Xcel Energy 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

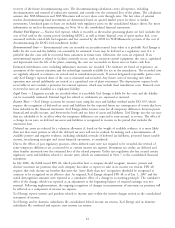

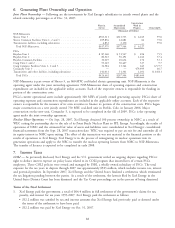

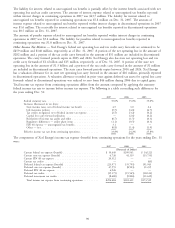

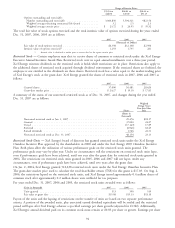

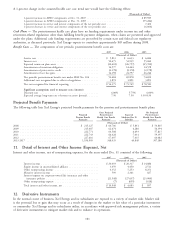

The components of Xcel Energy’s net deferred tax liability from continuing operations (current and noncurrent

portions) at Dec. 31 were:

2007 2006

(Thousands of Dollars)

Deferred tax liabilities:

Differences between book and tax bases of property .................... $2,535,181 $2,306,160

Regulatory assets .......................................... 182,215 153,749

Employee benefits ......................................... 16,707 25,291

Service contracts .......................................... 6,724 7,592

Partnership income/loss ...................................... 5,119 4,248

Other ................................................. 31,965 29,826

Total deferred tax liabilities ..................................... $2,777,911 $2,526,866

Deferred tax assets:

Net operating loss carry forward ................................ $ 77,350 $ 101,316

Tax credit carry forward ...................................... 103,585 99,025

Other comprehensive income .................................. 19,794 14,808

Deferred investment tax credits ................................. 44,220 47,606

Regulatory liabilities ........................................ 32,608 41,254

Accrued liabilities and other ................................... 70,079 71,572

Total deferred tax assets ....................................... $ 347,636 $ 375,581

Net deferred tax liability .................................... $2,430,275 $2,151,285

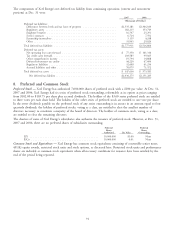

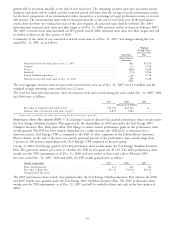

8. Preferred and Common Stock

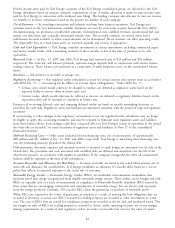

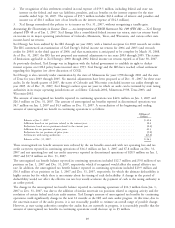

Preferred Stock — Xcel Energy has authorized 7,000,000 shares of preferred stock with a $100 par value. At Dec. 31,

2007 and 2006, Xcel Energy had six series of preferred stock outstanding, redeemable at its option at prices ranging

from $102.00 to $103.75 per share plus accrued dividends. The holders of the $3.60 series preferred stock are entitled

to three votes per each share held. The holders of the other series of preferred stock are entitled to one vote per share.

In the event dividends payable on the preferred stock of any series outstanding is in arrears in an amount equal to four

quarterly dividends, the holders of preferred stocks, voting as a class, are entitled to elect the smallest number of

directors necessary to constitute a majority of the board of directors. The holders of common stock, voting as a class,

are entitled to elect the remaining directors.

The charters of some of Xcel Energy’s subsidiaries also authorize the issuance of preferred stock. However, at Dec. 31,

2007 and 2006, there are no preferred shares of subsidiaries outstanding.

Preferred Preferred

Shares Shares

Authorized Par Value Outstanding

SPS ......................................... 10,000,000 $1.00 None

PSCo ........................................ 10,000,000 0.01 None

Common Stock and Equivalents — Xcel Energy has common stock equivalents consisting of convertible senior notes,

401(k) equity awards, restricted stock units and stock options, as discussed later. Restricted stock units and performance

shares are included as common stock equivalents when all necessary conditions for issuance have been satisfied by the

end of the period being reported.

91