Xcel Energy 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On Aug. 15, 2007, PSCo issued $350 million of 6.25 percent first mortgage bonds, series due Sept. 1, 2037. PSCo

added the net proceeds from the sale of the first mortgage bonds to its general funds and applied a portion of the

proceeds to the repayment of commercial paper, including commercial paper incurred to fund the payment at maturity

of $100 million of 7.11 percent secured medium-term notes, which matured on March 5, 2007.

On Jan. 16, 2008, Xcel Energy issued $400 million of 7.60 percent junior subordinated notes, series due 2068. Xcel

Energy added the net proceeds from the sale of the notes to its general funds and intends to use the proceeds to fund

equity investments in one or more of its utility subsidiaries that will be used to repay short-term debt of the subsidiary.

The remaining proceeds will be used to repay commercial paper.

All property of NSP-Minnesota and NSP-Wisconsin and the electric property of PSCo are subject to the liens of their

first mortgage indentures. In addition, certain SPS payments under its pollution-control obligations are pledged to

secure obligations of the Red River Authority of Texas.

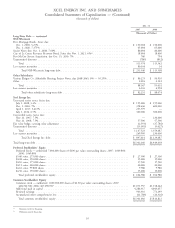

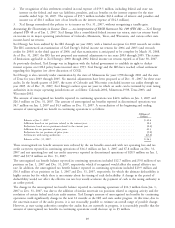

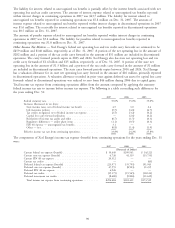

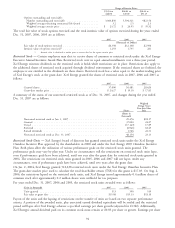

Maturities of long-term debt are:

(Millions of Dollars)

2008 ..................................................... $ 637.5

2009 ..................................................... 557.7

2010 ..................................................... 541.5

2011 ..................................................... 51.5

2012 ..................................................... 1,066.3

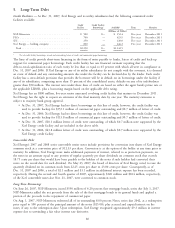

Debt Exchange

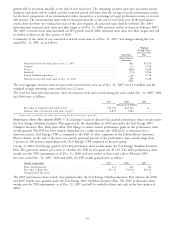

On March 30, 2007, Xcel Energy settled an exchange offer for up to $350 million aggregate principal amount of its

7 percent Senior Notes, Series due 2010 (the Old Notes). Xcel Energy accepted approximately $241.4 million aggregate

principal amount of its Old Notes in exchange for approximately $254.0 million aggregate principal amount of a new

series of 5.613 percent senior notes due April 1, 2017 (the New Notes). The $12.6 million non-cash increase in the

aggregate principal amount was a result of financing the premium associated with the exchange. In addition, Xcel

Energy paid the following amounts in cash: (i) approximately $4.8 million to certain investors as an early participation

payment for Old Notes validly tendered prior to 5:00 p.m., New York City time, on March 13, 2007 and accepted for

exchange; (ii) approximately $57,000 in cash in lieu of New Notes; and (iii) accrued and unpaid interest to, but not

including, the settlement date with respect to the Old Notes accepted for exchange.

The New Notes were issued only to holders of Old Notes that certified certain matters to Xcel Energy, including their

status as either ‘‘qualified institutional buyers,’’ as that term is defined in Rule 144A under the Securities Act of 1933,

or persons other than ‘‘U.S. persons,’’ as that term is defined in Rule 902 under the Securities Act of 1933. The New

Notes were issued with a registration rights agreement.

In accordance with the Emerging Issues Task Force Issue No. 96-19 (EITF 96-19), Debtor’s Accounting for a

Modification or Exchange of Debt Instruments, this transaction was accounted for as an exchange. As such, the fees

paid to the bondholders have been associated with the replacement debt instruments and, along with the existing

unamortized discount, will be amortized as an adjustment of interest expense over the remaining term of the

replacement debt instruments. Also, as required by EITF 96-19, the fees paid to third parties were expensed as incurred

and $1.7 million was included in interest charges and other financing costs in the consolidated statements of income.

On June 19, 2007, Xcel Energy filed a registration statement with the SEC to exchange the New Notes for the

exchange notes, which have terms identical in all material respects to the New Notes, except that the exchange notes do

not contain transfer restrictions nor are they subject to registration rights. The exchange offer was completed on

Dec. 20, 2007.

87