Xcel Energy 2007 Annual Report Download - page 90

Download and view the complete annual report

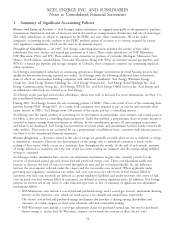

Please find page 90 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.accordance with SFAS 133. The documentation includes, among other factors, the identification of the hedging

instrument and the hedged transaction, as well as the risk management objectives and strategies for undertaking the

hedged transaction. In addition, at inception and on a quarterly basis, Xcel Energy and its subsidiaries formally assess

whether the derivative instruments being used are highly effective in offsetting changes in either the fair value or cash

flows of the hedged items.

Changes in the fair value of a derivative designated and qualified as a cash flow hedge, to the extent effective, are

included in OCI, until earnings are affected by the hedged transaction. Xcel Energy discontinues hedge accounting

prospectively when it has determined that a derivative no longer qualifies as an effective hedge, or when it is no longer

probable that the hedged forecasted transaction will occur. To test the effectiveness of hedges, a hypothetical hedge is

used to mirror all the critical terms of the underlying debt and the dollar offset method is utilized to assess the

effectiveness of the actual hedge at inception and on an ongoing basis. The fair value of interest rate derivatives is

determined through counterparty valuations, internal valuations and broker quotes. Gains and losses related to

discontinued hedges that were previously accumulated in OCI will remain in OCI until the underlying contract is

reflected in earnings; unless it is probable that the hedged forecasted transaction will not occur at which time associated

deferred amounts in OCI are immediately recognized in current earnings.

The effective portion of the change in the fair value of a derivative instrument qualifying as a fair value hedge is offset

against the change in the fair value of the underlying asset, liability or firm commitment being hedged. That is, fair

value hedge accounting allows the gains or losses of the derivative instrument to offset, in the same period, the gains

and losses of the hedged item. The ineffective portion of a derivative instrument’s change in fair value is recognized in

current earnings.

Normal Purchases and Normal Sales — Xcel Energy’s utility subsidiaries enter into contracts for the purchase and sale of

commodities for use in their business operations. SFAS 133 requires a company to evaluate these contracts to determine

whether the contracts are derivatives. Certain contracts that meet the definition of a derivative may be exempted from

SFAS 133 as normal purchases or normal sales.

Xcel Energy evaluates all of its contracts when such contracts are entered to determine if they are derivatives and, if so,

if they qualify to meet the normal designation requirements under SFAS 133. None of the contracts entered into

within the commodity trading operations qualify for a normal designation.

For further discussion of Xcel Energy’s risk management and derivative activities, see Note 12 to the consolidated

financial statements.

Property, Plant and Equipment and Depreciation — Property, plant and equipment is stated at original cost. The cost

of plant includes direct labor and materials, contracted work, overhead costs and applicable interest expense. The cost of

plant retired is charged to accumulated depreciation and amortization. Removal costs associated with regulatory

obligations are recorded as regulatory liabilities. Significant additions or improvements extending asset lives are

capitalized, while repairs and maintenance are charged to expense as incurred. Maintenance and replacement of items

determined to be less than units of property are charged to operating expenses. Planned major maintenance activities

are charged to operating expense unless the cost represents the acquisition of an additional unit of property or the

replacement of an existing unit of property. Property, plant and equipment also includes costs associated with property

held for future use.

Xcel Energy records depreciation expense related to its plant by using the straight-line method over the plant’s useful

life. Actuarial and semi-actuarial life studies are performed on a periodic basis and submitted to the state and federal

commissions for review. Upon acceptance by the various commissions, the resulting lives and net salvage rates are used

to calculate depreciation. Depreciation expense, expressed as a percentage of average depreciable property, was

approximately 3.2 percent for the years ended Dec. 31, 2007, 2006 and 2005.

AFDC — AFDC represents the cost of capital used to finance utility construction activity. AFDC is computed by

applying a composite pretax rate to qualified construction work in progress. The amount of AFDC capitalized as a

utility construction cost is credited to other nonoperating income (for equity capital) and interest charges (for debt

capital). AFDC amounts capitalized are included in Xcel Energy’s rate base for establishing utility service rates. In

addition to construction-related amounts, AFDC also is recorded to reflect returns on capital used to finance

conservation programs in Minnesota.

Generally, AFDC costs are recovered from customers as the related property is depreciated. However, in some cases our

commissions have approved a more current recovery of cost associated with large capital projects, resulting in a lower

recognition of AFDC.

Decommissioning — Xcel Energy accounts for the future cost of decommissioning, or retirement, of its nuclear

generating plants through annual depreciation accruals using an annuity approach designed to provide for full rate

80