Xcel Energy 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

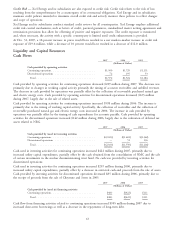

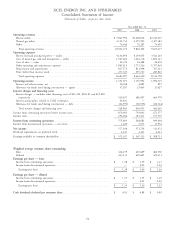

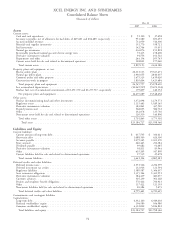

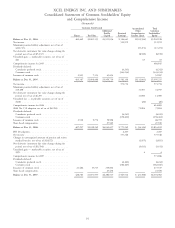

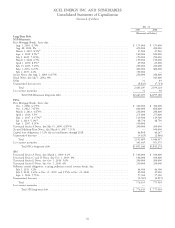

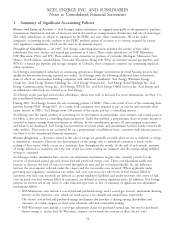

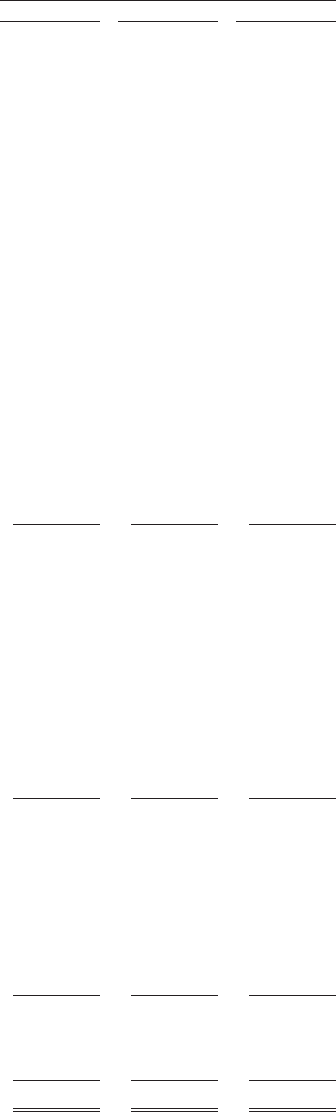

XCEL ENERGY INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(thousands of dollars)

Year ended Dec. 31

2007 2006 2005

Operating activities

Net income ................................................. $ 577,348 $ 571,754 $ 512,972

Remove income from discontinued operations ............................ (1,449) (3,073) (13,934)

Adjustments to reconcile net income to cash provided by operating activities:

Depreciation and amortization .................................... 855,897 857,129 782,074

Nuclear fuel amortization ....................................... 53,453 47,531 45,330

Deferred income taxes ......................................... 265,277 (59,843) 205,058

Amortization of investment tax credits ............................... (8,680) (9,806) (11,620)

Allowance for equity funds used during construction ...................... (37,207) (25,045) (21,627)

Undistributed equity in earnings of unconsolidated affiliates .................. (1,900) (2,775) (712)

Gain or write down of assets sold or held for sale ........................ — (6,189) 2,887

Share-based compensation expense .................................. 22,871 40,384 27,598

Net realized and unrealized hedging and derivative transactions ................ 6,463 (27,219) 9,715

Changes in operating assets and liabilities (net of effects of consolidation of NMC)

Accounts receivable .......................................... (79,373) 176,732 (250,305)

Accrued unbilled revenues ..................................... (217,659) 99,716 (178,585)

Inventories ............................................... (25,464) 28,967 (94,605)

Recoverable purchased natural gas and electric energy costs ................. 185,185 136,470 (130,442)

Other current assets ......................................... (9,922) (1,831) 2,002

Accounts payable ........................................... (10,018) (105,707) 281,430

Net regulatory assets and liabilities ................................ 27,428 (34,211) (20,433)

Other current liabilities ....................................... 52,771 97,216 15,927

Change in other noncurrent assets .................................. (56,053) 4,956 (39,995)

Change in other noncurrent liabilities ................................ (99,098) (56,415) 7,699

Operating cash flows provided by discontinued operations ..................... 72,346 195,255 53,283

Net cash provided by operating activities ............................ 1,572,216 1,923,996 1,183,717

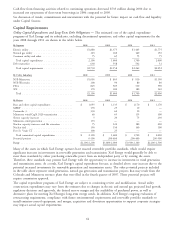

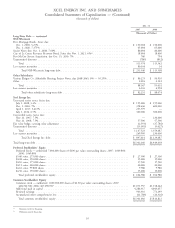

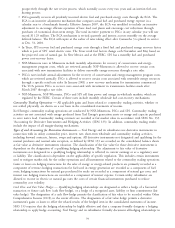

Investing activities

Utility capital/construction expenditures .............................. (2,095,721) (1,626,000) (1,304,468)

Allowance for equity funds used during construction ...................... 37,207 25,045 21,627

Purchase of investments in external decommissioning fund ................... (712,462) (1,288,103) (576,001)

Proceeds from the sale of investments in external decommissioning fund .......... 669,070 1,240,034 494,529

Nonregulated capital expenditures and asset acquisitions .................... (1,136) (1,620) (6,976)

Proceeds from sale of assets ...................................... — 24,670 11,228

Investment in WYCO ......................................... 29,659 — —

Change in restricted cash ....................................... (9,190) 11,813 (6,226)

Cash obtained from consolidation of NMC ............................ 38,950 — —

Other investments ............................................ 20,832 13,535 5,075

Investing cash flows provided by discontinued operations ..................... — 50,516 135,577

Net cash used in investing activities ............................... (2,022,791) (1,550,110) (1,225,635)

Financing activities

Proceeds from (repayment of) short-term borrowings — net .................. 462,260 (119,820) 433,820

Proceeds from issuance of long-term debt ............................. 1,162,272 1,326,180 2,529,408

Repayment of long-term debt, including reacquisition premiums ............... (768,146) (1,285,584) (2,517,698)

Proceeds from issuance of common stock ............................. 10,539 16,275 9,085

Dividends paid .............................................. (378,892) (358,746) (343,092)

Early participation payment on debt exchange .......................... (4,859) — —

Financing cash flows used in discontinued operations ........................ — — (200)

Net cash (used in) provided by financing activities ...................... 483,174 (421,695) 111,323

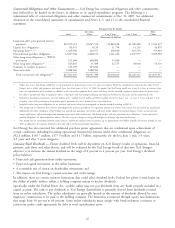

Net increase (decrease) in cash and cash equivalents ......................... 32,599 (47,809) 69,405

Net increase (decrease) in cash and cash equivalents — discontinued operations ....... (18,937) 13,071 (20,570)

Cash and cash equivalents at beginning of year ........................... 37,458 72,196 23,361

Cash and cash equivalents at end of year ............................... $ 51,120 $ 37,458 $ 72,196

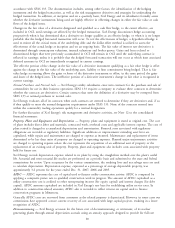

Supplemental disclosure of cash flow information

Cash paid for interest (net of amounts capitalized) ........................ $ 469,142 $ 427,683 $ 417,016

Cash paid for income taxes (net of refunds received) ...................... 6,467 (13,329) 10,625

Supplemental disclosure of non-cash investing transactions:

Property, plant and equipment additions in accounts payable ................. $ 39,681 $ 54,102 $ 42,526

Supplemental disclosure of non-cash financing transactions:

Issuance of common stock for reinvested dividends and 401(k) plans ............ $ 53,105 $ 56,194 $ 43,882

Issuance of common stock for senior convertible notes ..................... 229,623 — —

73