Zynga 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

We have not provided U.S. income taxes and foreign withholding taxes on the undistributed earnings of our profitable foreign subsidiaries

as of December 31, 2011 because we intend to permanently reinvest such earnings outside the United States. If these foreign earnings were to be

repatriated in the future, the related U.S. tax liability may be reduced by any foreign income taxes previously paid on these earnings. As of

December 31, 2011, the cumulative amount of earnings upon which U.S. income taxes have not been provided is approximately $1.2 million.

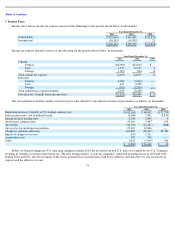

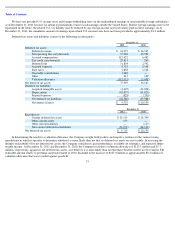

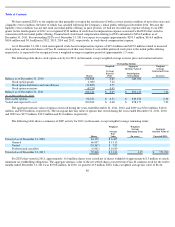

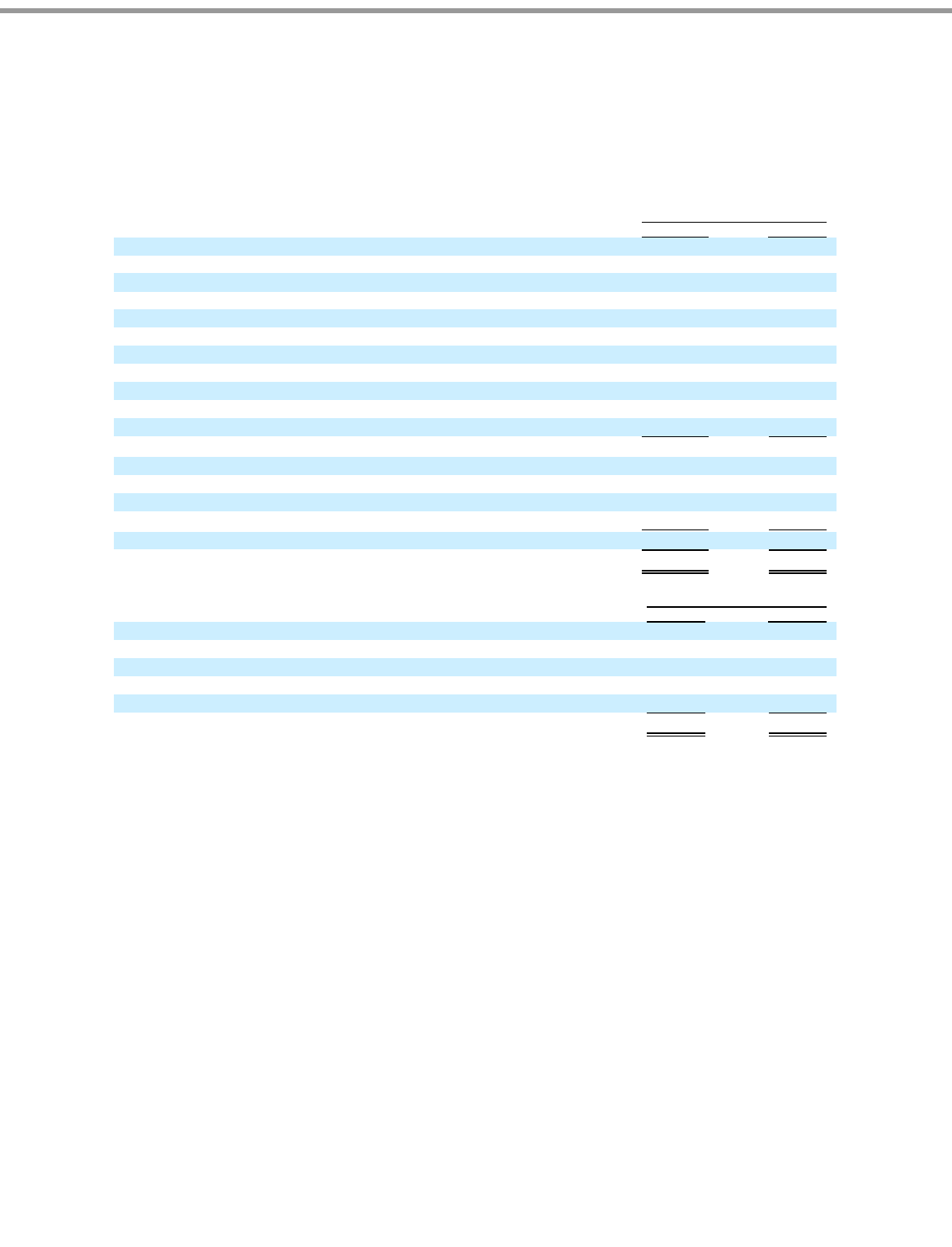

Deferred tax assets and liabilities consist of the following (in thousands):

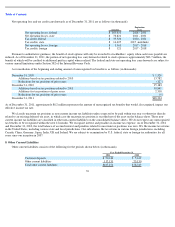

In determining the need for a valuation allowance, the Company weighs both positive and negative evidence in the various taxing

jurisdictions in which it operates to determine whether it is more likely than not that its deferred tax assets are recoverable. In assessing the

ultimate realizability of its net deferred tax assets, the Company considers its past performance, available tax strategies, and expected future

taxable income. At December 31, 2011 and December 31, 2010, the Company recorded a valuation allowance of $113.3 million and $5.7

million, respectively, against its net deferred tax assets, as it believes it is more likely than not that these benefits will be not be realized. The

realizable amount relates to potential carryback benefit to 2010. Included in the increase of $107.0 million is approximately $0.3 million of

valuation allowance that was recorded against goodwill.

75

December 31,

2011

2010

Deferred tax assets:

Deferred revenue

$

14,355

$

16,545

Net operating loss carryforwards

17,502

12,582

Accrued compensation

112,422

6,482

Tax credit carryforwards

25,811

249

Deferred rent

11,804

2,542

Accrued expenses

5,532

2,108

State taxes

1,858

1,148

Charitable contributions

1,448

—

Other

615

189

Valuation allowance

(113,352

)

(5,698

)

Net deferred tax assets

77,995

36,147

Deferred tax liabilities:

Acquired intangible assets

(4,495

)

(13,838

)

Depreciation

(62,957

)

(11,820

)

Prepaid expenses

(828

)

(330

)

Net deferred tax liabilities

(68,280

)

(25,988

)

Net deferre1d taxes

$

9,715

$

10,159

December 31,

2011

2010

Recorded as:

Current deferred tax assets

$

23,515

$

24,399

Other current assets

150

—

Other current liabilities

—

(

117

)

Non

-

current deferred tax liabilities

(13,950

)

(14,123

)

Net deferred tax assets

$

9,715

$

10,159