Xcel Energy 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.revenue recovery of the costs of large projects or other costs that vary over time. As an example, a rider for MERP went

into effect in January 2006, allowing Xcel Energy to earn a return on the project, while each of the facilities is being

constructed.

Xcel Energy’s regulatory strategy is based on filing reasonable rate requests designed to provide recovery of legitimate

expenses and a return on utility investments. Xcel Energy believes that the public utility commissions will provide

reasonable recovery, and it is important to note that the financial plans include this assumption. Constructive results

over the last several years are evidence of reasonable regulatory treatment and give Xcel Energy confidence that Xcel

Energy is pursuing the right strategy. These rate cases, as well others planned for 2008 and beyond, are some of the

building blocks of the earnings growth plan.

With any strategic plan, there are goals and objectives. Xcel Energy feels the following financial objectives continue to

be both realistic and achievable.

• Annual earnings-per-share growth rate target of 5 percent to 7 percent;

• Annual dividend increases of 2 percent to 4 percent; and

• Senior unsecured debt credit ratings in the BBB+ to A range.

Successful execution of the Building the Core strategic plan should allow Xcel Energy to achieve the outlined financial

objectives, which in turn should provide investors with an attractive total return on a low-risk investment.

Optimizing the Management of a Portfolio of Operating Utilities

Optimizing the management of a portfolio of operating utilities is the third area of focus related to the Building the

Core strategy. Even though Xcel Energy ultimately manages the business based on the revenue streams provided by

electric and natural gas, Xcel Energy continues to evolve the management of the portfolio of utility investments. While

Xcel Energy has four separate operating companies, there are certain similarities and differences that require a new

approach to more effectively manage this portfolio. More specifically, Xcel Energy’s goal is to build on the similarities

among the companies, which maximizes efficiencies from centralized management and deployment of common

initiatives. Examples include market branding and environmental policy research. From an organizational perspective,

examples include corporate center services as well as certain operational functions, such as asset management,

environmental compliance and safety.

At the same time, Xcel Energy realizes there are unique differences in each of our service territories such as local

community focus and priorities, regulatory environment, physical plant infrastructure and age, weather, as well as others

that require Xcel Energy to organize / align these utility specific areas to most effectively address these utility distinct

characteristics. To that end, Xcel Energy has operating presidents, each located in their respective jurisdiction. The

objective of this organizational structure is to optimize Xcel Energy’s operating efficiency while maximizing

accountability.

Financial Review

The following discussion and analysis by management focuses on those factors that had a material effect on Xcel

Energy’s financial condition, results of operations and cash flows during the periods presented, or are expected to have a

material impact in the future. It should be read in conjunction with the accompanying consolidated financial statements

and the related notes to consolidated financial statements. All note references refer to the notes to consolidated financial

statements.

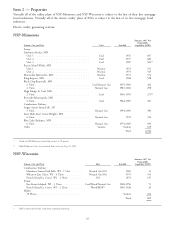

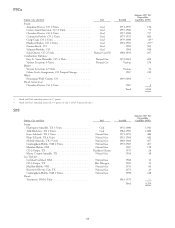

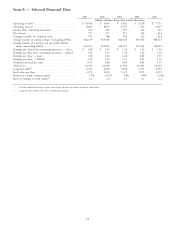

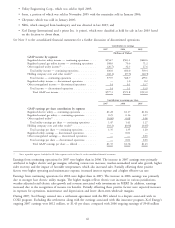

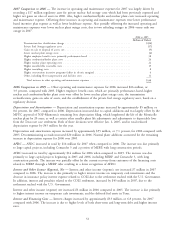

Summary of Financial Results

The following table summarizes the earnings contributions of Xcel Energy’s business segments on the basis of GAAP.

Continuing operations consist of the following:

• Regulated utility subsidiaries, operating in the electric and natural gas segments; and

• Other nonregulated subsidiaries and the holding company, where corporate financing activity occurs.

Discontinued operations consist of the following:

• Quixx Corp., a major portion of which was sold in October 2006;

45