Xcel Energy 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

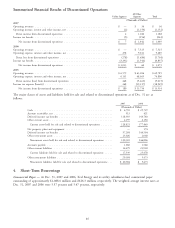

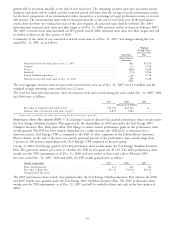

6. Generating Plant Ownership and Operation

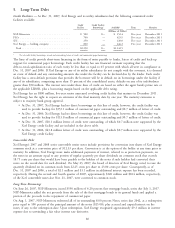

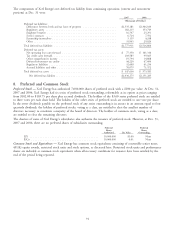

Joint Plant Ownership — Following are the investments by Xcel Energy’s subsidiaries in jointly owned plants and the

related ownership percentages as of Dec. 31, 2007:

Construction

Plant in Accumulated Work in

Service Depreciation Progress Ownership%

(Thousands of Dollars)

NSP-Minnesota

Sherco Unit 3 ..................................... $503,311 $313,733 $ 6,165 59.0

Sherco Common Facilities Units 1, 2 and 3 .................. 109,836 61,681 62 75.0

Transmission facilities, including substations .................. 4,832 2,130 — 59.0

Total NSP-Minnesota ............................... $617,979 $377,544 $ 6,227

PSCo

Hayden Unit 1 .................................... $ 87,160 $ 51,527 $ 494 75.5

Hayden Unit 2 .................................... 80,523 50,191 1,160 37.4

Hayden Common Facilities ............................. 30,019 10,634 176 53.1

Craig Units 1 and 2 ................................. 53,145 30,467 327 9.7

Craig Common Facilities Units 1, 2 and 3 ................... 32,584 13,344 643 6.5-9.7

Comanche Unit 3 .................................. — — 479,499 66.7

Transmission and other facilities, including substations ............ 141,031 51,341 1,101 11.6-68.1

Total PSCo ..................................... $424,462 $207,504 $483,400

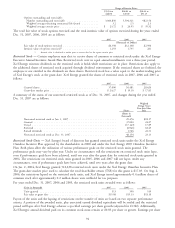

NSP-Minnesota is part owner of Sherco 3, an 860-MW, coal-fueled electric generating unit. NSP-Minnesota is the

operating agent under the joint ownership agreement. NSP-Minnesota’s share of operating expenses and construction

expenditures are included in the applicable utility accounts. Each of the respective owners is responsible for funding its

portion of the construction costs.

PSCo’s current operational assets include approximately 320 MWs of jointly owned generating capacity. PSCo’s share of

operating expenses and construction expenditures are included in the applicable utility accounts. Each of the respective

owners is responsible for the issuance of its own securities to finance its portion of the construction costs. PSCo began

major construction on a new jointly owned 750 MW, coal-fired unit in Pueblo, Colo. in January 2006. Major

construction on the new unit, Comanche 3, is expected to be completed in the fall of 2009. PSCo is the operating

agent under the joint ownership agreement.

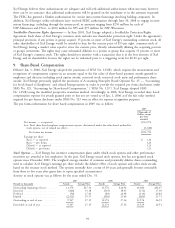

Nuclear Plant Operation — On Sept. 28, 2007, Xcel Energy obtained 100 percent ownership in NMC as a result of

WEC exiting the partnership due to the sale of its Point Beach Nuclear Plant to FPL Energy. Accordingly, the results of

operations of NMC and the estimated fair value of assets and liabilities were consolidated in Xcel Energy’s consolidated

financial statements from the Sept. 28, 2007 transaction date. WEC was required to pay an exit fee and surrender all of

its equity interest in NMC upon exiting. The effect of this transaction was not material to the financial position or the

results of operations to Xcel Energy. Xcel Energy is in the process of reintegrating its nuclear operations into its

generation operations and apply to the NRC to transfer the nuclear operating licenses from NMC to NSP-Minnesota.

The transfer of licenses is expected to be completed in early 2008.

7. Income Taxes

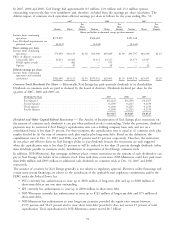

COLI — As previously disclosed, Xcel Energy and the U.S. government settled an ongoing dispute regarding PSCo’s

right to deduct interest expense on policy loans related to its COLI program that insured lives of certain PSCo

employees. These COLI policies were owned and managed by PSRI, a wholly owned subsidiary of PSCo. The total

exposure for the tax years in dispute through 2007 was approximately $583 million, which includes income tax, interest

and potential penalties. In September 2007, Xcel Energy and the United States finalized a settlement, which terminated

the tax litigation pending between the parties. As a result of the settlement, the lawsuit filed by Xcel Energy in the

United States District Court has been dismissed and the Tax Court proceedings are in the process of being dismissed.

Terms of the Final Settlement

1. Xcel Energy paid the government a total of $64.4 million in full settlement of the government’s claims for tax,

penalty, and interest for tax years 1993-2007. Xcel Energy paid the settlement as follows:

• $32.2 million was satisfied by tax and interest amounts that Xcel Energy had previously paid or deemed under

the terms of the settlement to have been paid.

• $32.2 million was paid by Xcel Energy on Oct. 31, 2007.

88