Xcel Energy 2007 Annual Report Download - page 121

Download and view the complete annual report

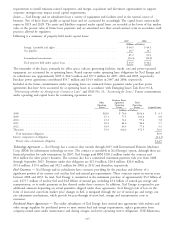

Please find page 121 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.year base period adjusted for known and measurable changes and includes a requested rate of return on equity of

11.0 percent, an electric rate base of approximately $307.3 million and an equity ratio of 51.2 percent.

• The NMPRC suspended the requested effective date for an additional 12 months beyond the requested effective

date, the maximum permitted under New Mexico law.

• Intervenor testimony is due in March 2008, and hearings are scheduled for April 2008.

• The hearing examiner is requested to issue a recommendation by June 30, 2008.

• A decision on the request is expected in the third quarter of 2008, and final rates are expected to be

implemented by Aug. 29, 2008.

Electric and Resource Adjustment Clauses

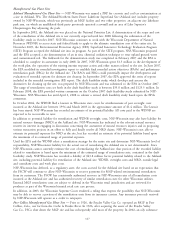

New Mexico Fuel Factor Continuation Filing — In August 2005, SPS filed with the NMPRC requesting continuation

of the use of SPS’ fuel and purchased power cost adjustment clause (FPPCAC) and current monthly factor cost

recovery methodology. This filing was required by NMPRC rule.

Testimony was filed in the case by staff and intervenors objecting to SPS’ assignment of system average fuel costs to

certain wholesale sales and the inclusion of certain purchased power capacity and energy payments in the FPPCAC.

The testimony also proposed limits on SPS’ future use of the FPPCAC. Related to these issues some intervenors

requested disallowances for past periods, which in the aggregate total approximately $45 million. This claim was for the

period from Oct. 1, 2001 through May 31, 2005 and does not include the value of incremental cost assigned for

wholesale transactions from that date forward. Other issues in the case include the treatment of renewable energy

certificates and SO2 allowance credit proceeds in relation to SPS’ New Mexico retail fuel and purchased power recovery

clause.

In December 2007, SPS, the NMPRC, Occidental Permian Ltd. and the New Mexico Industrial Energy Consumers

(NMIEC) filed an uncontested settlement of this matter with the NMPRC.

• The settlement resolves all issues in the fuel continuation proceeding for total consideration of $15 million.

• The amounts include resolution of all system average fuel matters through Dec. 31, 2007 with a refund to

customers of $11.7 million.

• Resolution of issues related to capacity costs and SO2 allowances resulting in refunds totaling $1.8 million.

• A commitment to fund low-income energy efficiency programs in 2008 and 2009 and invest in a solar project

all at a total cost of $1.5 million.

• At Dec. 31, 2007, a reserve had been previously established for this potential exposure, with no further expense

accrual required, assuming this settlement is approved.

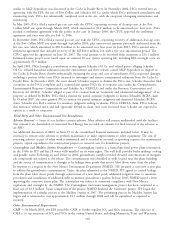

• The settlement would also resolve certain affiliate transactions raised by the parties, provide for significantly

greater certainty surrounding system average fuel cost assignment on a going forward basis and reduce

percentages of system average cost wholesale sales between now and 2019 on a stepped down basis.

• Under the terms of the settlement, SPS anticipates additional fuel cost disallowances in 2008 and a portion of

2009 of approximately $2 million per year. It does not anticipate any future disallowances beyond this period.

• The settlement would eliminate the need for any future proceedings related to wholesale contracts in effect in

2006 and beyond, and affiliate transactions dating back to the merger creating Xcel Energy in 2000, as would

have been required under the hearing examiner’s recommended decision.

• Finally, the settlement provides for SPS to continue its use of the FPPCAC subject to additional reporting

provisions.

Because New Mexico procedures traditionally require a hearing on any proposed settlement, the parties to the

settlement have jointly requested that the settlement be remanded back to the ALJ for such hearings before being taken

up by the NMPRC. In January 2008, the NMPRC issued an order remanding the proceeding to the hearing examiner.

A hearing on the settlement has been set for April 2008.

Other

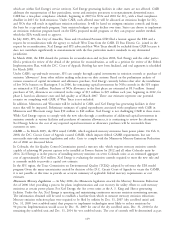

Investigation of SPS Participation in SPP — In October 2007, the NMPRC issued an order initiating an investigation

to consider the prudence and reasonableness of SPS’ participation in the SPP RTO. The investigation will consider the

costs and benefits of RTO participation to SPS customers in New Mexico. The order required SPS to file direct

testimony no later than 75 days after the completion of the hearing in the New Mexico electric rate case.

111