Xcel Energy 2007 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PSCo’s load center located on the front range. PSCo estimates the cost of the new line to be approximately

$110 million over five years.

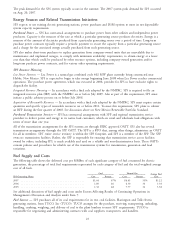

Fuel Supply and Costs

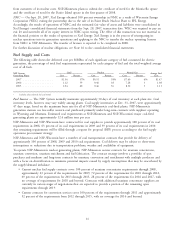

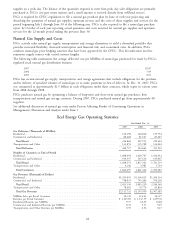

The following table shows the delivered cost per MMBtu of each significant category of fuel consumed for electric

generation, the percentage of total fuel requirements represented by each category of fuel and the total weighted average

cost of all fuels.

Coal Natural Gas Average Fuel

Cost Percent Cost Percent Cost

2007 ...................................... $1.26 84% $4.34 16% $1.76

2006 ...................................... 1.24 85 6.52 15 2.01

2005 ...................................... 1.01 85 7.56 15 2.00

See additional discussion of fuel supply and costs under Factors Affecting Results of Continuing Operations in

Management’s Discussion and Analysis under Item 7.

Fuel Sources — PSCo normally maintains approximately 30 days of coal inventory at each plant site. Coal inventory

levels, however, may vary widely among plants. Coal supply inventories at Dec. 31, 2007, were approximately 41 days

usage, based on the maximum burn rate for all of PSCo’s coal-fired plants. PSCo’s generation stations use low-sulfur

western coal purchased primarily under long-term contracts with suppliers operating in Colorado and Wyoming. During

2007, PSCo’s coal requirements for existing plants were approximately 10 million tons.

PSCo has contracted for coal suppliers to supply approximately 100 percent of its coal requirements in 2008,

76 percent of its coal requirements in 2009 and 30 percent of its coal requirements in 2010. Any remaining

requirements will be filled through an RFP process according to the fuel supply operations procurement strategy.

PSCo has coal transportation contracts that provide for delivery for approximately 100 percent of 2008 coal

requirements, 35 percent of 2009 coal requirements and 33 percent of 2010 coal requirements. Coal delivery may be

subject to short-term interruptions or reductions due to transportation problems, weather, and availability of equipment.

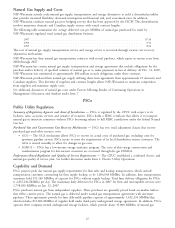

PSCo uses both firm and interruptible natural gas and standby oil in combustion turbines and certain boilers. Natural

gas supplies for associated transportation and storage services for PSCo’s power plants are procured under contracts with

various terms to provide an adequate supply of fuel. The supply contracts expire in various years from 2008 to 2010.

The transportation and storage contracts expire in various years from 2009 to 2040. Certain natural gas supply and

transportation agreements include obligations for the purchase and/or delivery of specified volumes of natural gas or to

make payments in lieu of delivery. At Dec. 31, 2007, PSCo’s commitments related to supply contracts were

approximately $161 million and transportation and storage contracts were approximately $1.0 billion.

Wholesale Commodity Marketing Operations

PSCo conducts various wholesale marketing operations, including the purchase and sale of electric capacity, energy and

energy related products. PSCo uses physical and financial instruments to minimize commodity price and credit risk and

hedge supplies and purchases. See additional discussion under Item 7A — Quantitative and Qualitative Disclosures

About Market Risk.

SPS

Public Utility Regulation

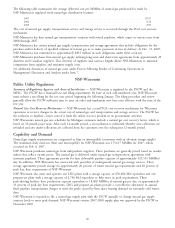

Summary of Regulatory Agencies and Areas of Jurisdiction — The PUCT and NMPRC regulate SPS’ retail electric

operations and have jurisdiction over its retail rates and services and the construction of transmission or generation in

their respective states. The municipalities in which SPS operates in Texas have jurisdiction over SPS’ rates in those

communities. The NMPRC also has jurisdiction over the issuance of securities. SPS is subject to the jurisdiction of the

FERC with respect to its wholesale electric operations, accounting practices, wholesale sales for resale and the

transmission of electricity in interstate commerce. SPS has received authorization from the FERC to make wholesale

electricity sales at market-based prices, however, as discussed previously, SPS withdrew its market-based rate authority

with respect to sales in its own and affiliated operating company control areas.

Fuel, Purchased Energy and Conservation Cost Recovery Mechanisms — Fuel and purchased energy costs are recovered

in Texas through a fixed fuel and purchased energy recovery factor, which is part of SPS’ retail electric rates. The Texas

retail fuel factors change each November and May based on the projected cost of natural gas.

21