Xcel Energy 2007 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

activities, revenues associated with processing solid waste into refuse-derived fuel and investments in rental housing

projects that qualify for low-income housing tax credits.

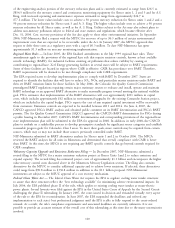

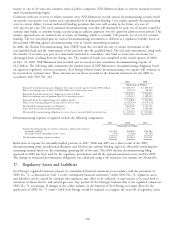

To report income from continuing operations for regulated electric and regulated natural gas utility segments, Xcel

Energy must assign or allocate all costs and certain other income. In general, costs are:

• directly assigned wherever applicable;

• allocated based on cost causation allocators wherever applicable; and

• allocated based on a general allocator for all other costs not assigned by the above two methods.

The accounting policies of the segments are the same as those described in Note 1 to the consolidated financial

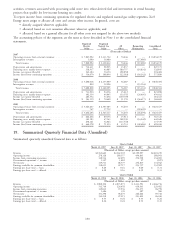

statements. Regulated Regulated

Electric Natural Gas All Reconciling Consolidated

Utility Utility Other Eliminations Total

(Thousands of Dollars)

2007

Operating revenues from external customers ............. $7,847,992 $ 2,111,732 $ 74,446 $ — $ 10,034,170

Intersegment revenues .......................... 1,000 16,680 — (17,680) —

Total revenues ............................. $7,848,992 $ 2,128,412 $ 74,446 $ (17,680) $ 10,034,170

Depreciation and amortization ..................... $ 714,411 $ 98,925 $ 13,837 $ — $ 827,173

Financing costs, mainly interest expense ................ 318,937 43,985 180,757 (14,834) 528,845

Income tax expense (benefit) ...................... 343,184 50,150 (98,850) — 294,484

Income (loss) from continuing operations ............... $ 554,670 $ 108,054 $ (22,583) $ (64,242) $ 575,899

2006

Operating revenues from external customers ............. $7,608,018 $ 2,155,999 $ 76,287 $ — $ 9,840,304

Intersegment revenues .......................... 820 12,296 — (13,116) —

Total revenues ............................. $7,608,838 $ 2,168,295 $ 76,287 $ (13,116) $ 9,840,304

Depreciation and amortization ..................... $ 711,930 $ 94,356 $ 15,612 $ — $ 821,898

Financing costs, mainly interest expense ................ 302,114 44,965 133,558 (24,605) 456,032

Income tax expense (benefit) ...................... 283,552 37,656 (139,797) — 181,411

Income (loss) from continuing operations ............... $ 503,119 $ 70,609 $ 51,570 $ (56,617) $ 568,681

2005

Operating revenues from external customers ............. $7,243,637 $ 2,307,385 $ 74,455 $ — $ 9,625,477

Intersegment revenues .......................... 767 17,732 — (18,499) —

Total revenues ............................. $7,244,404 $ 2,325,117 $ 74,455 $ (18,499) $ 9,625,477

Depreciation and amortization ..................... $ 662,236 $ 89,174 $ 15,911 $ — $ 767,321

Financing costs, mainly interest expense ................ 301,185 47,145 108,538 (14,242) 442,626

Income tax expense (benefit) ...................... 258,161 32,923 (117,545) — 173,539

Income (loss) from continuing operations ............... $ 440,578 $ 71,213 $ 35,733 $ (48,486) $ 499,038

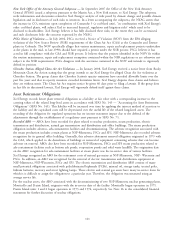

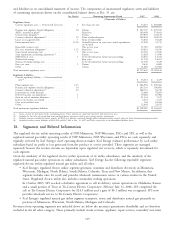

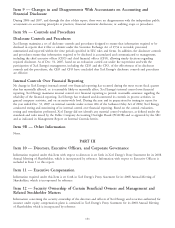

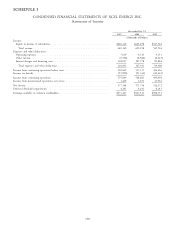

19. Summarized Quarterly Financial Data (Unaudited)

Summarized quarterly unaudited financial data is as follows:

Quarter Ended

March 31, 2007 June 30, 2007 Sept. 30, 2007 Dec. 31, 2007

(Thousands of Dollars, except per share amounts)

Revenue ......................................... $2,763,662 $2,267,292 $2,399,997 $2,603,219

Operating income ................................... 278,128 289,157 494,845 288,941

Income from continuing operations ......................... 118,514 67,695 254,720 134,969

Discontinued operations — income ......................... 1,197 1,082 97 (927)

Net income ....................................... 119,711 68,777 254,817 134,042

Earnings available for common shareholders .................... 118,651 67,717 253,757 132,982

Earnings per share total — basic ........................... $ 0.29 $ 0.16 $ 0.60 $ 0.31

Earnings per share total — diluted .......................... 0.28 0.16 0.59 0.31

Quarter Ended

March 31, 2006 June 30, 2006 Sept. 30, 2006 Dec. 31, 2006

(Thousands of Dollars, except per share amounts)

Revenue ......................................... $2,888,104 $ 2,073,873 $ 2,411,591 $ 2,466,736

Operating income ................................... 312,749 224,658 410,103 229,482

Income from continuing operations ......................... 149,812 97,936 224,175 96,758

Discontinued operations — income ......................... 1,486 339 287 960

Net income ....................................... 151,298 98,275 224,462 97,718

Earnings available for common shareholders .................... 150,238 97,215 223,402 96,658

Earnings per share total — basic ........................... $ 0.37 $ 0.24 $ 0.55 $ 0.24

Earnings per share total — diluted .......................... 0.36 0.24 0.53 0.23

130