Zynga 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Business Combinations

We account for acquisitions of entities that include inputs and processes and have the ability to create outputs as business combinations.

We allocate the purchase price of the acquisition to the tangible assets, liabilities, and identifiable intangible assets acquired based on their

estimated fair values. The excess of the purchase price over those fair values is recorded as goodwill. Acquisition-related expenses and

restructuring costs are expensed as incurred. During the measurement period, we record adjustments to the assets acquired and liabilities

assumed with the corresponding offset to goodwill. After the measurement period, which could be up to one year after the transaction date,

subsequent adjustments are recorded to our consolidated statements of operations.

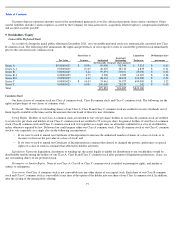

Goodwill and Indefinite-Lived Intangible Assets

Goodwill and indefinite-lived intangible assets are carried at cost and are evaluated annually for impairment, or more frequently if

circumstances exist which indicate that an impairment may exist. No impairment charges have been recorded to date.

Other Intangible Assets

Other intangible assets are carried at cost less accumulated amortization. Amortization is recorded over the estimated useful lives of the

assets, generally 12 to 24 months.

Impairment of Long-Lived Assets

Long-lived assets, including other intangible assets (excluding indefinite-lived intangible assets), are reviewed for impairment whenever

events or changes in circumstances indicate an asset’s carrying value may not be recoverable. If such circumstances are present, we assess the

recoverability of the long-lived assets by comparing the carrying amount to the estimated fair value calculated based on the undiscounted cash

flow associated with the related assets. If the future net undiscounted cash flows are less than the carrying amount of the assets, the assets are

considered impaired and an expense, equal to the amount required to reduce the carrying amount of the assets to the estimated fair value, is

recorded in the consolidated statements of operations to other income (expenses) net.

Stock-Based Compensation

We grant ZSUs to our employees that generally vest upon the satisfaction of service period criteria of up to four years and a liquidity

condition, the latter of which was satisfied in connection with our initial public offering in December 2011. The ZSUs have a contractual term of

seven years. Because the liquidity condition was not satisfied until our initial public offering, in prior periods, we had not recorded any expense

associated with ZSU grants.

For ZSUs granted prior to our initial public offering, we recognize stock-based compensation expense using the accelerated attribution

method, net of estimated forfeitures, in which compensation cost for each vesting tranche in an award is recognized ratably from the service

inception date to the vesting date for that tranche. For ZSUs granted after the initial public offering, which will only be subject to a service

condition, we will recognize stock-based compensation expense on a ratable basis over the requisite service period for the entire award.

In 2010 and 2011, we issued unvested Series Z preferred stock to employees of certain acquired companies. As the equity awards are

subject to post-acquisition employment, we have accounted for them as post-acquisition stock-based compensation expense. We recognize

compensation expense equal to the grant date fair value of the Series Z preferred stock on a straight-line basis over the four-year service period,

net of estimated forfeitures.

We estimate the fair value of stock options using the Black-Scholes option-pricing model. This model requires the use of the following

assumptions: (i) expected volatility of our common stock, which is based on our peer group in the industry in which we do business;

(ii) expected life of the option award, which we elected to

67