Xcel Energy 2007 Annual Report Download - page 94

Download and view the complete annual report

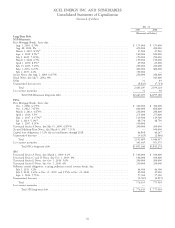

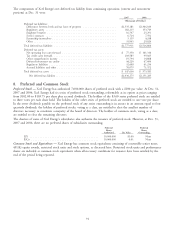

Please find page 94 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.provisions, management considered cash flow analyses, bids and offers related to those assets and businesses. Assets held

for sale are not depreciated.

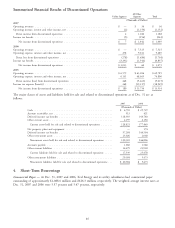

Results of operations for divested businesses and the results of businesses held for sale are reported, for all periods

presented, as discontinued operations. In addition, the assets and liabilities of the businesses divested and held for sale

in 2007 and 2006 have been reclassified to assets and liabilities held for sale in the consolidated balance sheets. The

majority of current and noncurrent assets related to discontinued operations are deferred tax assets associated with

temporary differences and NOL and tax credit carryforwards that will be deductible in future years.

Regulated Utility Subsidiaries

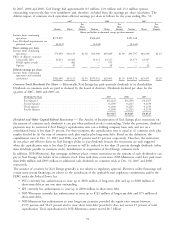

In 2005, Black Hills Corp. purchased all the common stock of Cheyenne, including the assumption of outstanding

debt of approximately $25 million, for approximately $90 million, plus a working capital adjustment finalized in 2005.

The sale resulted in an after-tax loss of approximately $13 million, or 3 cents per share.

Nonregulated Subsidiaries

Utility Engineering — In April 2005, Zachry acquired all of the outstanding shares of UE. Xcel Energy recorded an

insignificant loss during 2005 as a result of the transaction. The majority of Quixx Corp., including Borger Energy

Associates and Quixx Power Services, Inc., was sold in October 2006 to affiliates of Energy Investors Funds.

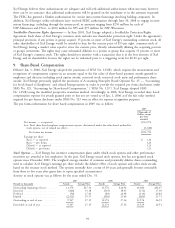

Seren — In November 2005, Xcel Energy sold Seren’s California assets to WaveDivision Holdings, LLC. In

January 2006, Xcel Energy sold Seren’s Minnesota assets to Charter Communications. An estimated after-tax

impairment charge, including disposition costs, of $143 million, or 34 cents per share, was recorded in 2004. Based on

the sales agreements entered into in 2005, the estimate was adjusted in 2005 to reflect a total asset impairment of

$140 million.

Xcel Energy International and e prime — The exit of all business conducted by Xcel Energy International was

completed in 2004. The results of discontinued nonregulated operations in 2004 include the impact of the sale of the

Argentina subsidiaries of Xcel Energy International, for a sales price of approximately $31 million. In addition to the

sales price, Xcel Energy also received approximately $21 million at the closing of one transaction as redemption of its

capital investment. The sales resulted in a gain of approximately $8 million, including the realization of approximately

$7 million of income tax benefits realizable upon the sale of the Xcel Energy International assets. The exit of all

business conducted by e prime was completed in 2004.

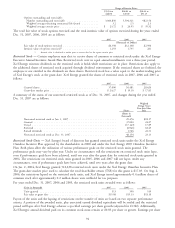

NRG — With NRG’s emergence from bankruptcy in December 2003, Xcel Energy divested its ownership interest in

NRG. Xcel Energy recognized a $17 million tax benefit related to the divestiture of NRG in 2005. These tax expenses

and benefits are reported as discontinued operations.

84