Western Union 2012 Annual Report Download - page 131

Download and view the complete annual report

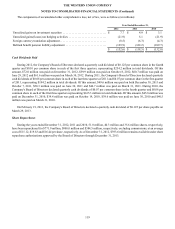

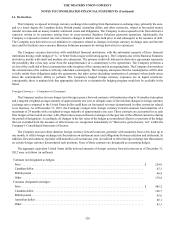

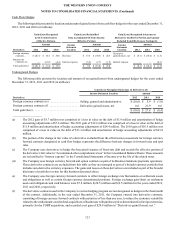

Please find page 131 of the 2012 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

126

On August 22, 2011, the Company issued $400.0 million of aggregate principal amount of unsecured notes due August 22,

2018 (“2018 Notes”). Interest with respect to the 2018 Notes is payable semi-annually in arrears on February 22 and August 22

of each year, based on the fixed per annum interest rate of 3.650%. The 2018 Notes are subject to covenants that, among other

things, limit or restrict the ability of the Company to sell or transfer assets or merge or consolidate with another company, and

limit or restrict the Company's and certain of its subsidiaries' ability to incur certain types of security interests, or enter into certain

sale and leaseback transactions. If a change of control triggering event occurs, holders of the 2018 Notes may require the Company

to repurchase some or all of their notes at a price equal to 101% of the principal amount of their notes, plus any accrued and unpaid

interest. The Company may redeem the 2018 Notes at any time prior to maturity at the greater of par or a price based on the

applicable treasury rate plus 35 basis points.

On March 7, 2011, the Company issued $300.0 million of aggregate principal amount of unsecured floating rate notes due

March 7, 2013 (“2013 Notes”). Interest with respect to the 2013 Notes is payable quarterly in arrears on each March 7, June 7,

September 7 and December 7, beginning June 7, 2011, at a per annum interest rate equal to the three-month LIBOR plus 58 basis

points (reset quarterly). The 2013 Notes are subject to covenants that, among other things, limit or restrict the ability of the Company

to sell or transfer assets or merge or consolidate with another company, and limit or restrict the Company's and certain of its

subsidiaries' ability to incur certain types of security interests, or enter into sale and leaseback transactions. If a change of control

triggering event occurs, holders of the 2013 Notes may require the Company to repurchase some or all of their notes at a price

equal to 101% of the principal amount of their notes, plus any accrued and unpaid interest. The Company has the ability to use

existing financing sources, including the Revolving Credit Facility or commercial paper program, and cash, including cash generated

from operations and proceeds from the 2015 Notes and 2017 Notes to repay this debt obligation.

On June 21, 2010, the Company issued $250.0 million of aggregate principal amount of unsecured notes due June 21, 2040

(“2040 Notes”). Interest with respect to the 2040 Notes is payable semi-annually on June 21 and December 21 each year based

on the fixed per annum interest rate of 6.200%. The 2040 Notes are subject to covenants that, among other things, limit or restrict

the Company's and certain of its subsidiaries' ability to grant certain types of security interests or enter into sale and leaseback

transactions. The Company may redeem the 2040 Notes at any time prior to maturity at the greater of par or a price based on the

applicable treasury rate plus 30 basis points.

On March 30, 2010, the Company exchanged $303.7 million of aggregate principal amount of the 2011 Notes for unsecured

notes due April 1, 2020 (“2020 Notes”). Interest with respect to the 2020 Notes is payable semi-annually on April 1 and October

1 each year based on the fixed per annum interest rate of 5.253%. In connection with the exchange, note holders were given a 7%

premium ($21.2 million), which approximated market value at the exchange date, as additional principal. As this transaction was

accounted for as a debt modification, this premium was not charged to expense. Rather, the premium, along with the offsetting

hedge accounting adjustments, will be accreted into “Interest expense” over the life of the notes. The 2020 Notes are subject to

covenants that, among other things, limit or restrict the Company's and certain of its subsidiaries' ability to grant certain types of

security interests, incur debt (in the case of significant subsidiaries), or enter into sale and leaseback transactions. The Company

may redeem the 2020 Notes at any time prior to maturity at the greater of par or a price based on the applicable treasury rate plus

15 basis points.

The 2020 Notes were originally issued in reliance on exemptions from the registration requirements of the Securities Act of

1933, as amended (the “Securities Act”). On October 8, 2010, the Company exchanged the 2020 Notes for notes registered under

the Securities Act, pursuant to the terms of a Registration Rights Agreement.

On February 26, 2009, the Company issued $500.0 million of aggregate principal amount of unsecured notes due February

26, 2014 (“2014 Notes”). Interest with respect to the 2014 Notes is payable semi-annually on February 26 and August 26 each

year based on the fixed per annum interest rate of 6.500%. The 2014 Notes are subject to covenants that, among other things, limit

or restrict the Company's and certain of its subsidiaries' ability to grant certain types of security interests or enter into sale and

leaseback transactions. The Company may redeem the 2014 Notes at any time prior to maturity at the greater of par or a price

based on the applicable treasury rate plus 50 basis points.

On November 17, 2006, the Company issued $1.0 billion aggregate principal amount of 5.400% Notes due 2011 (“2011

Notes”) and $500.0 million aggregate principal amount of 6.200% Notes due 2036 (“2036 Notes”). The 2011 Notes were redeemed

upon maturity in November 2011.