Xcel Energy 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

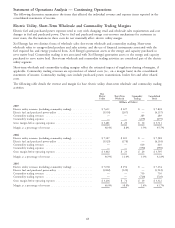

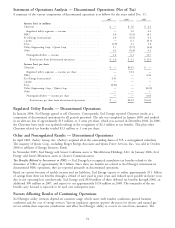

2007 Comparison to 2006 — The increase in operating and maintenance expenses for 2007 was largely driven by

recording a $17 million regulatory asset for private nuclear fuel storage costs which had been previously expensed and

higher net gains on sales of assets in 2006. Also, higher combustion/hydro and nuclear plant costs increased operating

and maintenance expense. Offsetting these increases in operating and maintenance expenses were lower performance

based incentive plan expense as well as lower healthcare expense. Also partially offsetting the increased operating and

maintenance expenses were lower nuclear plant outage costs, due to two refueling outages in 2006 versus only one

outage in 2007.

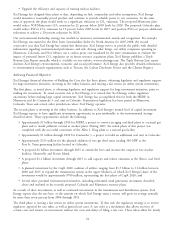

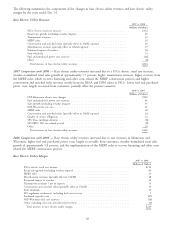

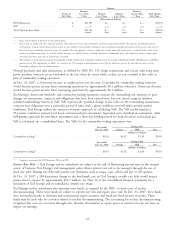

2006 vs. 2005

(Millions of Dollars)

Transmission fees classification change ....................................... $(26)

Private Fuel Storage regulatory asset ........................................ (17)

Gains on sale or disposal of assets, net ....................................... (9)

Lower nuclear plant outage costs .......................................... (4)

Higher employee benefit costs, primarily performance-based ......................... 38

Higher combustion/hydro plant costs ....................................... 24

Higher nuclear plant operating costs ........................................ 22

Higher uncollectible receivable costs ........................................ 15

Higher consulting costs ................................................ 8

Higher conservation incentive programs (offset in electric margins) ..................... 4

Other, including fleet transportation and facilities costs ............................ 11

Total increase in other operating and maintenance expenses ........................ $66

2006 Comparison to 2005 — Other operating and maintenance expenses for 2006 increased $66 million, or

3.9 percent, compared with 2005. Higher employee benefit costs, which are primarily performance-based, higher

nuclear and combustion/hydro plant costs were offset by lower nuclear plant outage costs, the transmission

reclassification, gains on sales of assets, and the establishment of the private fuel storage regulatory asset, based on a

regulatory decision.

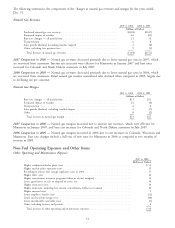

Depreciation and Amortization — Depreciation and amortization expense increased by approximately $5 million, or

0.6 percent, for 2007, compared to 2006. Depreciation increased due to capital additions and was largely offset by the

MPUC approval of NSP-Minnesota’s remaining lives depreciation filing, which lengthened the life of the Monticello

nuclear plant by 20 years, as well as certain other smaller plant life adjustments and adjustments to depreciable lives

from the Texas rate case settlement. Both of these decisions were effective Jan. 1, 2007, and in total reduced

depreciation expense by $45 million for the year.

Depreciation and amortization expense increased by approximately $55 million, or 7.1 percent, for 2006 compared with

2005. Decommissioning accruals increased $20 million in 2006. Normal plant additions accounted for the remaining

increase in depreciation expense for 2006 over 2005.

AFDC — AFDC increased in total by $16 million for 2007 when compared to 2006. The increase was due primarily

to large capital projects, including Comanche 3 and a portion of MERP, with long construction periods.

AFDC increased in total by approximately $14 million for 2006 when compared to 2005. The increase was due

primarily to large capital projects beginning in 2005 and 2006, including MERP and Comanche 3, with long

construction periods. The increase was partially offset by the current recovery from customers of the financing costs

related to MERP through a MERP rider resulting in a lower recognition of AFDC.

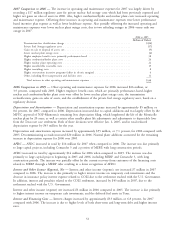

Interest and Other Income (Expense), Net — Interest and other income (expense), net increased $7 million in 2007

compared to 2006. The increase is due primarily to higher interest income on temporary cash investments and the

decrease in insurance policy interest expense related to COLI due to the settlement reached with the U.S. Government.

In addition, interest and penalties related to the COLI settlement, increased by $43 million in 2007, due to the

settlement reached with the U.S. Government.

Interest and other income (expense) net increased $3 million in 2006 compared to 2005. The increase is due primarily

to higher interest income on temporary cash investments, and the deferred fuel assets in Texas.

Interest and Financing Costs — Interest charges increased by approximately $33 million, or 6.8 percent, for 2007

compared with 2006. The increase is due to higher levels of both short-term and long-term debt and higher interest

rates.

52