Western Union 2012 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2012 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

114

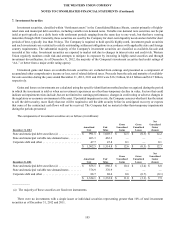

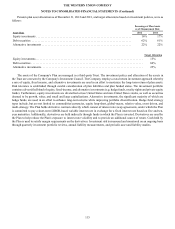

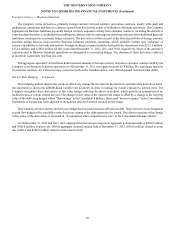

The following table provides the components of net periodic benefit cost for the Plan (in millions):

Year Ended December 31,

2012 2011 2010

Interest cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 14.7 $ 17.9 $ 20.1

Expected return on plan assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (20.8)(21.3)(20.4)

Amortization of actuarial loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.5 8.1 6.2

Net periodic benefit cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4.4 $ 4.7 $ 5.9

The accrued loss related to the pension liability included in “Accumulated other comprehensive loss”, net of tax, increased

$7.7 million, $12.5 million and $3.9 million in 2012, 2011 and 2010, respectively.

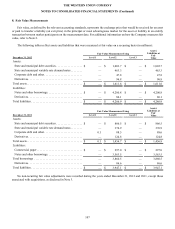

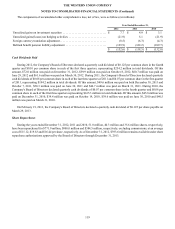

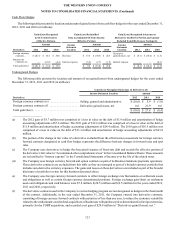

The rate assumptions used in the measurement of the Company's benefit obligation were as follows:

2012 2011

Discount rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.03% 3.72%

The rate assumptions used in the measurement of the Company's net cost were as follows:

2012 2011 2010

Discount rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.72% 4.69% 5.30%

Expected long-term return on plan assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.00% 7.00% 6.50%

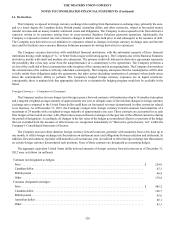

The Company measures the Plan's obligations and annual expense using assumptions that reflect best estimates and are

consistent to the extent that each assumption reflects expectations of future economic conditions. As the bulk of the pension benefits

will not be paid for many years, the computation of pension expenses and benefits is based on assumptions about future interest

rates and expected rates of return on plan assets. In general, pension obligations are most sensitive to the discount rate assumption,

and it is set based on the rate at which the pension benefits could be settled effectively. The discount rate is determined by matching

the timing and amount of anticipated payouts under the Plan to the rates from an AA spot rate yield curve. The curve is derived

from AA bonds of varying maturities.

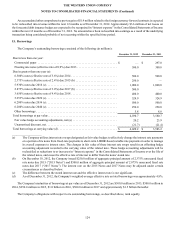

The estimated undiscounted future benefit payments are expected to be $39.2 million in 2013, $37.8 million in 2014, $36.3

million in 2015, $34.8 million in 2016, $33.2 million in 2017 and $141.0 million in 2018 through 2022.

The Company employs a building block approach in determining the long-term rate of return for plan assets. Historical markets

are studied and long-term historical risk, return, and co-variance relationships between equities, fixed-income securities, and

alternative investments are considered consistent with the widely accepted capital market principle that assets with higher volatility

generate a greater return over the long run. Current market factors such as inflation and interest rates are evaluated before long-

term capital market assumptions are determined. Consideration is given to diversification, re-balancing and yields anticipated on

fixed income securities held. Historical returns are reviewed within the context of current economic conditions to check for

reasonableness and appropriateness. The Company then applies this rate against a calculated value for its plan assets. The calculated

value recognizes changes in the fair value of plan assets over a five-year period.