Xcel Energy 2007 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

requirements to install emission-control equipment, and merger, acquisition and divestiture opportunities to support

corporate strategies may impact actual capital requirements.

Leases — Xcel Energy and its subsidiaries lease a variety of equipment and facilities used in the normal course of

business. Two of these leases qualify as capital leases and are accounted for accordingly. The capital leases contractually

expire in 2025 and 2028. The assets and liabilities acquired under capital leases are recorded at the lower of fair market

value or the present value of future lease payments and are amortized over their actual contract term in accordance with

practices allowed by regulators.

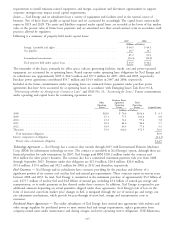

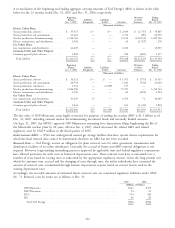

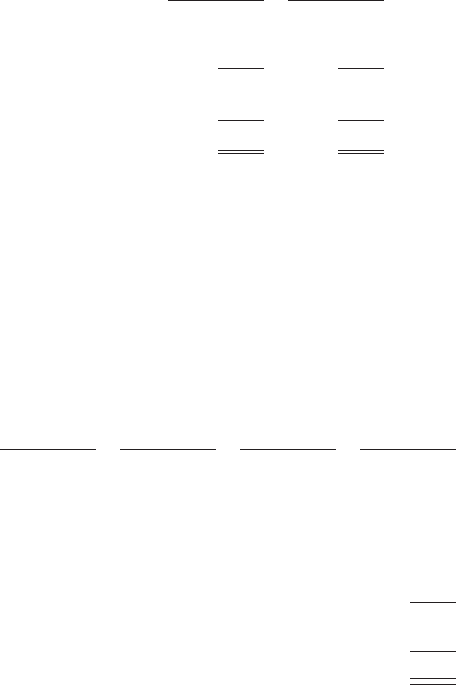

Following is a summary of property held under capital leases:

2007 2006

(Millions of Dollars)

Storage, leaseholds and rights .................................... $40.5 $ 40.5

Gas pipeline .............................................. 20.7 20.7

61.2 61.2

Accumulated amortization ...................................... (16.3) (15.0)

Total property held under capital leases .............................. $44.9 $ 46.2

The remainder of the leases, primarily for office space, railcars, generating facilities, trucks, cars and power-operated

equipment, are accounted for as operating leases. Rental expense under operating lease obligations for Xcel Energy and

its subsidiaries was approximately $105.2, $60.3 million and $57.2 million for 2007, 2006 and 2005, respectively.

Purchase power agreements contributed $55.7 million and $14.5 million in 2007 and 2006, respectively.

Included in the future commitments under operating leases are estimated future payments under purchase power

agreements that have been accounted for as operating leases in accordance with Emerging Issues Task Force 01-8,

‘‘Determining whether an Arrangement Contains a Lease’’ and SFAS No. 13, ‘‘Accounting for Leases.’’ Future commitments

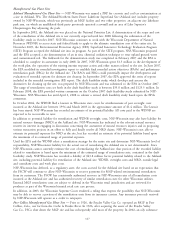

under operating and capital leases for continuing operations are:

Purchase Power

Other Agreement Total

Operating Operating Operating

Leases Leases Leases Capital Leases

(Millions of Dollars)

2008 ........................................... $28.0 $ 76.6 $104.6 $ 6.1

2009 ........................................... 25.1 77.5 102.6 6.0

2010 ........................................... 23.2 74.2 97.4 5.8

2011 ........................................... 20.4 64.0 84.4 5.7

2012 ........................................... 16.9 60.5 77.4 5.5

Thereafter ....................................... 55.9 916.6 972.5 56.9

Total minimum obligation ............................ 86.0

Interest component of obligation ......................... (41.1)

Present value of minimum obligation ..................... $44.9

Technology Agreement — Xcel Energy has a contract that extends through 2015 with International Business Machines

Corp. (IBM) for information technology services. The contract is cancelable at Xcel Energy’s option, although there are

financial penalties for early termination. In 2007, Xcel Energy paid IBM $126.2 million under the contract and

$0.4 million for other project business. The contract also has a committed minimum payment each year from 2008

through September 2015. Payments under this obligation are $21.6 million, $20.4 million, $20.0 million,

$19.6 million, $19.4 million and $52.5 million for 2008 to 2012 and thereafter, respectively.

Fuel Contracts — Xcel Energy and its subsidiaries have contracts providing for the purchase and delivery of a

significant portion of its current coal, nuclear fuel and natural gas requirements. These contracts expire in various years

between 2008 and 2033. In total, Xcel Energy is committed to the minimum purchase of approximately $3.2 billion of

coal, $475.7 million of nuclear fuel and $4.8 billion of natural gas, including $3.4 billion of natural gas storage and

transportation, or to make payments in lieu thereof, under these contracts. In addition, Xcel Energy is required to pay

additional amounts depending on actual quantities shipped under these agreements. Xcel Energy’s risk of loss, in the

form of increased costs from market price changes in fuel, is mitigated through the use of natural gas and energy cost

rate adjustment mechanisms, which provide for pass-through of most fuel, storage and transportation costs to

customers.

Purchased Power Agreements — The utility subsidiaries of Xcel Energy have entered into agreements with utilities and

other energy suppliers for purchased power to meet system load and energy requirements, replace generation from

company-owned units under maintenance and during outages, and meet operating reserve obligations. NSP-Minnesota,

115