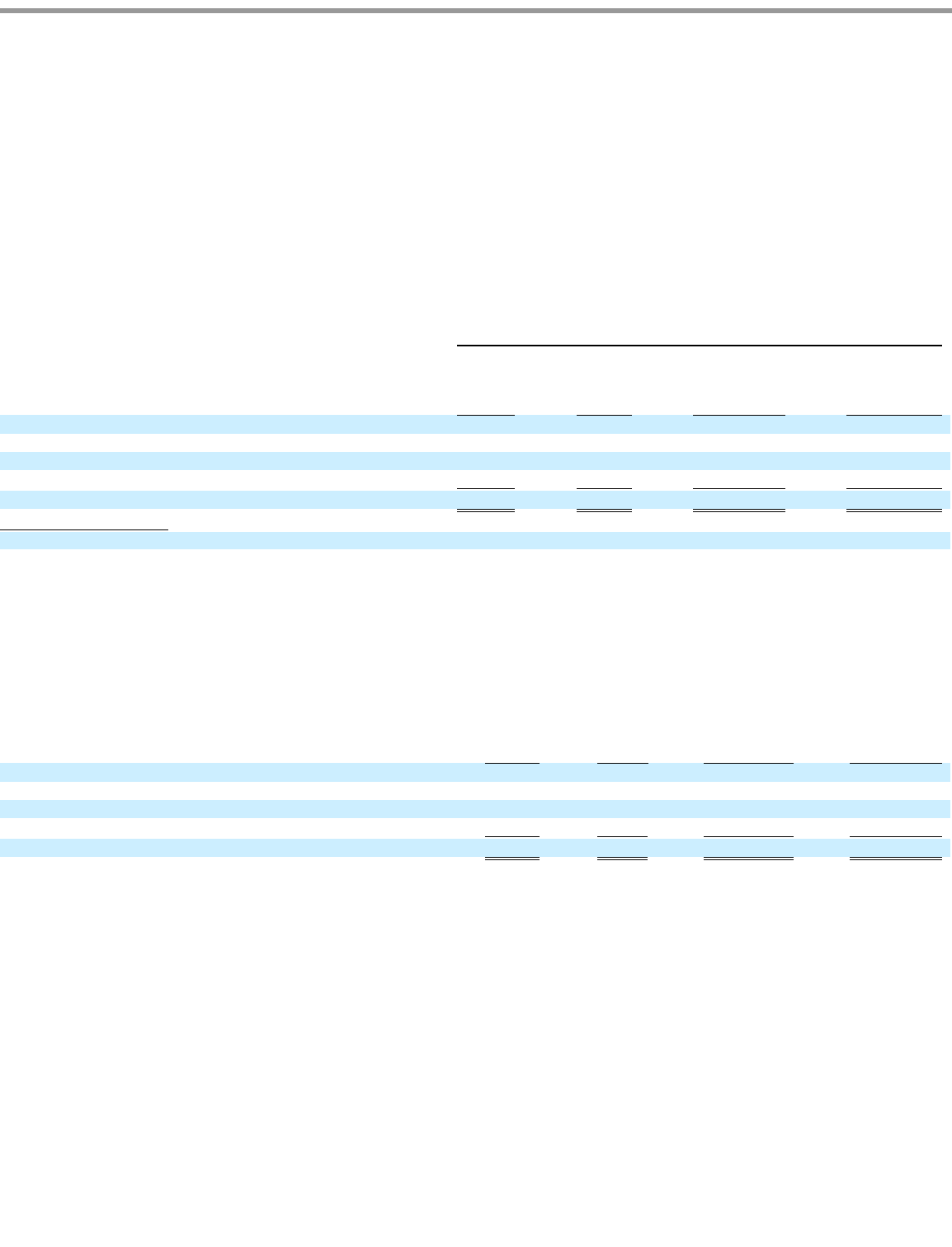

The following table shows stock option activity for 2011 (in thousands, except weighted average exercise price and contractual term):

The aggregate intrinsic value of options exercised during the years ended December 31, 2011, 2010, and 2009 was $78.2 million, $110.6

million, and $0.01 million, respectively. The total grant date fair value of options that vested during the years ended December 31, 2011, 2010,

and 2009 was $17.5 million, $12.9 million and $1.0 million, respectively.

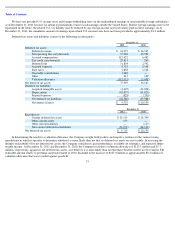

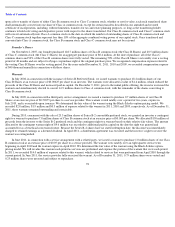

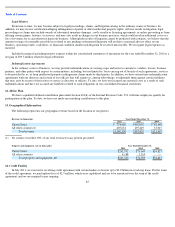

The following table shows a summary of ZSU activity for 2011 (in thousands, except weighted average remaining term):

For ZSUs that vested in 2011, approximately 16.0 million shares were issued net of shares withheld of approximately 8.3 million to satisfy

minimum tax withholding obligations. The aggregate intrinsic value of the net settled shares converted into Class B common stock for the twelve

months ended December 31, 2011 was $150.8 million. In 2010, we granted 41.9 million ZSUs with a weighted average fair value of $6.44.

80

Outstanding Options

Shares

Weighted

-

Average

Exercise

Price

Aggregate

Intrinsic Value of

Stock Options

Outstanding

Weighted

Average

Contractual Term

(In years)

Balance as of December 31, 2010

122,848

0.80

689,500

Stock option grants

1,080

7.22

Stock option forfeitures and cancellations

(12,885

)

2.55

Stock option exercises

(8,729

)

0.45

Balance as of December 31, 2011

102,314

$

0.69

$

892,135

7.04

As of December 31, 2011

Exercisable options

92,326

$

0.54

$

819,270

6.94

Vested and expected to vest

100,582

$

0.68

$

878,177

7.03

Shares

Weighted

Average

Fair

Value

Weighted

Average

Remaining Term

(In years)

Aggregate

Intrinsic Value of

Unvested ZSUs

Unvested as of December 31, 2010

44,179

$

6.435

Granted

66,907

$

13.13

Vested

(24,367

)

$

7.83

Forfeited and cancelled

(6,901

)

$

10.89

Unvested as of December 31, 2011

79,818

$

11.24

1.45

$

751,090