Xcel Energy 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

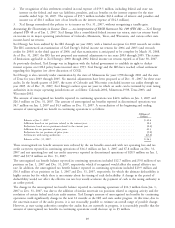

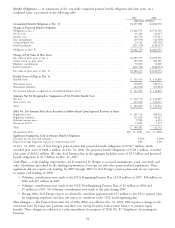

The liability for interest related to unrecognized tax benefits is partially offset by the interest benefit associated with net

operating loss and tax credit carryovers. The amount of interest expense related to unrecognized tax benefits reported

within interest charges in continuing operations in 2007 was $43.7 million. The liability for interest related to

unrecognized tax benefits reported in continuing operations was $5.8 million on Dec. 31, 2007. The amount of

interest expense related to unrecognized tax benefits reported within interest charges in discontinued operations in 2007

was $1.6 million. The receivable for interest related to unrecognized tax benefits reported in discontinued operations

was $0.5 million on Dec. 31, 2007.

The amount of penalty expense related to unrecognized tax benefits reported within interest charges in continuing

operations in 2007 was $3.2 million. The liability for penalties related to unrecognized tax benefits reported in

continuing operations was $1.0 million on Dec. 31, 2007.

Other Income Tax Matters — Xcel Energy’s federal net operating loss and tax credit carry forwards are estimated to be

$459 million and $140 million, respectively, as of Dec. 31, 2007. A portion of the net operating loss in the amount of

$282 million and a portion of the tax credit carry forward in the amount of $51 million are included in discontinued

operations. The carry forward periods expire in 2023 and 2024. Xcel Energy also has state net operating loss and tax

credit carry forwards of $1.4 billion and $15 million, respectively, as of Dec. 31, 2007. A portion of the state net

operating loss in the amount of $1.3 billion and a portion of the tax credit carry forward in the amount of $1 million

are included in discontinued operations. The state carry forward periods expire between 2014 and 2024. Xcel Energy

has a valuation allowance for its state net operating loss carry forward in the amount of $16 million, primarily reported

in discontinued operations. A valuation allowance recorded in prior years against deferred tax assets for capital loss carry

forwards related to discontinued operations was reduced to zero from $44 million during 2006 due to capital gains.

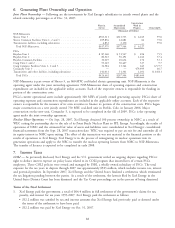

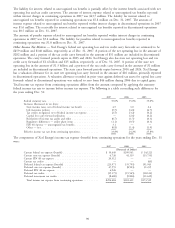

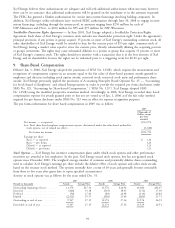

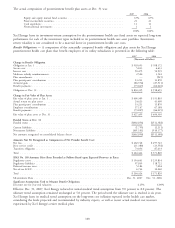

Total income tax expense from continuing operations differs from the amount computed by applying the statutory

federal income tax rate to income before income tax expense. The following is a table reconciling such differences for

the years ending Dec. 31:

2007 2006 2005

Federal statutory rate ............................... 35.0% 35.0% 35.0%

Increases (decreases) in tax from:

State income taxes, net of federal income tax benefit ......... 4.5 3.0 2.4

Life insurance policies ............................ (3.7) (4.6) (4.7)

Tax credits recognized, net of federal income tax expense ....... (2.5) (3.2) (4.2)

Capital loss carry forward utilization ................... — (2.6) (0.2)

Resolution of income tax audits and other ................ (0.7) (1.5) (0.3)

Regulatory differences — utility plant items ............... (1.1) (0.5) (0.3)

FIN 48 expense — unrecognized tax benefits .............. 3.1 — —

Other — net .................................. (0.8) (1.4) (1.9)

Effective income tax rate from continuing operations ........... 33.8% 24.2% 25.8%

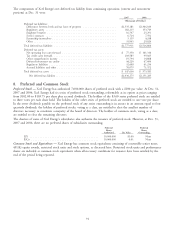

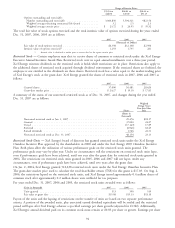

The components of Xcel Energy’s income tax expense (benefit) from continuing operations for the years ending Dec. 31

were:

2007 2006 2005

(Thousands of Dollars)

Current federal tax expense (benefit) ..................... $10,649 $209,941 $ (4,122)

Current state tax expense (benefit) ...................... 6,726 41,119 (15,733)

Current FIN 48 tax expense .......................... 20,512 — —

Current tax credits ................................ — — (45)

Deferred federal tax expense (benefit) .................... 225,971 (35,795) 191,945

Deferred state tax expense (benefit) ...................... 47,555 (8,503) 31,235

Deferred FIN 48 tax expense ......................... 6,926 — —

Deferred tax credits ............................... (15,175) (15,545) (18,122)

Deferred investment tax credits ........................ (8,680) (9,806) (11,619)

Total income tax expense from continuing operations ......... $294,484 $181,411 $173,539

90