Zynga 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

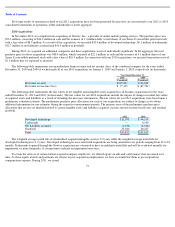

10. Net Income (Loss) Per Share of Common Stock

We compute net income (loss) per share of common stock using the two-

class method required for participating securities. Prior to the date

of the initial public offering, we considered all series of our convertible preferred stock to be participating securities due to their non-cumulative

dividend rights. Additionally, we consider shares issued upon the early exercise of options subject to repurchase and unvested restricted shares to

be participating securities, because holders of such shares have non-forfeitable dividend rights in the event of our declaration of a dividend for

common shares. In accordance with the two-class method, earnings allocated to these participating securities, which include participation rights

in undistributed earnings (see Note 9 to the consolidated financial statements for a description), are subtracted from net income to determine total

undistributed earnings to be allocated to common stockholders.

Basic net income (loss) per common share is computed by dividing total undistributed earnings attributable to common stockholders by the

weighted-average number of common shares outstanding during the period. All participating securities are excluded from basic weighted-

average common shares outstanding. For the 2011 basic net income (loss) per common share calculation, convertible preferred shares were

weighted as participating securities through December 15, 2011, the effective date of the initial public offering. In computing diluted net income

(loss) attributable to common stockholders, undistributed earnings are re-allocated to reflect the potential impact of dilutive securities, including

stock options, warrants and unvested ZSUs. The computation of the diluted net income (loss) per share of Class A common stock assumes the

conversion of Class B and Class C common stock, while the diluted net income (loss) per share of Class B and Class C common stock does not

assume the conversion of those shares into Class A common stock. Diluted net income (loss) per share attributable to common stockholders is

computed by dividing net income (loss) attributable to common stockholders by the weighted-average number of common shares outstanding,

including potential dilutive common shares including both outstanding stock options and warrants.

82