Western Union 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.60

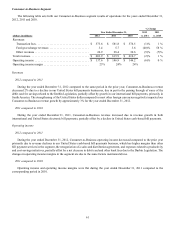

2011 compared to 2010

For the year ended December 31, 2011 compared to the same period in 2010, Consumer-to-Consumer money transfer revenue

grew 5%, on transaction growth of 6%. The weakening of the United States dollar compared to most other foreign currencies

positively impacted our revenue growth by approximately 1%, which was offset by slight price reductions for the year ended

December 31, 2011.

Revenue in our Europe and CIS region increased 3% during the year ended December 31, 2011 compared to the same period

in 2010 due to transaction growth of 1% as well as the other factors described above. The United Kingdom, France, and Germany

continued to experience revenue and transaction growth for the year ended December 31, 2011 versus the prior year, which was

partially offset by softness in Southern Europe and Russia.

North America revenue increased 3% due to transaction growth of 7% for the year ended December 31, 2011 compared to

the same period in 2010. Our domestic business experienced revenue growth of 8% for the year ended December 31, 2011 due to

transaction growth of 16%. Transaction growth in our domestic business was higher than revenue growth due to transaction growth

being greater in lower principal bands, which have lower revenue per transaction. Our United States outbound business experienced

both transaction and revenue growth in the year ended December 31, 2011. Mexico revenue increased 2% on flat transactions for

the year ended December 31, 2011. Our Mexico business was affected by changes to our compliance procedures related to the

agreement and settlement with the State of Arizona and other states.

Our Middle East and Africa, APAC, and LACA regions all experienced revenue and transaction growth in the year ended

December 31, 2011 compared to the same period in 2010. Revenues in the Middle East and Africa and APAC regions in the year

ended December 31, 2011 were positively impacted by the weakening of the United States dollar compared to most other foreign

currencies. The Gulf States continued to experience revenue and transaction growth for the year ended December 31, 2011, which

was partially offset by declines resulting from the political unrest in Libya and the Ivory Coast. China's revenue increased 6% for

year ended December 31, 2011 on transaction growth of 4%. Our money transfer business to India experienced revenue growth

of 11% and transaction growth of 10% for the year ended December 31, 2011 versus the prior year. Revenue generated from

transactions initiated at westernunion.com increased for the year ended December 31, 2011 compared to the same period in 2010

due to strong transaction growth.

Foreign exchange revenues for the year ended December 31, 2011 grew compared to the same period in 2010, driven primarily

by increased amounts of cross-border principal sent.

Fluctuations in the exchange rate between the United States dollar and currencies other than the United States dollar resulted

in a benefit to transaction fees and foreign exchange revenues for the year ended December 31, 2011 of $39.1 million over the

same period in 2010, net of foreign currency hedges, that would not have occurred had there been constant currency rates.

Operating income

2012 compared to 2011

Consumer-to-Consumer operating income declined 4% during the year ended December 31, 2012 compared to the prior year

due to investments in our strategic initiatives, including westernunion.com, increased compliance program costs, expenses related

to productivity and cost-savings initiatives, increased bad debt losses, and incremental costs associated with the Finint and Costa

acquisitions, partially offset by positive currency impacts, including the effect of foreign currency hedges, restructuring savings,

and decreased compensation expenses. The changes in operating income margins in the segment are due to the same factors

mentioned above.

2011 compared to 2010

Consumer-to-Consumer operating income increased 6% during the year ended December 31, 2011 compared to the same

period in 2010 due to revenue growth. The change in operating income margin for the year ended December 31, 2011 compared

to the same period in 2010 was primarily due to restructuring savings and revenue leverage, partially offset by negative currency

impacts, including the effect of foreign currency hedges, and spending on initiatives.