Xcel Energy 2007 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Xcel Energy believes these authorizations are adequate and will seek additional authorization when necessary, however,

there can be no assurance that additional authorization will be granted on the timeframe or in the amounts requested.

The FERC has granted a blanket authorization for certain intra-system financings involving holding companies. In

addition, Xcel Energy’s utility subsidiaries have received FERC authorization through June 30, 2008 to engage in intra-

system financings, including through the money pool, in amounts ranging from $250 million for each of

NSP-Minnesota and PSCo, to $100 million for SPS and $75 million for NSP-Wisconsin.

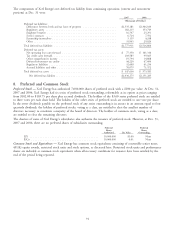

Stockholder Protection Rights Agreement — In June 2001, Xcel Energy adopted a Stockholder Protection Rights

Agreement. Each share of Xcel Energy’s common stock includes one shareholder protection right. Under the agreement’s

principal provision, if any person or group acquires 15 percent or more of Xcel Energy’s outstanding common stock, all

other shareholders of Xcel Energy would be entitled to buy, for the exercise price of $95 per right, common stock of

Xcel Energy having a market value equal to twice the exercise price, thereby substantially diluting the acquiring person’s

or group’s investment. The rights may cause substantial dilution to a person or group that acquires 15 percent or more

of Xcel Energy’s common stock. The rights should not interfere with a transaction that is in the best interests of Xcel

Energy and its shareholders because the rights can be redeemed prior to a triggering event for $0.01 per right.

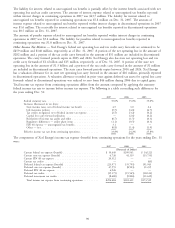

9. Share-Based Compensation

Effective Jan. 1, 2006, Xcel Energy adopted the provisions of SFAS No. 123(R), which requires the measurement and

recognition of compensation expense in an amount equal to the fair value of share-based payment awards granted to

employees and directors including stock option awards, restricted stock, restricted stock units and performance share

awards. Xcel Energy previously applied the provisions of Accounting Principles Board Opinion No. 25 — ‘‘Accounting

for Stock Issued to Employees’’ and related Interpretations in order to provide the required pro forma disclosures under

SFAS No. 123, ‘‘Accounting for Share-based Compensation,’’ (‘‘SFAS No. 123’’). Xcel Energy adopted SFAS

No. 123(R) using the modified prospective transition method. Accordingly, in 2006, Xcel Energy recorded share based

compensation expense for awards granted prior to but not yet vested as of Jan, 1, 2006 as if the fair value method

required for pro forma disclosure under SFAS No. 123 were in effect for expense recognition purposes.

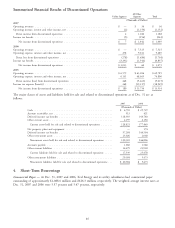

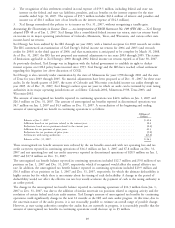

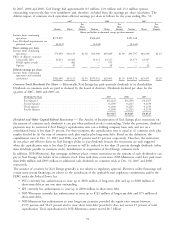

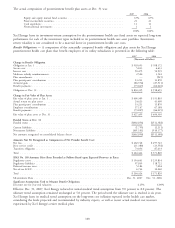

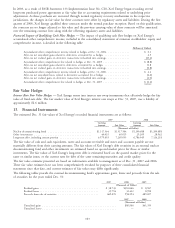

The pro forma information for share based compensation in 2005 was as follows:

2005

(Thousands of

Dollars, except

per share

amounts)

Net income — as reported ................................................ $512,972

Less: Total share-based employee compensation expense determined under fair-value-based method for

stock options, net of related tax effects ....................................... (1,180)

Pro forma net income ................................................ $511,792

Earnings per share:

Basic — as reported .................................................. $ 1.26

Basic — pro forma ................................................... 1.26

Diluted — as reported ................................................. 1.23

Diluted — pro forma ................................................. 1.23

Stock Options — Xcel Energy has incentive compensation plans under which stock options and other performance

incentives are awarded to key employees. In the past, Xcel Energy issued stock options, but has not granted stock

options since December 2001. The weighted average number of common and potentially dilutive shares outstanding

used to calculate Xcel Energy’s earnings per share include the dilutive effect of stock options and other stock awards

based on the treasury stock method. The options normally have a term of 10 years and generally become exercisable

from three to five years after grant date or upon specified circumstances.

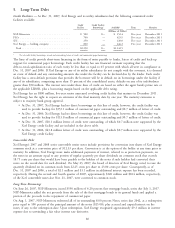

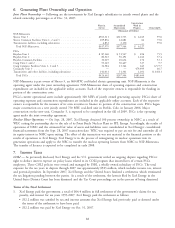

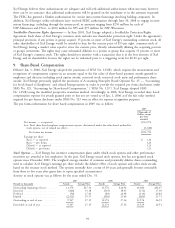

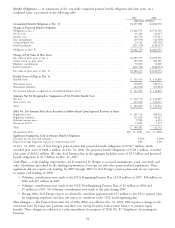

Activity in stock options was as follows for the years ended Dec. 31:

2007 2006 2005

(Awards in thousands) Awards Average Price Awards Average Price Awards Average Price

Outstanding beginning of year ...... 12,374 $27.36 13,576 $26.92 14,606 $26.67

Exercised ................... (266) 19.18 (563) 18.33 (152) 17.30

Forfeited ................... (50) 27.43 (89) 26.98 (213) 26.84

Expired .................... (2,511) 29.37 (550) 25.66 (665) 23.71

Outstanding at end of year ........ 9,547 27.19 12,374 27.36 13,576 26.92

Exercisable at end of year ......... 9,547 27.19 12,374 27.36 13,529 26.91

93