Western Union 2012 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2012 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

119

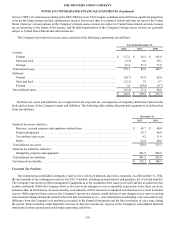

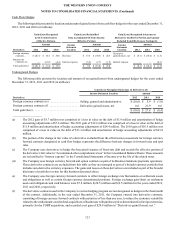

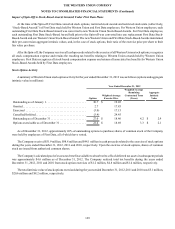

The components of accumulated other comprehensive loss, net of tax, were as follows (in millions):

Year Ended December 31,

2012 2011 2010

Unrealized gains on investment securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 7.7 $ 4.9 $ 3.1

Unrealized gains/(losses) on hedging activities . . . . . . . . . . . . . . . . . . . . . . . . . . (21.9) 5.1 (21.9)

Foreign currency translation adjustment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (8.5)(6.3)(4.3)

Defined benefit pension liability adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . . . (129.9)(122.2)(109.7)

$(152.6)$ (118.5)$ (132.8)

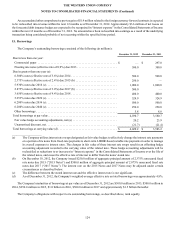

Cash Dividends Paid

During 2012, the Company's Board of Directors declared a quarterly cash dividend of $0.125 per common share in the fourth

quarter and $0.10 per common share in each of the first three quarters, representing $254.2 million in total dividends. Of this

amount, $72.0 million was paid on December 31, 2012, $59.9 million was paid on October 8, 2012, $60.7 million was paid on

June 29, 2012 and $61.6 million was paid on March 30, 2012. During 2011, the Company's Board of Directors declared quarterly

cash dividends of $0.08 per common share in each of the last three quarters of 2011 and $0.07 per common share in the first quarter

of 2011, representing $194.2 million in total dividends. Of this amount, $49.6 million was paid on both December 30, 2011 and

October 7, 2011, $50.3 million was paid on June 30, 2011 and $44.7 million was paid on March 31, 2011. During 2010, the

Company's Board of Directors declared quarterly cash dividends of $0.07 per common share in the fourth quarter and $0.06 per

common share in each of the first three quarters representing $165.3 million in total dividends. Of this amount, $45.8 million was

paid on December 31, 2010, $39.4 million was paid on October 14, 2010, $39.6 million was paid on June 30, 2010 and $40.5

million was paid on March 31, 2010.

On February 21, 2013, the Company's Board of Directors declared a quarterly cash dividend of $0.125 per share payable on

March 29, 2013.

Share Repurchases

During the years ended December 31, 2012, 2011 and 2010, 51.0 million, 40.3 million and 35.6 million shares, respectively,

have been repurchased for $771.9 million, $800.0 million and $584.5 million, respectively, excluding commissions, at an average

cost of $15.12, $19.83 and $16.44 per share, respectively. As of December 31, 2012, $393.6 million remains available under share

repurchase authorizations approved by the Board of Directors through December 31, 2013.