Xcel Energy 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

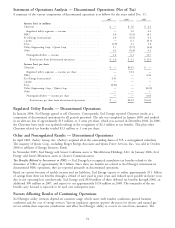

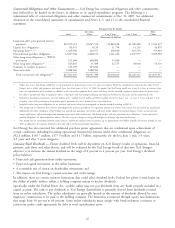

and measures the goodwill acquired in the business combination or a gain from a bargain purchase; and determines

what information to disclose to enable users of the financial statements to evaluate the nature and financial effects of

the business combination. SFAS No. 141R is to be applied prospectively to business combinations for which the

acquisition date is on or after the beginning of an entity’s fiscal year that begins on or after Dec. 15, 2008. Xcel Energy

is evaluating the impact of SFAS No. 141R on its consolidated financial statements for any potential business

combinations subsequent to Jan. 1, 2009.

Noncontrolling Interests in Consolidated Financial Statements, an Amendment of ARB No. 51(SFAS No. 160) — In

December 2007, the FASB issued SFAS No. 160, which establishes accounting and reporting standards that require the

ownership interest in subsidiaries held by parties other than the parent be clearly identified and presented in the

consolidated balance sheets within equity, but separate from the parent’s equity; the amount of consolidated net income

attributable to the parent and the noncontrolling interest be clearly identified and presented on the face of the

consolidated statement of earnings; and changes in a parent’s ownership interest while the parent retains its controlling

financial interest in its subsidiary be accounted for consistently. This statement is effective for fiscal years beginning on

or after Dec. 15, 2008. Xcel Energy is evaluating the impact of SFAS No. 160 on its consolidated financial statements.

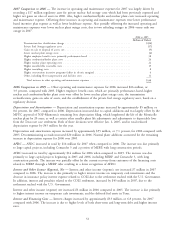

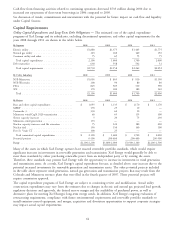

Derivatives, Risk Management and Market Risk

In the normal course of business, Xcel Energy and its subsidiaries are exposed to a variety of market risks. Market risk

is the potential loss or gain that may occur as a result of changes in the market or fair value of a particular instrument

or commodity. All financial and commodity-related instruments, including derivatives, are subject to market risk. These

risks, as applicable to Xcel Energy and its subsidiaries, are discussed in further detail later.

Commodity Price Risk — Xcel Energy’s utility subsidiaries are exposed to commodity price risk in their electric and

natural gas operations. Commodity price risk is managed by entering into long- and short-term physical purchase and

sales contracts for electric capacity, energy and energy-related products and for various fuels used in generation and

distribution activities. Commodity price risk is also managed through the use of financial derivative instruments. Xcel

Energy’s risk-management policy allows it to manage commodity price risk within each rate-regulated operation to the

extent such exposure exists.

Short-Term Wholesale and Commodity Trading Risk — Xcel Energy’s utility subsidiaries conduct various short-term

wholesale and commodity trading activities, including the purchase and sale of electric capacity and energy and other

energy-related instruments. Xcel Energy’s risk-management policy allows management to conduct these activities within

guidelines and limitations as approved by its risk management committee, which is made up of management personnel

not directly involved in the activities governed by this policy.

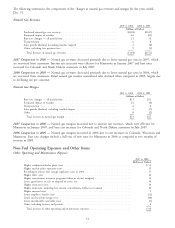

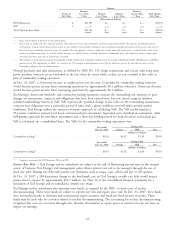

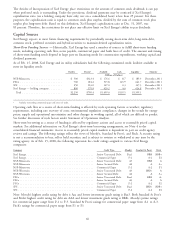

The fair value of the commodity trading contracts at Dec. 31, 2007, were as follows:

(Millions of Dollars)

Fair value of trading contracts outstanding at Jan. 1, 2007 ..................... $ (1.2)

Contracts realized or settled during the year .............................. (14.8)

Fair value of trading contract additions and changes during the year ............... 22.3

Fair value of trading contracts outstanding at Dec. 31, 2007 .................... $ 6.3

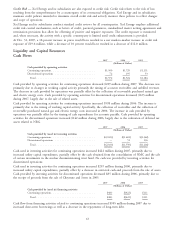

At Dec. 31, 2007, the fair values by source for the commodity trading net asset or liability balances were as follows:

Futures/Forwards

Maturity Maturity Total Futures/

Source of Less Than Maturity Maturity Greater Than Forwards Fair

Fair Value 1 Year 1 to 3 Years 4 to 5 Years 5 Years Fair Value

(Thousands of Dollars)

NSP-Minnesota ............... 1 $(2,499) $ — $— $— $(2,499)

2 3,769 980 — — 4,749

PSCo ..................... 1 (657) — — — (657)

2 3,893 701 — — 4,594

SPS* ...................... 1 63———63

2 163 38 — — 201

Total Futures/Forwards Fair Value .... $4,732 $1,719 $— $— $ 6,451

61