Western Union 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

98

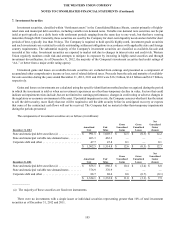

3. Acquisitions

On November 7, 2011, the Company acquired the business-to-business payment business known as Travelex Global Business

Payments from Travelex Holdings Limited for cash consideration of £596 million ($956.5 million), net of a final working capital

adjustment which resulted in a return of £15 million ($24.1 million) of purchase consideration in the third quarter of 2012. In

connection with the July 5, 2011 purchase agreement, on May 4, 2012, the Company also acquired the French assets of TGBP for

cash consideration of £3 million ($4.8 million) after receiving regulatory approval. For the year ended December 31, 2011, the

Company incurred $20.7 million of costs associated with the closing of the TGBP acquisition. With the acquisition of TGBP and

the Company's existing Business Solutions business, the Company has the ability to leverage TGBP's business-to-business payments

market expertise, distribution, products and capabilities with Western Union's brand, existing Business Solutions operations, global

infrastructure and relationships, and financial strength. The results of operations for TGBP have been included in the Company's

consolidated financial statements from the date of acquisition.

On October 31, 2011 and April 20, 2011, the Company acquired the remaining 70% interests in European-based Finint S.r.l.

(“Finint”) and Angelo Costa S.r.l. (“Costa”), respectively, two of the Company's largest agents providing services in a number of

European countries. The Company previously held a 30% equity interest in each of these agents. The Company expects these

acquisitions will help accelerate the introduction of additional Western Union products and services and will leverage its existing

European infrastructure to build new opportunities across the European Union. The acquisitions do not impact the Company's

money transfer revenue, because the Company was already recording all of the revenue arising from money transfers originating

at Finint's and Costa's subagents. As of the acquisition dates, the Company no longer incurs commission costs for transactions

related to Finint and Costa; rather the Company now pays commissions to Finint and Costa subagents, resulting in lower overall

commission expense. The Company's operating expenses include costs attributable to Finint's and Costa's operations subsequent

to the acquisition dates.

The Company acquired the remaining 70% interest in Finint for cash consideration of €99.6 million ($139.4 million). The

Company revalued its previous 30% equity interest to fair value of approximately $47.7 million on the acquisition date, resulting

in total value of $187.1 million. In conjunction with the revaluation, the Company recognized a gain of $20.5 million, recorded

in “Other income, net” in the Consolidated Statements of Income, for the amount by which the fair value of the 30% equity interest

exceeded its previous carrying value.

The Company acquired the remaining 70% interest in Costa for cash consideration of €95 million ($135.7 million). The

Company revalued its previous 30% equity interest to fair value of approximately $46.2 million on the acquisition date, resulting

in total value of $181.9 million. In conjunction with the revaluation, the Company recognized a gain of $29.4 million, recorded

in “Other income, net” in the Consolidated Statements of Income, for the amount by which the fair value of the 30% equity interest

exceeded its previous carrying value.