Zynga 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

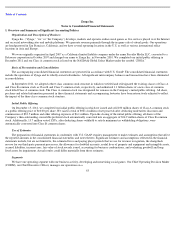

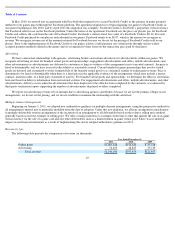

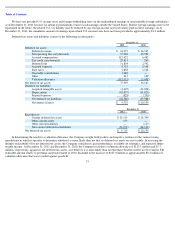

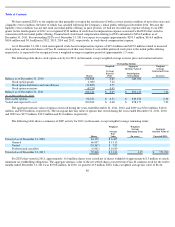

Changes in market interest rates and bond yields caused certain of the Company’s investments to fall below their cost basis, resulting in an

unrealized loss. All securities presented in the table above were in a continuous loss position for less than 12 months. There were no securities in

an unrealized loss position as of December 31, 2010. The following table shows all investments in an unrealized loss position for which an other-

than-temporary impairment has not been recognized and the related gross unrealized losses and fair value (in thousands):

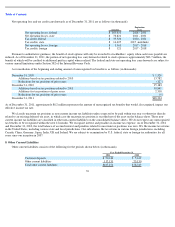

As of December 31, 2011, we did not consider any of our investments to be other-than-temporarily impaired. When evaluating its

investments for other-than-temporary impairment, we review factors such as the length of time and extent to which fair value has been below its

cost basis, the financial condition of the issuer, the Company’s intent to sell the security and whether it is more likely than not that the Company

will be required to sell the investment before recovery of its cost basis.

3. Fair Value Measurements

Our financial instruments consist of cash equivalents, short-term marketable securities and accounts receivable. Accounts receivable, net,

are stated at their carrying value, which approximates fair value due to the short time to expected receipt of cash.

Cash equivalents and short-term marketable securities, consisting of money market funds and U.S. government and corporate debt

securities, are carried at fair value, which is defined as an exit price, representing the amount that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between knowledgeable and willing market participants. As such, fair value is a market-based

measurement that should be determined based on assumptions that knowledgeable and willing market participants would use in pricing an asset

or liability. We use a three-tier value hierarchy, which prioritizes the inputs used in measuring fair value as follows:

Level 1 — Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets.

Level 2 — Includes other inputs that are directly or indirectly observable in the marketplace.

Level 3 — Unobservable inputs that are supported by little or no market activity.

70

December 31, 2011

Fair

Value

Unrealized

Losses

U.S. government debt securities

$

70,162

$

(53

)

Corporate debt securities

40,964

(64

)

Total

$

111,126

$

(117

)