Western Union 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

99

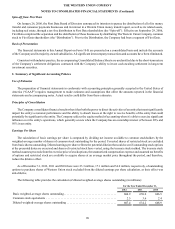

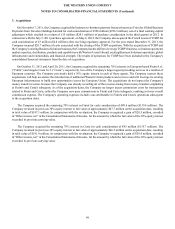

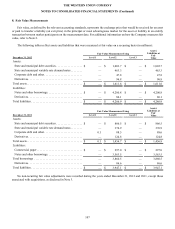

All assets and liabilities have been recorded at fair value, excluding deferred tax liabilities. The following table summarizes

the final allocations of consideration for TGBP, Finint and Costa (in millions):

Travelex Global

Business

Payments (b) Finint S.r.l.

Angelo Costa

S.r.l.

Assets:

Cash and cash equivalents. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 30.7 $ — $ —

Settlement assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 160.4 52.2 46.3

Property and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.1 0.5 3.0

Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 704.3 153.6 174.2

Other intangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 314.2 64.8 51.4

Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45.3 2.0 1.5

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,260.0 $ 273.1 $ 276.4

Liabilities:

Accounts payable and accrued liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 49.6 $ 6.1 $ 10.8

Settlement obligations. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 160.4 57.5 55.7

Income taxes payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.7 3.1 10.3

Deferred tax liability, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65.5 15.8 15.5

Other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21.5 3.5 2.2

Total liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 298.7 86.0 94.5

Total consideration (a). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 961.3 $ 187.1 $ 181.9

____________________

(a) Total consideration includes cash consideration transferred and the revaluation of the Company's previous equity

interest, if any, to fair value on the acquisition date.

(b) Amounts include the impact of the acquisition of the French assets of TGBP on May 4, 2012 and the final working

capital adjustment in the third quarter of 2012.

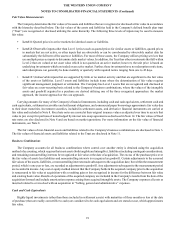

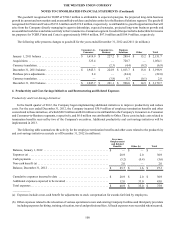

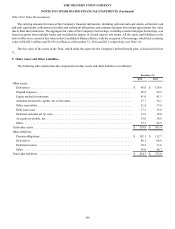

The valuation of assets acquired was derived using primarily unobservable Level 3 inputs, which require significant

management judgment and estimation, and resulted in identifiable intangible assets as follows (in millions):

Travelex Global

Business

Payments (a) Finint S.r.l.

Angelo Costa

S.r.l.

Customer and other contractual relationships . . . . . . . . . . . . . . . . . . . . . . . . . $ 264.5 $ — $ —

Network of subagents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 53.9 44.6

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49.7 10.9 6.8

Total identifiable intangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 314.2 $ 64.8 $ 51.4

____________________

(a) Amounts include the impact of the acquisition of the French assets of TGBP on May 4, 2012.

Customer and other contractual relationships and network of subagents identifiable intangible assets were valued using an

income approach and are being amortized over 9 to 15 years. Other intangibles were valued using both income and cost approaches

and are being amortized over one to five years. For the remaining assets and liabilities, excluding goodwill and deferred tax

liabilities, fair value approximated carrying value.