Xcel Energy 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Credit Risk — Xcel Energy and its subsidiaries are also exposed to credit risk. Credit risk relates to the risk of loss

resulting from the nonperformance by a counterparty of its contractual obligations. Xcel Energy and its subsidiaries

maintain credit policies intended to minimize overall credit risk and actively monitor these policies to reflect changes

and scope of operations.

Xcel Energy and its subsidiaries conduct standard credit reviews for all counterparties. Xcel Energy employs additional

credit risk control mechanisms, such as letters of credit, parental guarantees, standardized master netting agreements and

termination provisions that allow for offsetting of positive and negative exposures. The credit exposure is monitored

and, when necessary, the activity with a specific counterparty is limited until credit enhancement is provided.

At Dec. 31, 2007, a 10-percent increase in prices would have resulted in a net mark-to-market increase in credit risk

exposure of $19.6 million, while a decrease of 10 percent would have resulted in a decrease of $12.0 million.

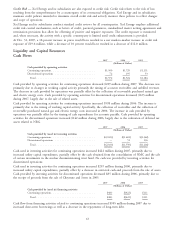

Liquidity and Capital Resources

Cash Flows

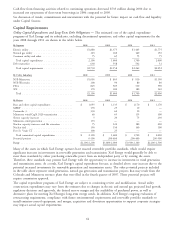

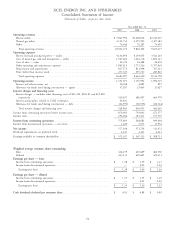

2007 2006 2005

(Millions of Dollars)

Cash provided by operating activities

Continuing operations .......................... $1,500 $1,729 $1,131

Discontinued operations ........................ 72 195 53

Total ................................... $1,572 $1,924 $1,184

Cash provided by operating activities for continuing operations decreased $229 million during 2007. The decrease was

primarily due to changes in working capital activity primarily the timing of accounts receivables and unbilled revenues.

The decrease in cash provided by operations was partially offset by the collection of recoverable purchased natural gas

and electric energy costs. Cash provided by operating activities for discontinued operations decreased $123 million

during 2007, largely due to the sale of related assets.

Cash provided by operating activities for continuing operations increased $598 million during 2006. The increase is

primarily due to the timing of working capital activity. Specifically, the collection of receivables and the collection of

recoverable purchased natural gas and electric energy costs increased in 2006. The increase in cash provided by

operations was partially offset by the timing of cash expenditures for accounts payable. Cash provided by operating

activities for discontinued operations increased $142 million during 2006, largely due to the realization of deferred tax

assets related to NRG.

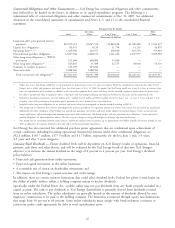

2007 2006 2005

(Millions of Dollars)

Cash provided by (used in) investing activities

Continuing operations .......................... $(2,023) $(1,601) $(1,362)

Discontinued operations ........................ — 51 136

Total ................................... $(2,023) $(1,550) $(1,226)

Cash used in investing activities for continuing operations increased $422 million during 2007, primarily due to

increased utility capital expenditures, partially offset by the cash obtained from the consolidation of NMC and the sale

of certain investments in the nuclear decommissioning trust fund. No cash was provided by investing activities for

discontinued operations.

Cash used in investing activities for continuing operations increased $239 million during 2006, primarily due to

increased utility capital expenditures, partially offset by a decrease in restricted cash and proceeds from the sale of assets.

Cash provided by investing activities for discontinued operations decreased $85 million during 2006, primarily due to

the receipt of proceeds from the sale of Cheyenne and Seren in 2005.

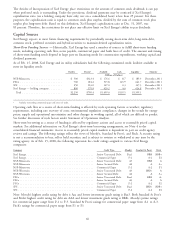

2007 2006 2005

(Millions of Dollars)

Cash provided by (used in) financing activities

Continuing operations .......................... $483 $(422) $111

Total ................................... $483 $(422) $111

Cash flow from financing activities related to continuing operations increased $905 million during 2007 due to

increased short-term borrowings as well as a decrease in the repayments of long-term debt.

63