Xcel Energy 2007 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2. The recognition of this settlement resulted in total expense of $59.5 million, including federal and state tax,

interest on the federal and state tax liabilities, penalties, and tax benefits on the interest expense for the nine

months ended Sept. 30, 2007. The expense of $59.5 million includes $43.4 million of interest and penalties and

income tax of $16.1 million (net of tax benefit on the interest expense of $14.3 million).

3. Xcel Energy surrendered the policies to its insurer on Oct. 31, 2007, without recognizing a taxable gain.

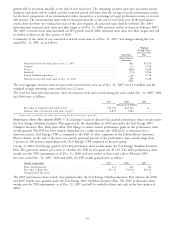

Accounting for Uncertainty in Income Taxes — an interpretation of FASB Statement No. 109 (FIN 48) — Xcel Energy

adopted FIN 48 as of Jan. 1, 2007. Xcel Energy files a consolidated federal income tax return, state tax returns based

on income in its major operating jurisdictions of Colorado, Minnesota, Texas, and Wisconsin, and various other state

income-based tax returns.

Xcel Energy has been audited by the IRS through tax year 2003, with a limited exception for 2003 research tax credits.

The IRS commenced an examination of Xcel Energy’s federal income tax returns for 2004 and 2005 (and research

credits for 2003) in the third quarter of 2006, and that examination is anticipated to be complete by March 31, 2008.

As of Dec. 31, 2007, the IRS has not proposed any material adjustments to tax years 2003 through 2005. The statute

of limitations applicable to Xcel Energy’s 2000 through 2002 federal income tax returns expired as of June 30, 2007.

As previously disclosed, Xcel Energy was in litigation with the federal government to establish its right to deduct

interest expense on COLI policy loans incurred since 1993. Xcel Energy and the IRS have reached a final settlement

regarding this litigation (see above discussion of COLI).

Xcel Energy is also currently under examination by the state of Minnesota for years 1998 through 2001 and the state

of Texas for years 2003 through 2005. No material adjustments have been proposed as of Dec. 31, 2007 for these state

audits. In the fourth quarter of 2007, the states of Colorado and Wisconsin concluded income tax audits through tax

year 2005. As of Dec. 31, 2007, Xcel Energy’s earliest open tax years in which an audit can be initiated by state taxing

authorities in its major operating jurisdictions are as follows: Colorado-2002, Minnesota-1998, Texas-2003, and

Wisconsin-2002.

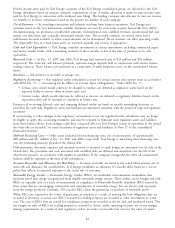

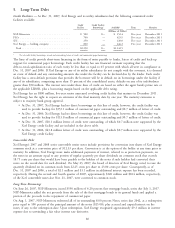

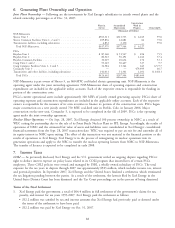

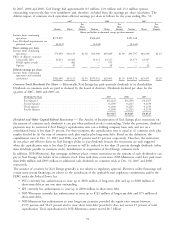

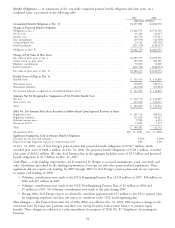

The amount of unrecognized tax benefits reported in continuing operations was $42.6 million on Jan. 1, 2007 and

$26.3 million on Dec. 31, 2007. The amount of unrecognized tax benefits reported in discontinued operations was

$4.7 million on Jan. 1, 2007 and $4.3 million on Dec. 31, 2007. A reconciliation of the beginning and ending

amount of unrecognized tax benefit in continuing operations is as follows:

(Millions of

Dollars)

Balance at Jan. 1, 2007 .................................................. $42.6

Additions based on tax positions related to the current year ............................ 10.4

Reductions based on tax positions related to the current year ........................... (0.4)

Additions for tax positions of prior years ....................................... 42.3

Reductions for tax positions of prior years ...................................... (5.0)

Settlements with taxing authorities ........................................... (63.6)

Balance at Dec. 31, 2007 ................................................. $26.3

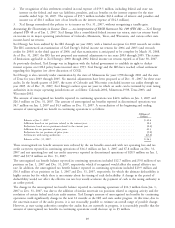

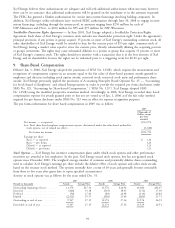

These unrecognized tax benefit amounts were reduced by the tax benefits associated with net operating loss and tax

credit carryovers reported in continuing operations of $14.3 million on Jan. 1, 2007 and $7.8 million on Dec. 31,

2007 and net operating loss and tax credit carryovers reported in discontinued operations of $28.9 million on Jan. 1,

2007 and $17.8 million on Dec. 31, 2007.

The unrecognized tax benefit balance reported in continuing operations included $12.7 million and $9.8 million of tax

positions on Jan. 1, 2007 and Dec. 31, 2007, respectively, which if recognized would affect the annual effective tax

rate. In addition, the unrecognized tax benefit balance reported in continuing operations included $29.9 million and

$16.5 million of tax positions on Jan. 1, 2007 and Dec. 31, 2007, respectively, for which the ultimate deductibility is

highly certain but for which there is uncertainty about the timing of such deductibility. A change in the period of

deductibility would not affect the effective tax rate but would accelerate the payment of cash to the taxing authority to

an earlier period.

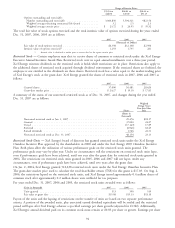

The change in the unrecognized tax benefit balance reported in continuing operations of $16.3 million from Jan. 1,

2007 to Dec. 31, 2007, was due to the addition of similar uncertain tax positions related to ongoing activity and the

resolution of certain federal and state audit matters. Xcel Energy’s amount of unrecognized tax benefits for continuing

operations could significantly change in the next 12 months as the IRS and state audits progress. At this time, due to

the uncertain nature of the audit process, it is not reasonably possible to estimate an overall range of possible change.

However, as state taxing authorities complete the audits that are currently in progress, it is reasonably possible that the

amount of unrecognized tax benefits in continuing operations could decrease up to $5 million.

89