Xcel Energy 2007 Annual Report Download - page 89

Download and view the complete annual report

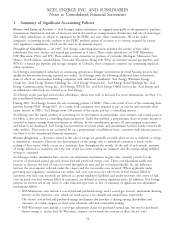

Please find page 89 of the 2007 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.prospectively through the rate review process, which normally occurs every two years and an interim fuel-cost

hearing process.

• PSCo generally recovers all prudently incurred electric fuel and purchased energy costs through the ECA. The

ECA is an incentive adjustment mechanism that compares actual fuel and purchased energy expense in a

calendar year to a benchmark formula. Effective January 2007, the ECA was modified to include an incentive

adjustment to encourage efficient operation of base load coal plants and encourage cost reductions through

purchases of economical short-term energy. The total incentive payment to PSCo in any calendar year will not

exceed $11.25 million. The ECA mechanism is revised quarterly and interest accrues monthly on the average

deferred balance. The ECA will expire at the earlier of rates taking effect after Comanche 3 is placed in service

or Dec. 31, 2010.

• In Texas, SPS recovers fuel and purchased energy costs through a fixed fuel and purchased energy recovery factor,

which is part of SPS’ retail electric rates. The Texas retail fuel factors change each November and May based on

the projected costs of natural gas. In New Mexico and at the FERC, SPS has a monthly fuel and purchased

power cost-recovery factor.

• NSP-Minnesota rates in Minnesota include monthly adjustments for recovery of conservation and energy-

management program costs, which are reviewed annually. NSP-Minnesota is allowed to recover certain costs

associated with new transmission facilities to deliver renewable energy resources through a rate rider.

• PSCo’s rates include annual adjustments for the recovery of conservation and energy-management program costs,

which are reviewed annually. PSCo is allowed to recover certain costs associated with renewable energy resources

through a specific retail rate rider. In January 2008, a new recovery mechanism for transmission commenced.

The TCA permits PSCo to recover costs associated with investment in transmission facilities made after

March 2007 through a rate rider.

• NSP-Minnesota, NSP-Wisconsin, PSCo and SPS sell firm power and energy in wholesale markets, which are

regulated by the FERC. Certain of these rates include monthly wholesale fuel cost-recovery mechanisms.

Commodity Trading Operations — All applicable gains and losses related to commodity trading activities, whether or

not settled physically, are shown on a net basis in the consolidated statements of income.

Xcel Energy’s commodity trading operations are conducted by NSP-Minnesota, PSCo and SPS. Commodity trading

activities are not associated with energy produced from Xcel Energy’s generation assets or energy and capacity purchased

to serve native load. Commodity trading contracts are recorded at fair market value in accordance with SFAS No. 133

‘‘Accounting for Derivative Instruments and Hedging Activities: (SFAS 133). In addition, commodity trading results

include the impact of all margin-sharing mechanisms.

Types of and Accounting for Derivative Instruments — Xcel Energy and its subsidiaries use derivative instruments in

connection with its utility commodity price, interest rate, short-term wholesale and commodity trading activities,

including forward contracts, futures, swaps and options. All derivative instruments not designated and qualifying for the

normal purchases and normal sales exception, as defined by SFAS 133 are recorded on the consolidated balance sheets

at fair value as derivative instruments valuation. The classification of the fair value for those derivative instruments is

dependent on the designation of a qualifying hedging relationship. The adjustment to fair value of derivative

instruments not designated in a qualifying hedging relationship is reflected in current earnings or as a regulatory asset

or liability. The classification is dependent on the applicability of specific regulation. This includes certain instruments

used to mitigate market risk for the utility operations and all instruments related to the commodity trading operations.

Gains or losses on hedging transactions for the sales of energy or energy-related products are primarily recorded as a

component of revenue; hedging transactions for fuel used in energy generation are recorded as a component of fuel

costs; hedging transactions for natural gas purchased for resale are recorded as a component of natural gas costs; and

interest rate hedging transactions are recorded as a component of interest expense. Certain utility subsidiaries are

allowed to recover in electric or natural gas rates the costs of certain financial instruments purchased to reduce

commodity cost volatility.

Cash Flow and Fair Value Hedges — Qualifying hedging relationships are designated as either a hedge of a forecasted

transaction or future cash flow (cash flow hedge), or a hedge of a recognized asset, liability or firm commitment (fair

value hedge). The designation of a cash flow hedge permits the classification of fair value to be recorded within Other

Comprehensive Income (OCI), to the extent effective. The designation of a fair value hedge permits a derivative

instrument’s gains or losses to offset the related results of the hedged item in the consolidated statements of income.

SFAS 133 requires that the hedging relationship be highly effective and that a company formally designate a hedging

relationship to apply hedge accounting. Xcel Energy and its subsidiaries formally document all hedging relationships in

79