Xcel Energy 2007 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

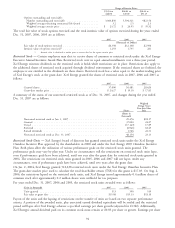

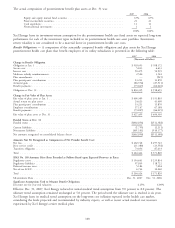

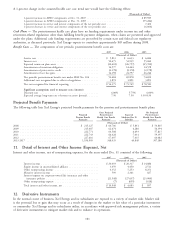

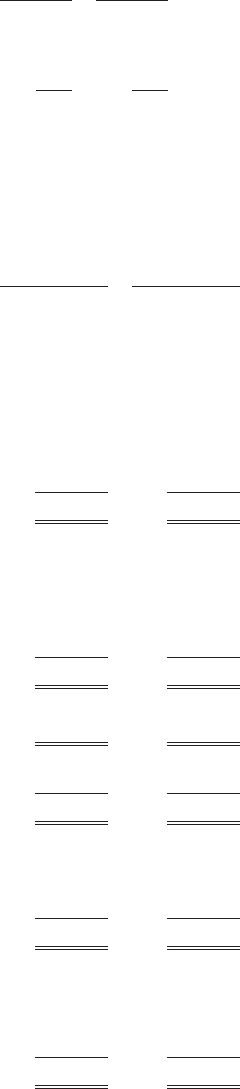

The actual composition of postretirement benefit plan assets at Dec. 31 was:

2007 2006

Equity and equity mutual fund securities ................................. 67% 67%

Fixed income/debt securities ......................................... 21 21

Cash equivalents ................................................ 11 11

Nontraditional investments ......................................... 1 1

100% 100%

Xcel Energy bases its investment-return assumption for the postretirement health care fund assets on expected long-term

performance for each of the investment types included in its postretirement health care asset portfolio. Investment-

return volatility is not considered to be a material factor in postretirement health care costs.

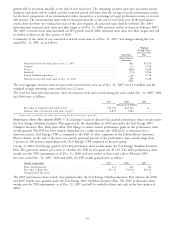

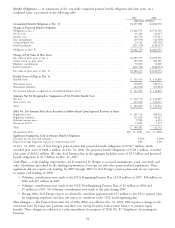

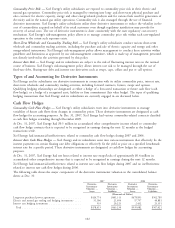

Benefit Obligations — A comparison of the actuarially computed benefit obligation and plan assets for Xcel Energy

postretirement health care plans that benefit employees of its utility subsidiaries is presented in the following table:

2007 2006

(Thousands of Dollars)

Change in Benefit Obligation

Obligation at Jan. 1 .................................................... $918,693 $ 938,172

Service cost ......................................................... 5,813 6,633

Interest cost ......................................................... 50,475 52,939

Medicare subsidy reimbursements ............................................ 2,526 3,561

Plan amendments ...................................................... — (945)

Plan participants’ contributions ............................................. 13,211 11,870

Actuarial gain ........................................................ (86,576) (27,511)

Benefit payments ...................................................... (73,827) (66,026)

Obligation at Dec. 31 ................................................... $830,315 $ 918,693

Change in Fair Value of Plan Assets

Fair value of plan assets at Jan. 1 ............................................ $406,305 $ 351,863

Actual return on plan assets ............................................... 24,623 41,409

Plan participants’ contributions ............................................. 13,211 11,870

Employer contributions .................................................. 57,147 67,188

Benefit payments ...................................................... (73,827) (66,025)

Fair value of plan assets at Dec. 31 ........................................... $427,459 $ 406,305

Funded Status at Dec. 31

Funded status ........................................................ $(402,856) $(512,388)

Current liabilities ...................................................... (1,755) (2,211)

Noncurrent liabilities ................................................... (401,101) (510,177)

Net amounts recognized on consolidated balance sheets .............................. $(402,856) $(512,388)

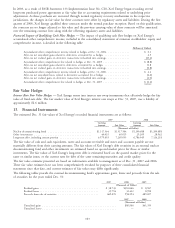

Amounts Not Yet Recognized as Components of Net Periodic Benefit Cost:

Net loss ............................................................ $202,748 $ 297,745

Prior service credit ..................................................... (11,380) (13,558)

Transition obligation .................................................... 73,056 87,633

Total ............................................................. $264,424 $ 371,820

SFAS No. 158 Amounts Have Been Recorded as Follows Based upon Expected Recovery in Rates:

Regulatory assets ...................................................... $154,661 $ 235,834

Regulatory liabilities .................................................... 97,835 118,722

Deferred income taxes ................................................... 5,184 7,004

Net-of-tax AOCI ...................................................... 6,744 10,260

Total ............................................................. $264,424 $ 371,820

Measurement Date ..................................................... Dec. 31, 2007 Dec. 31, 2006

Significant Assumptions Used to Measure Benefit Obligations

Discount rate for year-end valuation .......................................... 6.25% 6.00%

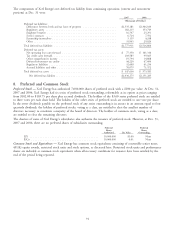

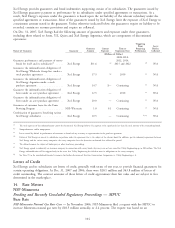

Effective Dec. 31, 2007, Xcel Energy reduced its initial medical trend assumption from 9.0 percent to 8.0 percent. The

ultimate trend assumption remained unchanged at 5.0 percent. The period until the ultimate rate is reached is six years.

Xcel Energy bases its medical trend assumption on the long-term cost inflation expected in the health care market,

considering the levels projected and recommended by industry experts, as well as recent actual medical cost increases

experienced by Xcel Energy’s retiree medical plan.

100