Xcel Energy 2007 Annual Report Download - page 122

Download and view the complete annual report

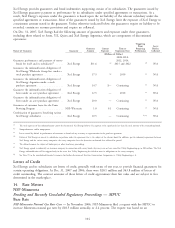

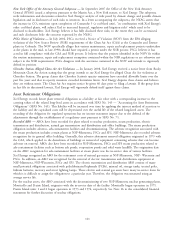

Please find page 122 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Investigation into the Reasonableness of Executive Compensation — In December 2007, the NMPRC initiated an

investigation into executive compensation of investor-owned electric and natural gas utilities serving within the state.

SPS is required to report executive and board compensation levels for the past 30 years.

Pending and Recently Concluded Regulatory Proceedings — FERC

Wholesale Rate Complaints — In November 2004, Golden Spread Electric, Lyntegar Electric, Farmer’s Electric, Lea

County Electric, Central Valley Electric and Roosevelt County Electric, all wholesale cooperative customers of SPS, filed

a rate complaint with the FERC alleging that SPS’ rates for wholesale service were excessive and that SPS had

incorrectly calculated monthly fuel cost adjustments contained in SPS’ wholesale rate schedules (the Complaint).

Among other things, the complainants asserted that SPS was not properly calculating the fuel costs that are eligible for

recovery and that SPS had inappropriately allocated average fuel and purchased power costs to its other wholesale

customers, effectively raising the fuel cost charges to complainants. Additionally, the Complaint alleged that the base

rates being charged were too high and that the FERC should act to lower SPS’ customers’ rates. Cap Rock Energy

Corporation (Cap Rock), a full-requirements customer of SPS, Public Service Company of New Mexico (PNM) and

Occidental Permian Ltd. and Occidental Power Marketing, L.P. (Occidental), SPS’ largest retail customer, intervened in

the proceeding.

In May 2006, a FERC administrative law judge (ALJ) issued an initial recommended decision in the proceeding. In the

recommended decision, the ALJ found that SPS should recalculate its wholesale fuel and purchased economic energy

cost adjustment clause (FCAC) billings for the period beginning Jan. 1, 1999, to reduce the fuel and purchased power

costs recovered from the complaining customers by allocating incremental fuel costs incurred by SPS in making

wholesale sales of system firm capacity and associated energy to other firm customers served under market-based rates

during this period based on the view that such sales should be treated as opportunity sales. In addition, the ALJ made

recommendations on a number of base rate issues including a 9.64 percent ROE and the use of a 3-month coincident

peak (3CP) demand allocator. The FERC will review the ALJ’s recommended decisions and issue a final order, which

may or may not follow any of the ALJ’s recommendation.

SPS believes the ALJ erred on significant and material issues that contradict FERC policy or rules of law. Specifically,

SPS believes, based on FERC rules and precedent, that it has appropriately applied its FCAC tariff to the proper classes

of customers. These firm market-based sales were of a long-term duration under FERC precedent and were made from

SPS’ entire system. Accordingly, SPS believes that the ALJ erred in concluding that these transactions were opportunity

sales, which require the assignment of incremental costs.

The FERC has approved system average cost allocation treatment in previous filings by SPS for sales having similar

service characteristics and previously accepted for filing certain of the challenged agreements with average fuel cost

pricing.

Moreover, SPS believes that the ALJ’s recommendation constituted a violation of the filed rate doctrine in that it

effectively results in a retroactive amendment to the SPS FERC-approved FCAC tariff provisions. Under existing

regulations, the FERC may modify a previously approved FCAC on a prospective basis. Accordingly, SPS believes it has

applied its FCAC correctly and has sought review of the recommended decision by the FERC by filing a brief on the

exceptions.

SPS believes it should ultimately prevail in this proceeding; however, if the FERC were to adopt the majority of the

ALJ’s recommendations, SPS’ refund exposure, including Golden Spread, could be approximately $50 million, based on

an evaluation of all sales made from Jan. 1, 1999 to Dec. 31, 2006. This estimate is based upon sales to wholesale

customers of SPS that had been customers for less than five years and assumes that the FERC would not assign

incremental fuel cost to agreements with longstanding customers to whom SPS has assigned system average fuel costs

for many years. If the FERC were to assign incremental fuel costs to longstanding customers, SPS’ exposure could

exceed $50 million.

SPS has reached a settlement with Golden Spread (which now includes Lyntegar Electric) and Occidental regarding base

rate and fuel issues. In December 2007, this comprehensive offer of settlement (the Settlement) was filed with the

FERC. If the Settlement is approved, any potential exposure faced by SPS for fuel cost disallowances in the Complaint

proceeding would be reduced by approximately 40 percent, Golden Spread’s relative proportion of energy delivered

during the period.

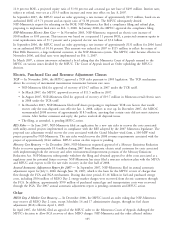

The Settlement seeks approval of:

• A $1.25 million payment by SPS to Golden Spread related to potential damage claims Golden Spread may have

associated with the quantities they are entitled to take under the existing partial requirements agreement for the

years 2006 and 2007. The Settlement caps those quantities for the period 2008 through 2011. SPS is not

112