Xcel Energy 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

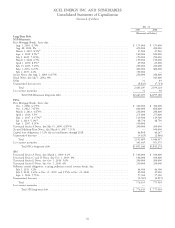

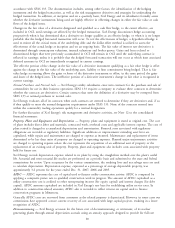

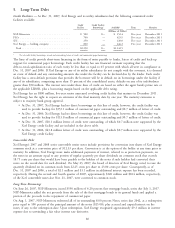

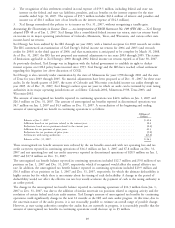

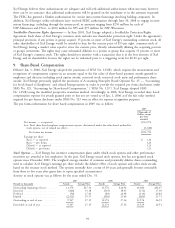

5. Long-Term Debt

Credit Facilities — At Dec. 31, 2007, Xcel Energy and its utility subsidiaries had the following committed credit

facilities available:

Credit Credit Facility

Facility Borrowings Available* Term Maturity

(Millions of Dollars)

NSP-Minnesota ....................... $ 500 $— $ 152.4 Five year December 2011

PSCo .............................. 700 — 423.9 Five year December 2011

SPS............................... 250 — 120.0 Five year December 2011

Xcel Energy — holding company ............ 800 — 446.2 Five year December 2011

Total ............................. $2,250 $— $1,142.5

* Net of credit facility borrowings, issued and outstanding letters of credit and commercial paper borrowings

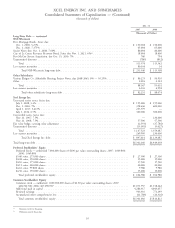

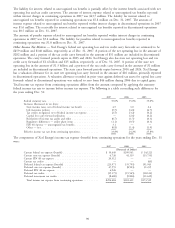

The lines of credit provide short-term financing in the form of notes payable to banks, letters of credit and back-up

support for commercial paper borrowings. Each credit facility has one financial covenant requiring that the

debt-to-total-capitalization ratio of each entity be less than or equal to 65 percent with which all were in compliance at

Dec. 31, 2007 and 2006. If Xcel Energy or any of its utility subsidiaries do not comply with the covenant, it is deemed

an event of default and any outstanding amounts due under the facility can be declared due by the lender. Each credit

facility has a cross default provision that provides the borrower will be in default on its borrowings under the facility if

any of its subsidiaries, comprising more than 15 percent of the consolidated assets, defaults on any of its indebtedness

greater than $50 million. The interest rates under these lines of credit are based on either the agent bank’s prime rate or

the applicable LIBOR, plus a borrowing margin based on the applicable debt rating.

Xcel Energy has an $800 million, five-year senior unsecured revolving credit facility that matures in December 2011.

Xcel Energy has the right to request an extension of the final maturity date by one year. The maturity extension is

subject to majority bank group approval.

• At Dec. 31, 2007, Xcel Energy had no direct borrowings on this line of credit, however, the credit facility was

used to provide backup for $353.1 million of commercial paper outstanding and $0.7 million of letters of credit.

• At Dec. 31, 2006, Xcel Energy had no direct borrowings on this line of credit, however, the credit facility was

used to provide backup for $113.8 million of commercial paper outstanding and $0.7 million of letters of credit.

• At Dec. 31, 2007, $20.1 million letters of credit were outstanding, of which $0.7 million were supported by the

Xcel Energy credit facility and are included in the above table.

• At Dec. 31, 2006, $43.8 million letters of credit were outstanding, of which $0.7 million were supported by the

Xcel Energy credit facility.

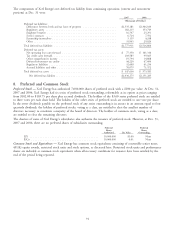

Convertible Debt

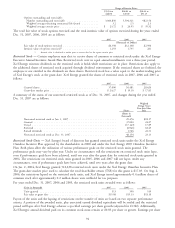

Xcel Energy’s 2007 and 2008 series convertible senior notes include provisions for conversion into shares of Xcel Energy

common stock at a conversion price of $12.33 per share. Conversion is at the option of the holder at any time prior to

maturity. In addition, Xcel Energy must make additional payments of interest, referred to as protection payments, on

the notes in an amount equal to any portion of regular quarterly per share dividends on common stock that exceeds

18.75 cents per share that would have been payable to the holders of the notes if such holders had converted their

notes on the record date for such dividend. On May 23, 2007, the board of directors of Xcel Energy voted to raise the

quarterly dividend on its common stock from 22.25 cents per share to 23.00 cents per share. Consequently, as of

Dec. 31, 2007 and 2006, a total of $2.1 million and $3.1 million in additional interest expense has been recorded,

respectively. During the second and fourth quarter of 2007, approximately $126 million and $104 million, respectively,

of the Xcel convertible notes due Nov. 21, 2007, were converted to common stock.

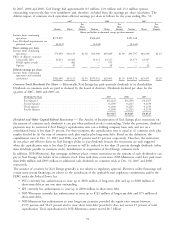

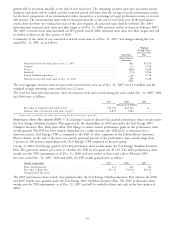

Long-Term Borrowings

On June 26, 2007, NSP-Minnesota issued $350 million of 6.20 percent first mortgage bonds, series due July 1, 2037.

NSP-Minnesota added the net proceeds from the sale of the first mortgage bonds to its general funds and applied a

portion of the proceeds to the repayment of commercial paper.

On Aug. 1, 2007, NSP-Minnesota redeemed all of its outstanding 8.00 percent Notes, series due 2042, at a redemption

price equal to 100 percent of the principal amount of the notes ($25.00), plus accrued and unpaid interest on the

notes, if any, to the redemption date. Upon redemption, Xcel Energy recognized approximately $9.3 million in interest

expense due to unwinding a fair value interest rate derivative.

86