Western Union 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50

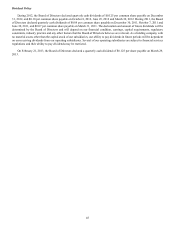

• Generating and deploying cash flow for shareholders - We currently anticipate continuing to return capital to our shareholders

in 2013 through dividends and share repurchases.

Significant factors affecting our financial condition and results of operations include:

• Transaction volume - Transaction volume is the primary generator of revenue in our businesses. Transaction volume in our

Consumer-to-Consumer segment is affected by, among other things, the size of the international migrant population,

individual needs to transfer funds, and global and regional economic trends. For more information, refer to the Consumer-

to-Consumer segment discussion below.

• Competition - We continue to face robust competition in each of our segments. In the year ended December 31, 2012,

competitive pressures, including with respect to pricing in certain key corridors, adversely impacted our Consumer-to-

Consumer segment.

• Consumer Value Proposition - Revenue is also impacted by our overall value proposition, including with respect to our

consumer experience, the fees we charge consumers, the principal sent per transaction and the variance in the exchange

rate set by us to the customer and the rate at which we or our agents are able to acquire the currency.

• Regulatory Compliance - Our services are subject to an increasingly strict set of legal and regulatory requirements. The

number and complexity of regulations around the world and the pace at which regulation is changing are factors that pose

significant challenges to our business. We have made, and continue to make, enhancements to our processes and systems

designed to detect and prevent money laundering, terrorist financing, and fraud and other illicit activity. These and other

enhancements have resulted in, and in coming quarters we expect them to continue to result in, changes to certain of our

business practices and increased costs. Some of these changes have had, and we believe will continue to have, an adverse

effect on our business, financial condition and results of operations. See “Operating Expense Overview - Enhanced

Regulatory Compliance” for more information.

• Cost Structure - As described earlier, in the fourth quarter of 2012, we began implementing additional initiatives to improve

productivity and reduce costs. We expect to implement additional productivity and cost-savings initiatives throughout 2013,

and we expect to incur approximately $45 million of expenses related to these initiatives in 2013. These initiatives are

expected to result in approximately $30 million of estimated cost savings in 2013 and approximately $45 million of estimated

cost savings in 2014, if all actions are implemented as contemplated. Much of our cost structure is comprised of agent

commissions, which are generally variable and fluctuate as revenues fluctuate. However, we expect agent commissions as

a percentage of revenue to increase in 2013 primarily due to the renewal of certain strategic agent agreements. We also

expect to increase expenses in 2013 related to investments to support initiatives to continue expanding the digital and account

based electronic channels for money transfers for consumers and to increase product offerings. In addition, we expect

increased expenses related to compliance program costs.

• Exchange Rates - Fluctuations in the exchange rate between the United States dollar and other currencies impact our

transaction fee and foreign exchange revenue. The impact to earnings per share is less than the revenue impact due to the

translation of expenses and our foreign currency hedging program.

Spin-off from First Data

We were incorporated in Delaware as a wholly-owned subsidiary of First Data on February 17, 2006. On September 29, 2006,

First Data distributed all of its money transfer and consumer payments businesses and its interest in a Western Union money

transfer agent, as well as its related assets, including real estate, through a tax-free distribution to First Data shareholders (“Spin-

off”).

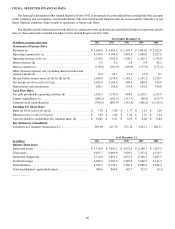

Basis of Presentation

The financial statements in this Annual Report on Form 10-K are presented on a consolidated basis and include the accounts

of our Company and its majority-owned subsidiaries. All significant intercompany transactions and accounts have been eliminated.