Xcel Energy 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

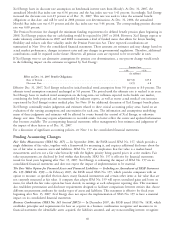

Xcel Energy bases its discount rate assumption on benchmark interest rates from Moody’s. At Dec. 31, 2007, the

annualized Moody’s Baa index rate was 6.56 percent, and the Aaa index rate was 5.41 percent. Accordingly, Xcel Energy

increased the discount rate to 6.25 percent as of Dec. 31, 2007. This rate was used to value the actuarial benefit

obligations at that date, and will be used in 2008 pension cost determinations. At Dec. 31, 2006, the annualized

Moody’s Baa index rate was 6.35 percent and the Aaa index rate was 5.46 percent. The corresponding pension discount

rate was 6.00 percent.

The Pension Protection Act changed the minimum funding requirements for defined benefit pension plans beginning in

2008. Xcel Energy projects that no cash funding would be required for 2007 or 2008. However, Xcel Energy expects to

make voluntary contributions in 2007 and 2008 to maintain a level of funded status that allows for future funding

flexibility and reduces cash flow volatility under the Pension Protection Act. These expected contributions are

summarized in Note 10 to the consolidated financial statements. These amounts are estimates and may change based on

actual market performance, changes in interest rates and any changes in governmental regulations. Therefore, additional

contributions could be required in the future. However, all pension costs are expected to be recoverable in rates.

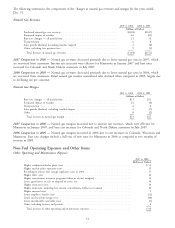

If Xcel Energy were to use alternative assumptions for pension cost determinations, a one-percent change would result

in the following impact on the estimates recognized by Xcel Energy:

Pension Costs

+1% ⴑ1%

(in millions)

Effect on Dec. 31, 2007 Benefit Obligations:

Rate of Return ............................................ $(19.8) $19.8

Discount Rate ............................................ (4.9) 6.8

Effective Dec. 31, 2007, Xcel Energy reduced its initial medical trend assumption from 9.0 percent to 8.0 percent. The

ultimate trend assumption remained unchanged at 5.0 percent. The period until the ultimate rate is reached is six years.

Xcel Energy bases its medical trend assumption on the long-term cost inflation expected in the health care market,

considering the levels projected and recommended by industry experts, as well as recent actual medical cost increases

experienced by Xcel Energy’s retiree medical plan. See Note 10 for additional discussion of Xcel Energy’s benefit plans.

Xcel Energy continually makes judgments and estimates related to these critical accounting policy areas, based on an

evaluation of the varying assumptions and uncertainties for each area. The information and assumptions underlying

many of these judgments and estimates will be affected by events beyond the control of Xcel Energy, or otherwise

change over time. This may require adjustments to recorded results to better reflect the events and updated information

that becomes available. The accompanying financial statements reflect management’s best estimates and judgments of

the impact of these factors as of Dec. 31, 2007.

For a discussion of significant accounting policies, see Note 1 to the consolidated financial statements.

Pending Accounting Changes

Fair Value Measurements (SFAS No. 157) — In September 2006, the FASB issued SFAS No. 157, which provides a

single definition of fair value, together with a framework for measuring it, and requires additional disclosure about the

use of fair value to measure assets and liabilities. SFAS No. 157 also emphasizes that fair value is a market-based

measurement, and sets out a fair value hierarchy with the highest priority being quoted prices in active markets. Fair

value measurements are disclosed by level within that hierarchy. SFAS No. 157 is effective for financial statements

issued for fiscal years beginning after Nov. 15, 2007. Xcel Energy is evaluating the impact of SFAS No. 157 on its

consolidated financial statements and does not expect the impact of implementation to be material.

The Fair Value Option for Financial Assets and Financial Liabilities — Including an Amendment of FASB Statement

No. 115 (SFAS No. 159) — In February 2007, the FASB issued SFAS No. 159, which provides companies with an

option to measure, at specified election dates, many financial instruments and certain other items at fair value that are

not currently measured at fair value. A company that adopts SFAS No. 159 will report unrealized gains and losses on

items, for which the fair value option has been elected, in earnings at each subsequent reporting date. This statement

also establishes presentation and disclosure requirements designed to facilitate comparisons between entities that choose

different measurement attributes for similar types of assets and liabilities. This statement is effective for fiscal years

beginning after Nov. 15, 2007. Xcel Energy does not expect the implementation of SFAS No. 159 to have a material

impact on its consolidated financial statements.

Business Combinations (SFAS No. 141 (revised 2007)) — In December 2007, the FASB issued SFAS No. 141R, which

establishes principles and requirements for how an acquirer in a business combination recognizes and measures in its

financial statements the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest; recognizes

60