Xcel Energy 2007 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

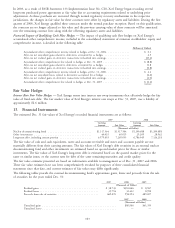

In 2003, as a result of FASB Statement 133 Implementation Issue No. C20, Xcel Energy began recording several

long-term purchased power agreements at fair value due to accounting requirements related to underlying price

adjustments. As these purchases are recovered through normal regulatory recovery mechanisms in the respective

jurisdictions, the changes in fair value for these contracts were offset by regulatory assets and liabilities. During the first

quarter of 2006, Xcel Energy qualified these contracts under the normal purchase exception. Based on this qualification,

the contracts are no longer adjusted to fair value and the previous carrying value of these contracts will be amortized

over the remaining contract lives along with the offsetting regulatory assets and liabilities.

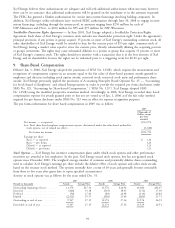

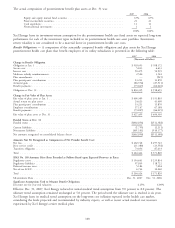

Financial Impact of Qualifying Cash Flow Hedges — The impact of qualifying cash flow hedges on Xcel Energy’s

accumulated other comprehensive income, included in the consolidated statements of common stockholders’ equity and

comprehensive income, is detailed in the following table:

(Millions of Dollars)

Accumulated other comprehensive income related to hedges at Dec. 31, 2004 .............. $ 0.1

After-tax net unrealized gains related to derivatives accounted for as hedges ............... 4.5

After-tax net realized gains on derivative transactions reclassified into earnings .............. (13.4)

Accumulated other comprehensive loss related to hedges at Dec. 31, 2005 ................ $(8.8)

After-tax net unrealized gains related to derivatives accounted for as hedges ............... 11.8

After-tax net realized gains on derivative transactions reclassified into earnings .............. (0.8)

Accumulated other comprehensive income related to hedges at Dec. 31, 2006 .............. $ 2.2

After-tax net unrealized losses related to derivatives accounted for as hedges ............... (2.6)

After-tax net realized gains on derivative transactions reclassified into earnings .............. (1.0)

Accumulated other comprehensive loss related to hedges at Dec. 31, 2007 ................ $(1.4)

Fair Value Hedges

Interest Rate Fair Value Hedges — Xcel Energy enters into interest rate swap instruments that effectively hedge the fair

value of fixed-rate debt. The fair market value of Xcel Energy’s interest rate swaps at Dec. 31, 2007, was a liability of

approximately $2.6 million.

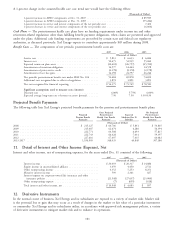

13. Financial Instruments

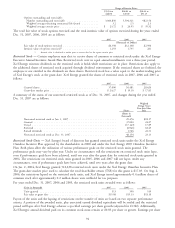

The estimated Dec. 31 fair values of Xcel Energy’s recorded financial instruments are as follows:

2007 2006

Carrying Carrying

Amount Fair Value Amount Fair Value

(Thousands of Dollars)

Nuclear decommissioning fund .......................... $1,317,564 $1,317,564 $1,200,688 $1,200,688

Other investments .................................. 40,019 40,019 29,209 28,962

Long-term debt, including current portion ................... 6,979,695 7,269,035 6,786,049 7,324,218

The fair value of cash and cash equivalents, notes and accounts receivable and notes and accounts payable are not

materially different from their carrying amounts. The fair values of Xcel Energy’s debt securities in an external nuclear

decommissioning fund and other investments are estimated based on quoted market prices for those or similar

investments. The fair values of Xcel Energy’s long-term debt is estimated based on the quoted market prices for the

same or similar issues, or the current rates for debt of the same remaining maturities and credit quality.

The fair value estimates presented are based on information available to management as of Dec. 31, 2007 and 2006.

These fair value estimates have not been comprehensively revalued for purposes of these consolidated financial

statements since that date, and current estimates of fair values may differ significantly.

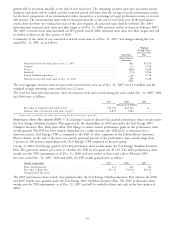

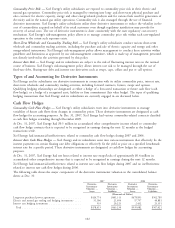

The following tables provide the external decommissioning fund’s approximate gains, losses and proceeds from the sale

of securities for the years ended Dec. 31:

2007 2006 2005

(Thousands of Dollars)

Realized gains ................................... $38,745 $310,066 $ 8,967

Realized losses ................................... 35,794 32,412 8,990

Proceeds from sale of securities ........................ 669,070 958,294 489,697

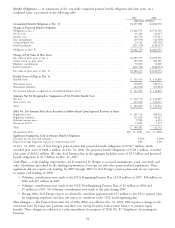

2007 2006

(Thousands of Dollars)

Unrealized gains ............................................ $80,960 $41,355

Unrealized losses ............................................ — —

103