Xcel Energy 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

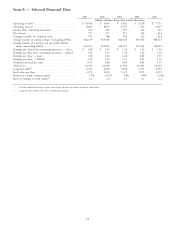

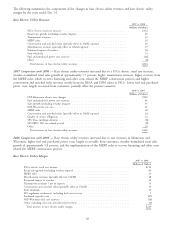

2007 Comparison to 2006 — The increase in base electric margin for the year was due to PSCo electric rate increase,

the impact of favorable temperatures and weather normalized retail sales growth. These items were partially offset by

purchased power costs, NSP-Wisconsin fuel cost recovery and other items.

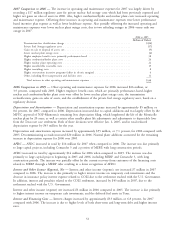

2006 vs. 2005

(Millions of Dollars)

NSP-Minnesota electric rate changes ................................... $129

NSP-Wisconsin rate changes, including fuel and purchased power cost recovery ........ 41

Sales growth (excluding weather impact) ................................. 39

MERP rider .................................................. 38

Conservation and non-fuel rider revenues ................................ 24

Firm wholesale ................................................. 12

Quality-of-service obligations ........................................ 12

Transmission fee classification change ................................... (26)

PSCo ECA incentive ............................................. (20)

SPS Texas surcharge decision ........................................ (8)

SPS FERC 206 rate refund accrual .................................... (8)

Estimated impact of weather ........................................ (3)

Other, including certain regulatory reserves ............................... (4)

Total increase in base electric utility margin ............................. $226

2006 Comparison to 2005 — Base electric utility margins, which are primarily derived from retail customer sales,

increased due to rate increases in Minnesota and Wisconsin, weather-normalized retail sales growth, the implementation

of the MERP rider, and higher firm wholesale margins. Partially offsetting the increase, is a transmission fee

classification change from other operating and maintenance expenses-utility in 2005 to electric utility margin in 2006,

which did not impact operating income or net income. The change resulted from an analysis conducted in conjunction

with the expiration and renegotiation of certain transmission agreements, resulting in better alignment of reporting such

costs consistent with MISO classification. In addition, the ECA incentive earned in Colorado in 2006 resulted in a loss,

as compared to a gain in 2005.

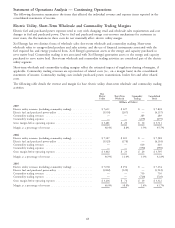

Short-Term Wholesale and Commodity Trading Margin

2007 Comparison to 2006 — Short-term wholesale and commodity trading margins decreased approximately

$13 million for 2007 compared to 2006. As expected, short-term wholesale margins declined due to retail sales growth,

which reduced generation available for sale in the wholesale market.

2006 Comparison to 2005 — As expected, short-term wholesale and commodity trading margins declined by

$43 million for 2006 compared with 2005, due to retail sales growth, which reduced surplus generation available for

sale in the wholesale market, reductions in the availability of the coal-fired King plant due to the MERP project,

decreased opportunities to sell due to the MISO centralized dispatch market and the Minnesota rate case settlement

agreement to refund to customers the majority of short-term wholesale margins attributable to Minnesota jurisdiction

customers starting in 2006.

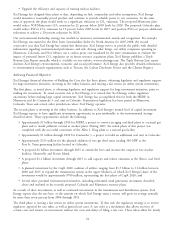

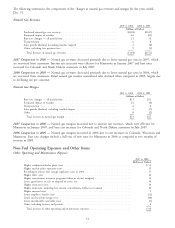

Natural Gas Utility Revenues and Margins

The following table details the changes in natural gas utility revenues and margin. The cost of natural gas tends to vary

with changing sales requirements and the unit cost of wholesale natural gas purchases. However, due to purchased

natural gas cost-recovery mechanisms for sales to retail customers, fluctuations in the wholesale cost of natural gas have

little effect on natural gas margin. See further discussion under Factors Affecting Results of Continuing Operations.

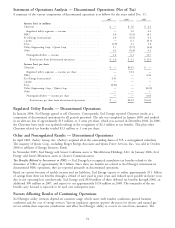

2007 2006 2005

(Millions of Dollars)

Natural gas utility revenues ........................... $2,112 $ 2,156 $ 2,307

Cost of natural gas purchased and transported ............... (1,548) (1,645) (1,823)

Natural gas utility margin ........................... $ 564 $ 511 $ 484

50