Xcel Energy 2007 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

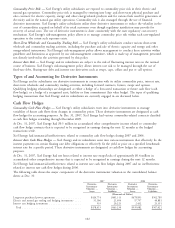

Commodity Price Risk — Xcel Energy’s utility subsidiaries are exposed to commodity price risk in their electric and

natural gas operations. Commodity price risk is managed by entering into long- and short-term physical purchase and

sales contracts for electric capacity, energy and other energy-related products and for various fuels used for generation of

electricity and in the natural gas utility operations. Commodity risk is also managed through the use of financial

derivative instruments. Xcel Energy’s utility subsidiaries utilize these derivative instruments to reduce the volatility in the

cost of commodities acquired on behalf of its retail customers even though regulatory jurisdiction may provide for

recovery of actual costs. The use of derivative instruments is done consistently with the state regulatory cost-recovery

mechanism. Xcel Energy’s risk-management policy allows it to manage commodity price risk within each rate-regulated

operation to the extent such exposure exists.

Short-Term Wholesale and Commodity Trading Risk — Xcel Energy’s utility subsidiaries conduct various short-term

wholesale and commodity trading activities, including the purchase and sale of electric capacity and energy and other

energy-related instruments. Xcel Energy’s risk-management policy allows management to conduct these activities within

guidelines and limitations as approved by our risk-management committee, which is made up of management personnel

not directly involved in the activities governed by this policy.

Interest Rate Risk — Xcel Energy and its subsidiaries are subject to the risk of fluctuating interest rates in the normal

course of business. Xcel Energy’s risk-management policy allows interest rate risk to be managed through the use of

fixed-rate debt, floating-rate debt and interest rate derivatives such as swaps, caps, collars and put or call options.

Types of and Accounting for Derivative Instruments

Xcel Energy and its subsidiaries use derivative instruments in connection with its utility commodity price, interest rate,

short-term wholesale and commodity trading activities, including forward contracts, futures, swaps and options.

Qualifying hedging relationships are designated as either a hedge of a forecasted transaction or future cash flow (cash

flow hedge), or a hedge of a recognized asset, liability or firm commitment (fair value hedge). The types of qualifying

hedging transactions that Xcel Energy and its subsidiaries are currently engaged in are discussed below.

Cash Flow Hedges

Commodity Cash Flow Hedges — Xcel Energy’s utility subsidiaries enter into derivative instruments to manage

variability of future cash flows from changes in commodity prices. These derivative instruments are designated as cash

flow hedges for accounting purposes. At Dec. 31, 2007, Xcel Energy had various commodity-related contracts classified

as cash flow hedges extending through December 2009.

At Dec. 31, 2007, Xcel Energy had $0.5 million in accumulated other comprehensive income related to commodity

cash flow hedge contracts that is expected to be recognized in earnings during the next 12 months as the hedged

transactions settle.

Xcel Energy had immaterial ineffectiveness related to commodity cash flow hedges during 2007 and 2006.

Interest Rate Cash Flow Hedges — Xcel Energy and its subsidiaries enter into various instruments that effectively fix the

interest payments on certain floating rate debt obligations or effectively fix the yield or price on a specified benchmark

interest rate for a specific period. These derivative instruments are designated as cash flow hedges for accounting

purposes.

At Dec. 31, 2007, Xcel Energy had net losses related to interest rate swaps/locks of approximately $0.4 million in

accumulated other comprehensive income that is expected to be recognized in earnings during the next 12 months.

Xcel Energy had immaterial ineffectiveness related to interest rate cash flow hedges during 2007 and no ineffectiveness

related to interest rate cash flow hedges during 2006.

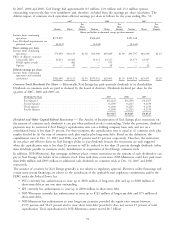

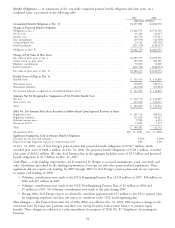

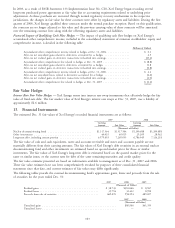

The following table shows the major components of the derivative instruments valuation in the consolidated balance

sheets at Dec. 31:

2007 2006

Derivative Derivative Derivative Derivative

Instruments Instruments Instruments Instruments

Valuation — Valuation — Valuation — Valuation —

Assets Liabilities Assets Liabilities

(Thousands of Dollars)

Long-term purchased power agreements ............... $426,774 $401,313 $478,853 $502,789

Electric and natural gas trading and hedging instruments .... 51,106 21,694 57,797 40,881

Interest rate hedging instruments ................... 535 20,223 2,432 23,351

Total ................................... $478,415 $443,230 $539,082 $567,021

102