Western Union 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.70

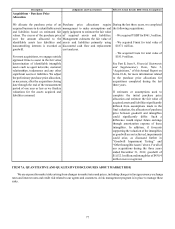

Pension Plan

We have one frozen defined benefit pension plan, for which we had recorded unfunded pension obligations of $102.1 million

and $112.7 million as of December 31, 2012 and 2011, respectively. In both years ended December 31, 2012 and 2011, we made

contributions of approximately $25 million to the Plan, including discretionary contributions of $5 million and $3 million,

respectively. We will be required to fund approximately $23 million to the Plan in 2013.

Our most recent measurement date for our pension plan was December 31, 2012. The calculation of the funded status and net

periodic benefit income is dependent upon two primary assumptions: 1) expected long-term return on plan assets; and 2) discount

rate.

We employ a building block approach in determining the long-term rate of return for plan assets. Historical markets are studied

and long-term historical risk, return, and co-variance relationships between equities, fixed-income securities, and alternative

investments are considered consistent with the widely accepted capital market principle that assets with higher volatility generate

a greater return over the long run. Current market factors such as inflation and interest rates are evaluated before long-term capital

market assumptions are determined. Consideration is given to diversification, re-balancing and yields anticipated on fixed income

securities held. Historical returns are reviewed within the context of current economic conditions to check for reasonableness and

appropriateness. We then apply this rate against a calculated value for our plan assets. The calculated value recognizes changes

in the fair value of plan assets over a five-year period. Our expected long-term return on plan assets was 7.00% for 2012 and 2011.

The expected long-term return on plan assets is 7.00% for 2013. As of December 31, 2012, pension plan target allocations were

approximately 15% in equity investments, 60% in debt securities and 25% in alternative investment strategies (e.g. hedge funds,

royalty rights and private equity funds). Hedge fund strategy types include, but are not limited to: commodities/currencies, equity

long-short, relative value, multi-strategy, event driven, and global-macro. The Plan holds derivative contracts directly which consist

of interest rate swap agreements, under which the Plan is committed to pay a short-term LIBOR-based variable interest rate in

exchange for a fixed interest rate based on five and ten-year maturities. Additionally, derivatives are held indirectly through funds

in which the Plan is invested. Derivatives are used by the Plan to help reduce the Plan's exposure to interest rate volatility and to

provide an additional source of return. Cash held by the Plan is used to satisfy margin requirements on the derivatives. Investment

risk is measured and monitored on an ongoing basis through quarterly investment portfolio reviews, annual liability measurements,

and periodic asset and liability studies.

The discount rate assumption is set based on the rate at which the pension benefits could be settled effectively. The discount

rate is determined by matching the timing and amount of anticipated payouts under the Plan to the rates from an AA spot rate yield

curve. The curve is derived from AA bonds of varying maturities. The discount rate assumption for our benefit obligation was

3.03% and 3.72% as of December 31, 2012 and 2011, respectively. A 100 basis point change to both the discount rate and long-

term rate of return on plan assets would not have a material impact to our annual pension expense.