Western Union 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

91

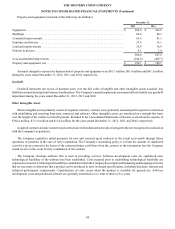

Fair Value Measurements

The Company determines the fair values of its assets and liabilities that are recognized or disclosed at fair value in accordance

with the hierarchy described below. The fair values of the assets and liabilities held in the Company's defined benefit plan trust

(“Trust”) are recognized or disclosed utilizing the same hierarchy. The following three levels of inputs may be used to measure

fair value:

• Level 1: Quoted prices in active markets for identical assets or liabilities.

• Level 2: Observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities, quoted prices

in markets that are not active, or other inputs that are observable or can be corroborated by observable market data for

substantially the full term of the assets or liabilities. For most of these assets, the Company utilizes pricing services that

use multiple prices as inputs to determine daily market values. In addition, the Trust has other investments that fall within

Level 2 that are valued at net asset value which is not quoted on an active market; however, the unit price is based on

underlying investments which are traded on an active market. Further, these investments have no redemption restrictions,

and redemptions can generally be done monthly or quarterly with required notice ranging from one to 45 days.

• Level 3: Unobservable inputs that are supported by little or no market activity and that are significant to the fair value

of the assets or liabilities. Level 3 assets and liabilities include items where the determination of fair value requires

significant management judgment or estimation. The Company has Level 3 assets that are recognized and disclosed at

fair value on a non-recurring basis related to the Company's business combinations, where the values of the intangible

assets and goodwill acquired in a purchase are derived utilizing one of the three recognized approaches: the market

approach, the income approach or the cost approach.

Carrying amounts for many of the Company's financial instruments, including cash and cash equivalents, settlement cash and

cash equivalents, settlement receivables and settlement obligations, and commercial paper borrowings approximate fair value due

to their short maturities. Investment securities, included in settlement assets, and derivative financial instruments are carried at

fair value and included in Note 8. Fixed rate notes are carried at their original issuance values as adjusted over time to accrete that

value to par, except for portions of notes hedged by interest rate swap agreements as disclosed in Note 14. The fair values of fixed

rate notes are also disclosed in Note 8 and are based on market quotations. For more information on the fair value of financial

instruments, see Note 8.

The fair values of non-financial assets and liabilities related to the Company's business combinations are disclosed in Note 3.

The fair values of financial assets and liabilities related to the Trust are disclosed in Note 11.

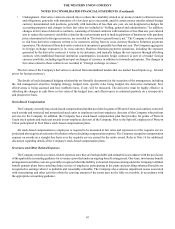

Business Combinations

The Company accounts for all business combinations where control over another entity is obtained using the acquisition

method of accounting, which requires that most assets (both tangible and intangible), liabilities (including contingent consideration),

and remaining noncontrolling interests be recognized at fair value at the date of acquisition. The excess of the purchase price over

the fair value of assets less liabilities and noncontrolling interests is recognized as goodwill. Certain adjustments to the assessed

fair values of the assets, liabilities, or noncontrolling interests made subsequent to the acquisition date, but within the measurement

period, which is one year or less, are recorded as adjustments to goodwill. Any adjustments subsequent to the measurement period

are recorded in income. Any cost or equity method interest that the Company holds in the acquired company prior to the acquisition

is remeasured to fair value at acquisition with a resulting gain or loss recognized in income for the difference between fair value

and existing book value. Results of operations of the acquired company are included in the Company's results from the date of the

acquisition forward and include amortization expense arising from acquired intangible assets. The Company expenses all costs as

incurred related to or involved with an acquisition in “Selling, general and administrative” expenses.

Cash and Cash Equivalents

Highly liquid investments (other than those included in settlement assets) with maturities of three months or less at the date

of purchase (that are readily convertible to cash) are considered to be cash equivalents and are stated at cost, which approximates

fair value.