Zynga 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

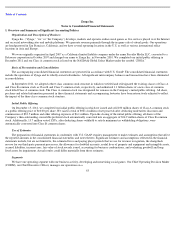

Table of Contents

Stock-based compensation expense is recorded net of estimated forfeitures so that expense is recorded for only those stock-based awards

that we expect to vest. We estimate forfeitures based on our historical forfeiture of equity awards adjusted to reflect future changes in facts and

circumstances, if any. We will revise our estimated forfeiture rate if actual forfeitures differ from our initial estimates. We record stock-based

compensation expense for stock options on a straight-line basis over the vesting term.

For stock options issued to non-employees, including consultants, we record expense equal to the fair value of the options calculated using

the Black-Scholes model over the service performance period. The fair value of options granted to non-

employees is remeasured over the vesting

period, and the resulting value is recognized as an expense over the period the services are received.

Recently Issued and Adopted Accounting Pronouncements

Presentation of Comprehensive Income

In June 2011, the Financial Accounting Standards Board, or FASB, issued an amendment to an existing accounting standard which

requires companies to present net income and other comprehensive income in one continuous statement or in two separate but consecutive

statements. The standard is effective for fiscal years beginning after December 15, 2011. We will adopt this standard in the first quarter of 2012.

Common Fair Value Measurement and Disclosure Requirements

In May 2011, the FASB issued an amendment to provide a consistent definition of fair value and ensure that the fair value measurement

and disclosure requirements are similar between U.S. GAAP and International Financial Reporting Standards. The amendment changes certain

fair value measurement principles and enhances the disclosure requirements particularly for Level 3 fair value measurements. The standard is

effective for fiscal years beginning after December 15, 2011. We will adopt this standard in the first quarter of 2012 and do not expect the

adoption to have a material impact on our financial statements and disclosures.

Testing of Goodwill Impairment

In September 2011, the FASB issued an amendment to an existing accounting standard which provides entities an option to perform a

qualitative assessment to determine whether further impairment testing on goodwill is necessary, thereby only requiring the current two-step test

to be completed if the qualitative assessment deems it necessary. This standard is effective for fiscal years beginning after December 15, 2011.

We will adopt this standard in the first quarter of 2012 and do not expect the adoption to have a material impact on our financial statements.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK

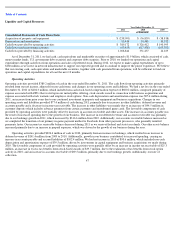

Interest Rate Fluctuation Risk

Our cash and cash equivalents and marketable securities consist of cash, money market funds, U.S. government debt securities and

corporate debt securities.

The primary objective of our investment activities is to preserve principal, ensure liquidity and maximize income without significantly

increasing risk. Our available-for-sale investments consist of U.S. government and corporate debt securities which may be subject to market risk

due to changes in prevailing interest rates that may cause the principal amount of the investment to fluctuate. Based on a sensitivity analysis, we

have determined that a hypothetical 100 basis points increase in interest rates would have resulted in a decrease in the fair values of our

investments of approximately $2.2 million as of December 31, 2011. Such losses would only be realized if we sold the investments prior to

maturity.

53