Xcel Energy 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

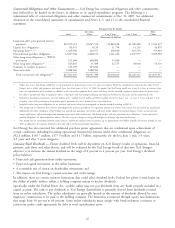

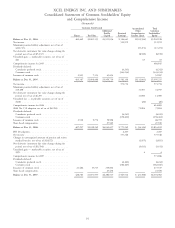

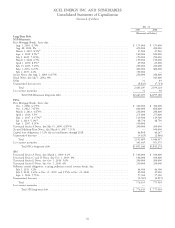

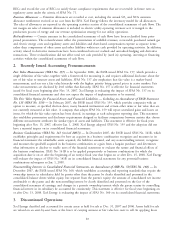

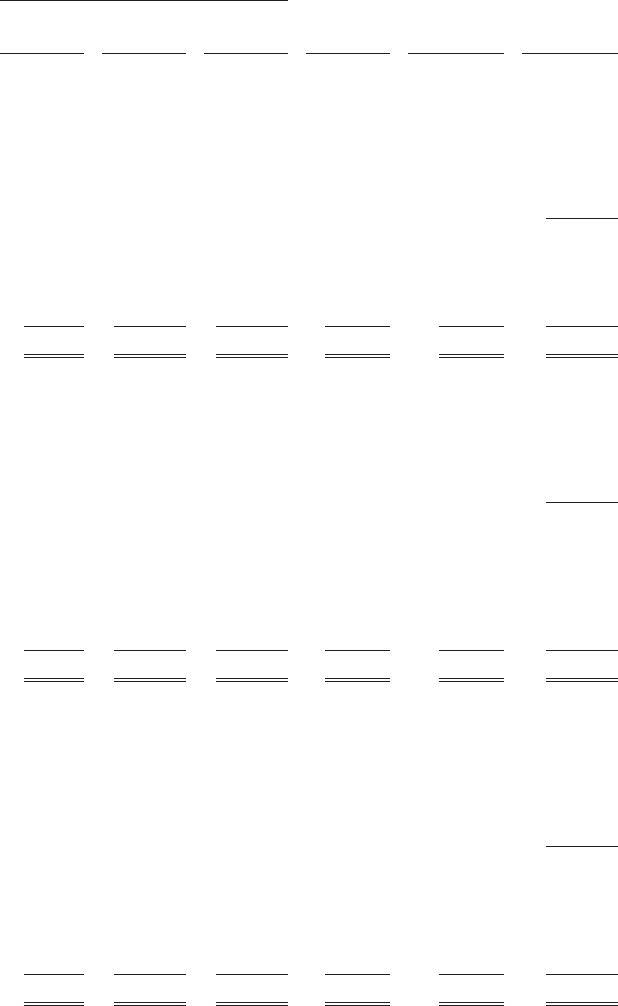

XCEL ENERGY INC. AND SUBSIDIARIES

Consolidated Statements of Common Stockholders’ Equity

and Comprehensive Income

(thousands)

Common Stock Issued Accumulated Total

Additional Other Common

Paid In Retained Comprehensive Stockholders’

Shares Par Value Capital Earnings Income (Loss) Equity

Balance at Dec. 31, 2004 ................... 400,462 $1,001,155 $3,911,056 $ 396,641 $(105,934) $5,202,918

Net income ........................... 512,972 512,972

Minimum pension liability adjustment, net of tax of

$(10,717) ........................... (17,271) (17,271)

Net derivative instrument fair value changes during the

period, net of tax of $(5,137) ............... (8,919) (8,919)

Unrealized gain — marketable securities, net of tax of

$41 .............................. 63 63

Comprehensive income for 2005 ............... 486,845

Dividends declared:

Cumulative preferred stock ................. (4,241) (4,241)

Common stock ....................... (343,234) (343,234)

Issuances of common stock .................. 2,925 7,313 45,654 52,967

Balance at Dec. 31, 2005 ................... 403,387 $1,008,468 $3,956,710 $ 562,138 $(132,061) $5,395,255

Net income ........................... 571,754 571,754

Minimum pension liability adjustment, net of tax of

$19,498 ........................... 31,957 31,957

Net derivative instrument fair value changes during the

period, net of tax of $6,297 ................ 11,000 11,000

Unrealized loss — marketable securities, net of tax of

$(18) ............................. (26) (26)

Comprehensive income for 2006 ............... 614,685

SFAS No. 158 adoption, net of tax of $42,265 ...... 72,804 72,804

Dividends declared:

Cumulative preferred stock ................. (4,241) (4,241)

Common stock ....................... (358,402) (358,402)

Issuances of common stock .................. 3,910 9,774 58,998 68,772

Share-based compensation ................... 27,949 27,949

Balance at Dec. 31, 2006 ................... 407,297 $1,018,242 $4,043,657 $ 771,249 $ (16,326) $5,816,822

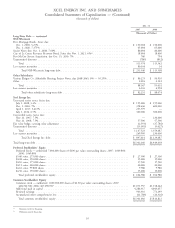

FIN 48 adoption ........................ 2,207 2,207

Net income ........................... 577,348 577,348

Changes in unrecognized amounts of pension and retiree

medical benefits, net of tax of $(1,872) ......... (1,855) (1,855)

Net derivative instrument fair value changes during the

period, net of tax of $(4,704) ............... (3,611) (3,611)

Unrealized gain — marketable securities, net of tax of

$(2) .............................. 44

Comprehensive income for 2007 ............... 571,886

Dividends declared:

Cumulative preferred stock ................. (4,241) (4,241)

Common stock ....................... (382,647) (382,647)

Issuances of common stock .................. 21,486 53,715 219,802 273,517

Share-based compensation ................... 23,458 23,458

Balance at Dec. 31, 2007 ................... 428,783 $1,071,957 $4,286,917 $ 963,916 $ (21,788) $6,301,002

75