Western Union 2012 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2012 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.89

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Formation of the Entity and Basis of Presentation

The Western Union Company (“Western Union” or the “Company”) is a leader in global money movement and payment

services, providing people and businesses with fast, reliable and convenient ways to send money and make payments around the

world. The Western Union® brand is globally recognized. The Company’s services are available through a network of agent

locations in more than 200 countries and territories. Each location in the Company’s agent network is capable of providing one

or more of the Company’s services.

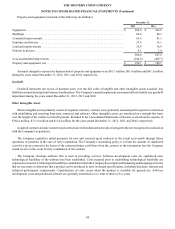

The Western Union business consists of the following segments:

• Consumer-to-Consumer - The Consumer-to-Consumer operating segment facilitates money transfers between two

consumers, primarily through a network of third-party agents. The Company's multi-currency, real-time money transfer

service is viewed by the Company as one interconnected global network where a money transfer can be sent from one

location to another, around the world. This service is available for international cross-border transfers - that is, the transfer

of funds from one country to another - and, in certain countries, intra-country transfers - that is, money transfers from

one location to another in the same country. This segment also includes money transfer transactions that can be initiated

through the Company's websites and account based money transfers.

• Consumer-to-Business - The Consumer-to-Business operating segment facilitates bill payments from consumers to

businesses and other organizations, including utilities, auto finance companies, mortgage servicers, financial service

providers, government agencies and other businesses. This segment consists of United States bill payments, Pago Fácil

(bill payments in Argentina), and international bill payments. The significant majority of the segment's revenue was

generated in the United States during all periods presented.

• Business Solutions - The Business Solutions operating segment facilitates payment and foreign exchange solutions,

primarily cross-border, cross-currency transactions, for small and medium size enterprises and other organizations and

individuals. The majority of the segment's business relates to exchanges of currency at the spot rate which enables

customers to make cross-currency payments. In addition, in certain countries, the Company writes foreign currency

forward and option contracts for customers to facilitate future payments. Travelex Global Business Payments (“TGBP”),

which was acquired in November 2011 (see Note 3), is included in this segment.

All businesses that have not been classified in the above segments are reported as “Other” and include the Company's money

order, prepaid services, mobile money transfer, and other businesses and services, in addition to costs for the investigation and

closing of acquisitions.

The Company's previously reported segments were Consumer-to-Consumer, Global Business Payments, and Other. The

changes in the Company's segment structure primarily relate to the separation of the Global Business Payments segment into two

new reportable segments, Consumer-to-Business and Business Solutions. All prior segment information has been reclassified to

reflect these new segments.

There are legal or regulatory limitations on transferring certain assets of the Company outside of the countries where these

assets are located, or these assets constitute undistributed earnings of affiliates of the Company accounted for under the equity

method of accounting. However, there are generally no limitations on the use of these assets within those countries. Additionally,

the Company must meet minimum capital requirements in some countries in order to maintain operating licenses. As of

December 31, 2012, the amount of net assets subject to these limitations totaled approximately $305 million.

Various aspects of the Company’s services and businesses are subject to United States federal, state and local regulation, as

well as regulation by foreign jurisdictions, including certain banking and other financial services regulations.