Xcel Energy 2007 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SPS

Pending and Recently Concluded Regulatory Proceedings — PUCT

Base Rate

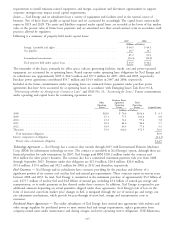

Texas Retail Base Rate And Fuel Reconciliation Case — In May 2006, SPS filed a Texas retail electric rate case

requesting an increase in annual revenues of approximately $48 million. The rate filing was based on a historical test

year, an electric rate base of $943 million, a requested ROE of 11.6 percent and a common equity ratio of

51.1 percent.

In addition, SPS submitted a fuel reconciliation filing, which requested approval of approximately $957 million of

Texas-jurisdictional fuel and purchased power costs for 2004 through 2005. As a part of the fuel reconciliation case,

fuel and purchased energy costs were reviewed.

In March 2007, SPS and various intervenors filed a unanimous stipulation agreement related to the Texas retail rate

case as well as the fuel reconciliation portion of the proceeding. An estimated settlement allowance and reserve was

established in 2006 and prior periods, which approximated the settled amounts of previously deferred or recovered fuel

expense.

In July 2007, the PUCT issued a written order adopting the settlement and determined that SPS’ sale to EPE should

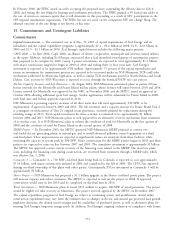

be assigned incremental cost. Included in the order are the following decisions:

• An annual base rate increase of $23 million, or approximately 3 percent.

• Disallowed approximately $27 million of SPS’ 2004 and 2005 fuel expense.

• An additional $2.3 million will be deducted from SPS’ next fuel reconciliation filing to be made in 2008,

associated with the 2006-2007 fuel reconciliation period.

• All of SPS’ existing long-term firm and interruptible capacity wholesale sales are assigned system average costs for

purposes of Texas retail ratemaking, except for sales to El Paso Electric (EPE), which is assigned incremental

costs to the EPE sale. The effect of this decision under the terms of the settlement is a continuation of

incremental fuel assignment for the sale to EPE in 2007, a portion of which SPS will not recover either through

its FCA or its contract. For 2008, this amount will be $6.3 million

• Established a standard for cost assignment that would apply to future wholesale sale transactions, and establishes

margin sharing of market based wholesale demand revenues.

• If SPS files a general rate case in 2008, the settlement would allow for an interim rate increase associated with a

purchased power agreement with Lea Power Partners of approximately $1.5 million per month from the date of

commercial operations. Interim rates would be subject to a true-up based on the outcome of the rate case

proceeding and actual capacity costs incurred.

SPS has previously given notice to EPE to terminate the agreement based on a regulatory provision and Xcel Energy

has reached agreement with EPE that the termination will be effective Sept. 30, 2009. SPS plans to file in mid-2008,

another Texas retail base rate case and application to reconcile its 2006 and 2007 fuel costs.

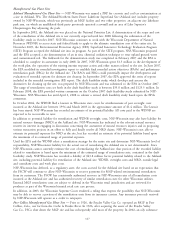

Application to Increase Voltage-Level Line Loss Factors — In June 2007, SPS filed for approval of an increase in its

voltage level line-loss factors. On Jan. 31, 2008, the PUCT approved SPS’ application to update its current Texas retail

fuel. Under the Texas Retail Base Rate case discussed above, SPS is permitted to implement the revised line loss factors

effective to May 2007. SPS recognized $6.2 million in the fourth quarter of 2007 for the impact of the study from

May 1, 2007 through Dec. 31, 2007.

Electric and Resource Adjustment Clauses

TCR Factor Rulemaking — The PUCT adopted in November 2007 new rules relating to TCR Factor outside of a base

rate case. The rule establishes the mechanism by which SPS can request annual recovery of its reasonable and necessary

expenditures for transmission infrastructure improvement costs and changes in wholesale transmission charges that are

not included in existing rates. This new rule allows SPS more timely recovery of transmission cost increases in-between

base rate cases.

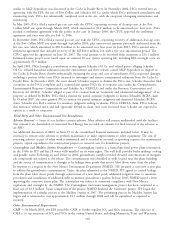

Pending and Recently Concluded Regulatory Proceedings — NMPRC

Base Rate

New Mexico Electric Rate Case — In July 2007, SPS filed with the NMPRC requesting a New Mexico retail electric

general rate increase of $17.3 million annually, or a 6.6 percent increase. The rate filing is based on a 2006 calendar

110