Zynga 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

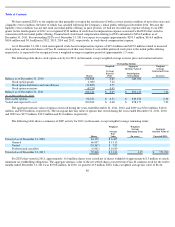

In December 2010, we cancelled an aggregate of 4.2 million unvested ZSUs held by certain of our employees in order to maintain

compliance with certain laws. The ZSUs were cancelled with no consideration given. In March 2011, our board of directors approved a grant of

1.1 million ZSUs to the then current employees impacted by this cancellation, all of which vested on the date of our initial public offering. Our

board of directors also approved a grant of 3.1 million ZSUs to these employees that have a 32 month service period condition that is fulfilled

monthly and were also subject to the liquidity condition (initial public offering or change of control) in order to vest. These ZSUs had a grant

date fair value of $6.44 per share. We also paid this group of employees retention cash bonus payments totaling $3.6 million.

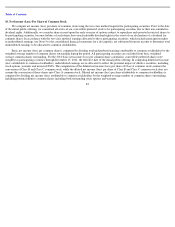

2011 Employee Stock Purchase Plan

Our 2011 Employee Stock Purchase Plan (“2011 ESPP”), was approved by our board of directors in September 2011 and by our

stockholders in November 2011. The maximum number of shares of our Class A common stock that may be issued under our 2011 ESPP is

8,500,000 shares.

Our 2011 ESPP permits participants to purchase shares of our Class A common stock through payroll deductions up to 15% of their

earnings. Unless otherwise determined by the administrator, the purchase price of the shares will be 85% of the lower of the fair market value of

our Class A common stock on the first day of an offering or on the date of purchase. The ESPP offers a six month look-

back feature as well as an

automatic reset feature that will roll the funds contributed by plan participants automatically into the next offering period if the price declines.

Participants may end their participation at any time during an offering and will be paid their accrued contributions that have not yet been used to

purchase shares. Participation ends automatically upon termination of employment with us.

As of December 31, 2011, there were no employee contributions made to the 2011 ESPP, and as a result, no stock-based compensation

expense was recognized in 2011.

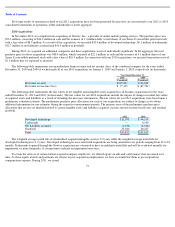

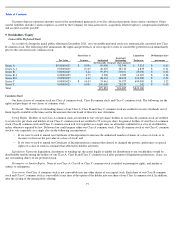

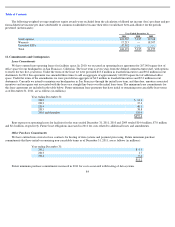

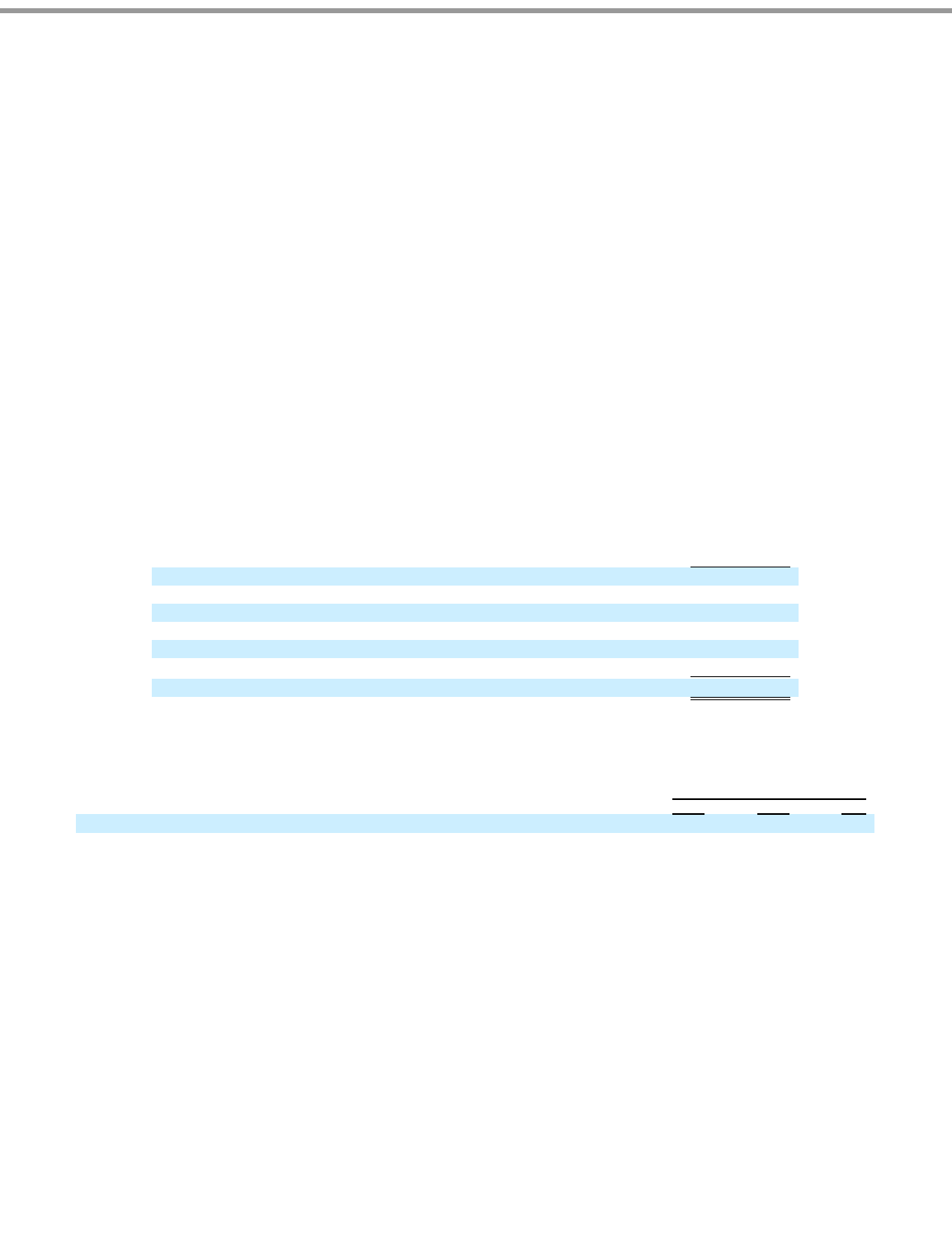

Common Stock Reserved for Future Issuance

For the period ended shown below, we had reserved shares of common stock for future issuance as follows (in thousands):

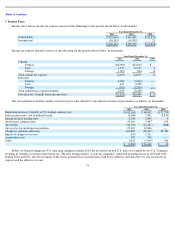

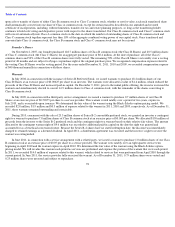

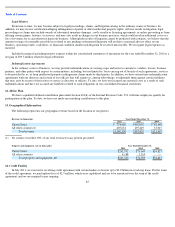

Accumulated Other Comprehensive Income

The components of accumulated other comprehensive income, net of taxes, were as follows (in thousands):

81

December 31, 2011

Common stock warrants

695

Stock options outstanding

102,314

ZSUs outstanding

79,818

Stock options and ZSUs reserved for future issuance

5,283

2011 Equity Incentive Plan

42,500

2011 Employee Stock Purchase Plan

8,500

239,110

December 31,

2011

2010

2009

Unrealized gains (losses) on available-for-sale securities

$

(91

)

$

117

$

3

Foreign currency translation

453

(3

)

18