Zynga 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Pro forma results of operations related to our 2011 acquisitions have not been presented because they are not material to our 2011 or 2010

consolidated statements of operations, either individually or in the aggregate.

2010 Acquisitions

In November 2010, we completed our acquisition of Newtoy, Inc., a provider of online mobile gaming services. The purchase price was

$53.3 million, consisting of $44.3 million in cash and the issuance of 1.4 million fully vested shares of our Series Z convertible preferred stock

with a fair value of $8.9 million. As a result of this acquisition, we recorded $18.4 million of developed technology, $6.1 million of trademarks,

$12.7 million of net liabilities assumed and $41.4 million of goodwill.

During 2010, we acquired six additional companies and these acquisitions were not individually significant. In the aggregate, the total

purchase price for these acquisitions was $48.4 million, which consisted of $22.1 million in cash and the issuance of 4.1 million shares of our

Series Z convertible preferred stock with a fair value of $26.3 million. In connection with our 2010 acquisitions, we incurred transaction costs of

$2.1 million that we expensed as incurred.

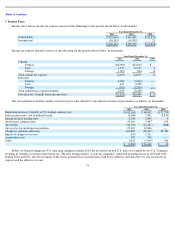

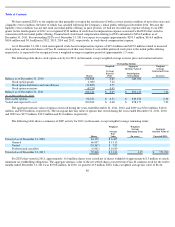

The following table summarizes our unaudited pro forma revenue and net income (loss) of the combined company for the years ended

December 31, 2010 and 2009 if we had made all of our 2010 acquisitions on January 1, 2009 and January 1, 2010, respectively (in thousands):

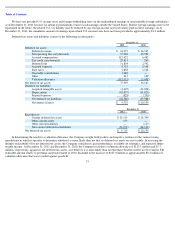

The following table summarizes the fair values of net tangible and intangible assets acquired for all business acquisitions for the years

ended December 31, 2011 and 2010 (in thousands). The fair values for our 2010 acquisitions include the impact of changes in initial fair values

of acquired assets and liabilities as a result of obtaining the necessary information. The fair values for our 2011 acquisitions were based upon a

preliminary valuation estimate. The preliminary purchase price allocations for each of our acquisitions are subject to change as we obtain

additional information for our estimates during the respective measurement periods. The primary areas of the preliminary purchase price

allocations that are not yet finalized related to certain tangible assets and liabilities acquired, income and non-income based taxes and residual

goodwill.

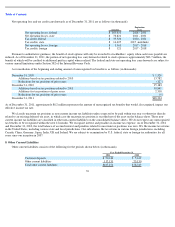

The weighted average useful life of all identified acquired intangible assets is 2.0 years while the weighted average useful life for

developed technologies is 1.9 years. Developed technologies associated with acquisitions are being amortized over periods ranging from 12 to 24

months. Trademarks acquired through the Newtoy acquisition are estimated to have an indefinite useful life and will be evaluated annually for

impairment, or more frequently, if circumstances indicate an impairment may exist.

To retain the services of certain former acquired company employees, we offered equity awards and cash bonuses that are earned over

time. As these equity awards and payments are subject to post-acquisition employment, we have accounted for them as post-acquisition

compensation expense. During 2011, we issued

72

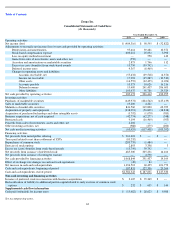

Year Ended December 31,

2010

2009

(Unaudited)

(Unaudited)

Pro forma revenue

$

607,827

$

126,838

Pro forma net income (loss)

$

77,135

$

(87,741

)

2011

2010

Developed technology

$

11,056

$

44,114

Trademarks

—

6,100

Net liabilities assumed

(1,530

)

(8,818

)

Goodwill

35,946

60,217

Total

$

45,472

$

101,613