Xcel Energy 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Off-Balance-Sheet Arrangements

Xcel Energy does not have any off-balance-sheet arrangements, other than those currently disclosed, that have or are

reasonably likely to have a current or future effect on financial condition, changes in financial condition, revenues or

expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Earnings Guidance

Xcel Energy’s 2008 earnings per share from continuing operations guidance and key assumptions are detailed in the

following table.

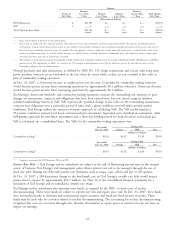

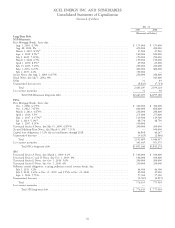

2008 Diluted Earnings Per Share

Range

Utility operations ........................................ $1.61 - $1.71

Holding company financing costs and other ........................ (0.16)

Xcel Energy Continuing Operations ........................... $1.45 - $1.55

Key Assumptions for 2008:

• Normal weather patterns are experienced during the year.

• Regulatory approval of various riders associated with MERP, Minnesota and Colorado transmission and Minnesota

renewable energy, which are expected to increase revenue by approximately $60 million to $70 million over the

projected 2007 levels.

• Reasonable regulatory outcomes in the New Mexico electric rate case, Texas electric rate case and North Dakota

electric rate case.

• No material incremental accruals related to the SPS regulatory proceedings.

• Weather-adjusted retail electric utility sales grow by approximately 1.8 percent to 2.2 percent.

• Weather-adjusted retail firm natural gas sales grow by approximately 0.0 percent to 1.0 percent.

• Short-term wholesale and commodity trading margins are within a range of $20 million to $30 million.

• Capacity costs at NSP-Minnesota and SPS are projected to increase approximately $45 million to $55 million over

2007 levels. We expect regulatory recovery of approximately $11 million of the increase in capacity costs at SPS.

Capacity costs at PSCo are recovered under the PCCA.

• Utility operating and maintenance expenses increase between 2 percent and 3 percent.

• Depreciation expense is projected to increase approximately $60 million to $70 million over 2007 levels.

• Interest expense increases approximately $25 million to $35 million over 2007 levels.

• Allowance for funds used during construction-equity increases approximately $35 million to $45 million over 2007

levels.

• An effective tax rate for continuing operations of approximately 32 percent to 35 percent.

• Average common stock and equivalents for diluted earnings per share calculations of approximately 438 million

shares.

Item 7A — Quantitative and Qualitative Disclosures About Market Risk

See Management’s Discussion and Analysis under Item 7, incorporated by reference.

68