Western Union 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.69

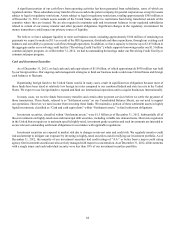

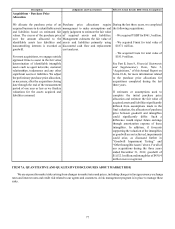

During 2012, our Board of Directors declared a quarterly cash dividend of $0.125 per common share in the fourth quarter and

$0.10 per common share in each of the first three quarters representing $254.2 million in total dividends. During 2011, our Board

of Directors declared quarterly cash dividends of $0.08 per common share in each of the last three quarters and $0.07 per common

share in the first quarter representing $194.2 million in total dividends. During the year ended December 31, 2010, our Board of

Directors declared quarterly cash dividends of $0.07 per common share in the fourth quarter and $0.06 per common share in each

of the first three quarters representing $165.3 million in total dividends. These amounts were paid to shareholders of record in the

respective quarter the dividend was declared, except for the September 2012, 2011 and 2010 declared dividends, which were paid

in October 2012, 2011 and 2010, respectively.

On February 21, 2013, our Board of Directors declared a quarterly cash dividend of $0.125 per common share payable on

March 29, 2013.

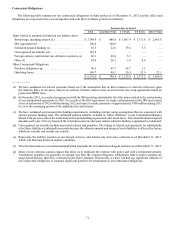

Debt Service Requirements

Our 2013 debt service requirements will include $300.0 million of our floating rate notes maturing in March 2013, payments

on future borrowings under our commercial paper program, if any, and interest payments on all outstanding indebtedness. We have

the ability to use existing financing sources, including our Revolving Credit Facility or commercial paper program, and cash,

including cash generated from operations and proceeds from our 2015 and 2017 borrowings to meet our debt obligations as they

come due.

Our ability to continue to grow the business, make acquisitions, return capital to shareholders, including share repurchases

and dividends, and service our debt will depend on our ability to continue to generate excess operating cash through our operating

subsidiaries and to continue to receive dividends from those operating subsidiaries, our ability to obtain adequate financing and

our ability to identify acquisitions that align with our long-term strategy.

Off-Balance Sheet Arrangements

Other than facility and equipment leasing arrangements disclosed in Part II, Item 8, Financial Statements and Supplementary

Data, Note 12, “Operating Lease Commitments,” we have no material off-balance sheet arrangements that have or are reasonably

likely to have a material current or future effect on our financial condition, revenues or expenses, results of operations, liquidity,

capital expenditures or capital resources.