Xcel Energy 2007 Annual Report Download - page 93

Download and view the complete annual report

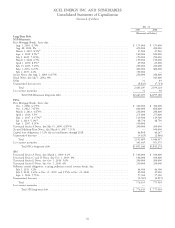

Please find page 93 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RECs and record the cost of RECs to satisfy future compliance requirements that are recoverable in future rates as

regulatory assets under the criteria of SFAS No. 71.

Emission Allowances — Emission allowances are recorded at cost, including the annual SO2 and NOx emission

allowance entitlement received at no cost from the EPA. Xcel Energy follows the inventory model for all allowances.

The sales of allowances are reported in the operating activities section of the consolidated statements of cash flows. The

net margin on sales of emission allowances is included in electric utility operating revenues as it is integral to the

production process of energy and our revenue optimization strategy for our utility operations.

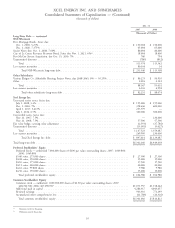

Reclassifications — Certain amounts in the consolidated statements of cash flows have been reclassified from prior-

period presentation. The reclassifications reflect the presentation of unbilled revenues, recoverable purchased natural gas

and electric energy costs and regulatory assets and liabilities and share-based compensation expense as separate items

rather than components of other assets and other liabilities within net cash provided by operating activities. In addition,

activity related to derivative transactions have been combined into net realized and unrealized hedging and derivative

transactions. These reclassifications did not affect total net cash provided by (used in) operating, investing or financing

activities within the consolidated statements of cash flows.

2. Recently Issued Accounting Pronouncements

Fair Value Measurements (SFAS No. 157) — In September 2006, the FASB issued SFAS No. 157, which provides a

single definition of fair value, together with a framework for measuring it, and requires additional disclosure about the

use of fair value to measure assets and liabilities. SFAS No. 157 also emphasizes that fair value is a market-based

measurement, and sets out a fair value hierarchy with the highest priority being quoted prices in active markets. Fair

value measurements are disclosed by level within that hierarchy. SFAS No. 157 is effective for financial statements

issued for fiscal years beginning after Nov. 15, 2007. Xcel Energy is evaluating the impact of SFAS No. 157 on its

consolidated financial statements and does not expect the impact of implementation to be material.

The Fair Value Option for Financial Assets and Financial Liabilities — Including an Amendment of FASB Statement

No. 115 (SFAS No. 159) — In February 2007, the FASB issued SFAS No. 159, which provides companies with an

option to measure, at specified election dates, many financial instruments and certain other items at fair value that are

not currently measured at fair value. A company that adopts SFAS No. 159 will report unrealized gains and losses on

items, for which the fair value option has been elected, in earnings at each subsequent reporting date. This statement

also establishes presentation and disclosure requirements designed to facilitate comparisons between entities that choose

different measurement attributes for similar types of assets and liabilities. This statement is effective for fiscal years

beginning after Nov. 15, 2007, effective Jan. 1, 2008. Xcel Energy adopted SFAS No. 159 and the adoption did not

have a material impact on its consolidated financial statements.

Business Combinations (SFAS No. 141 (revised 2007)) — In December 2007, the FASB issued SFAS No. 141R, which

establishes principles and requirements for how an acquirer in a business combination recognizes and measures in its

financial statements the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest; recognizes

and measures the goodwill acquired in the business combination or a gain from a bargain purchase; and determines

what information to disclose to enable users of the financial statements to evaluate the nature and financial effects of

the business combination. SFAS No. 141R is to be applied prospectively to business combinations for which the

acquisition date is on or after the beginning of an entity’s fiscal year that begins on or after Dec. 15, 2008. Xcel Energy

will evaluate the impact of SFAS No. 141R on its consolidated financial statements for any potential business

combinations subsequent to Jan. 1, 2009.

Noncontrolling Interests in Consolidated Financial Statements, an Amendment of ARB No. 51(SFAS No. 160) — In

December 2007, the FASB issued SFAS No. 160, which establishes accounting and reporting standards that require the

ownership interest in subsidiaries held by parties other than the parent be clearly identified and presented in the

consolidated balance sheets within equity, but separate from the parent’s equity; the amount of consolidated net income

attributable to the parent and the noncontrolling interest be clearly identified and presented on the face of the

consolidated statement of earnings; and changes in a parent’s ownership interest while the parent retains its controlling

financial interest in its subsidiary be accounted for consistently. This statement is effective for fiscal years beginning on

or after Dec. 15, 2008. Xcel Energy is evaluating the impact of SFAS No. 160 on its consolidated financial statements.

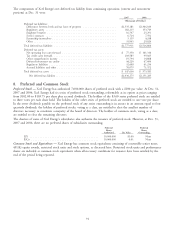

3. Discontinued Operations

Xcel Energy classified and accounted for certain assets as held for sale at Dec. 31, 2007 and 2006. Assets held for sale

are valued on an asset-by-asset basis at the lower of carrying amount or fair value less costs to sell. In applying those

83