Xcel Energy 2007 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

from customers of its nuclear costs. NSP-Minnesota plans to submit the certificate of need for the Monticello uprate

and the certificate of need for the Prairie Island uprate in the first quarter of 2008.

NMC — On Sept. 28, 2007, Xcel Energy obtained 100 percent ownership in NMC as a result of Wisconsin Energy

Corporation (WEC) exiting the partnership due to the sale of its Point Beach Nuclear Plant to FPL Energy.

Accordingly, the results of operations of NMC and the estimated fair value of assets and liabilities were consolidated in

Xcel Energy’s consolidated financial statements from the Sept. 28, 2007, transaction date. WEC was required to pay an

exit fee and surrender all of its equity interest in NMC upon exiting. The effect of this transaction was not material to

the financial position or the results of operations to Xcel Energy. Xcel Energy is in the process of reintegrating its

nuclear operations into its generation operations and applying to the NRC to transfer the nuclear operating licenses

from NMC to NSP-Minnesota. The transfer of licenses is expected to be completed in 2008.

For further discussion of nuclear obligations, see Note 16 to the consolidated financial statements.

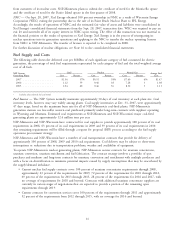

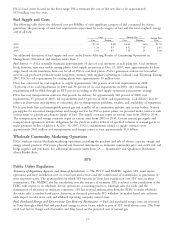

Fuel Supply and Costs

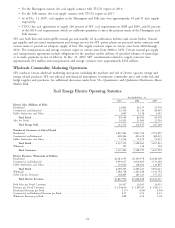

The following table shows the delivered cost per MMBtu of each significant category of fuel consumed for electric

generation, the percentage of total fuel requirements represented by each category of fuel and the total weighted average

cost of all fuels.

Coal* Nuclear Natural Gas

NSP System Average Fuel

Generating Plants Cost Percent Cost Percent Cost Percent Cost

2007 .................. $1.56 57% $0.51 38% $7.60 4% $1.47

2006 .................. 1.12 59 0.46 38 7.28 3 1.08

2005 .................. 1.04 60 0.46 36 8.32 3 1.11

* Includes refuse-derived fuel and wood

Fuel Sources — The NSP System normally maintains approximately 30 days of coal inventory at each plant site. Coal

inventory levels, however, may vary widely among plants. Coal supply inventories at Dec. 31, 2007, were approximately

47 days usage, based on the maximum burn rate for all of NSP-Minnesota’s coal-fired plants. NSP-Minnesota’s

generation stations use low-sulfur western coal purchased primarily under long-term contracts with suppliers operating

in Wyoming and Montana. Estimated coal requirements at NSP-Minnesota and NSP-Wisconsin’s major coal-fired

generating plants are approximately 12.4 million tons per year.

NSP-Minnesota and NSP-Wisconsin have contracted for coal supplies to provide approximately 100 percent of its coal

requirements in 2008, 63 percent of its coal requirements in 2009 and 39 percent of its coal requirements in 2010.

Any remaining requirements will be filled through a request for proposal (RFP) process according to the fuel supply

operations procurement strategy.

NSP-Minnesota and NSP-Wisconsin have a number of coal transportation contracts that provide for delivery of

approximately 100 percent of 2008, 2009 and 2010 coal requirements. Coal delivery may be subject to short-term

interruptions or reductions due to transportation problems, weather and availability of equipment.

To operate NSP-Minnesota’s nuclear generating plants, NSP-Minnesota secures contracts for uranium concentrates,

uranium conversion, uranium enrichment and fuel fabrication. The contract strategy involves a portfolio of spot

purchases and medium- and long-term contracts for uranium, conversion and enrichment with multiple producers and

with a focus on diversification to minimize potential impacts caused by supply interruptions that may be exacerbated by

the supply/demand imbalance.

• Current nuclear fuel supply contracts cover 100 percent of uranium concentrates requirements through 2008,

approximately 63 percent of the requirements for 2009, 72 percent of the requirements for 2010 through 2012,

69 percent of the requirements for 2013 through 2015, 28 percent of the requirements for 2016 and 2017, with

no coverage of requirements for 2018 and beyond. Contracts with additional uranium concentrate suppliers are

currently in various stages of negotiations that are expected to provide a portion of the remaining open

requirements through 2019.

• Current contracts for conversion services cover 100 percent of the requirements through 2011 and approximately

52 percent of the requirements from 2012 through 2015, with no coverage for 2016 and beyond.

16