Western Union 2012 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2012 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

124

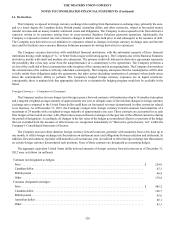

An accumulated other comprehensive pre-tax gain of $1.9 million related to the foreign currency forward contracts is expected

to be reclassified into revenue within the next 12 months as of December 31, 2012. Approximately $3.6 million of net losses on

the forecasted debt issuance hedges are expected to be recognized in “Interest expense” in the Consolidated Statements of Income

within the next 12 months as of December 31, 2012. No amounts have been reclassified into earnings as a result of the underlying

transaction being considered probable of not occurring within the specified time period.

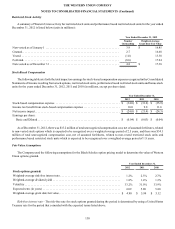

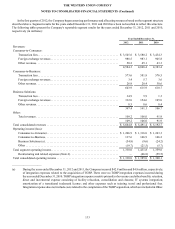

15. Borrowings

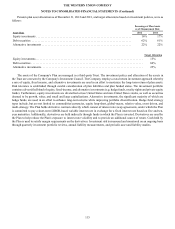

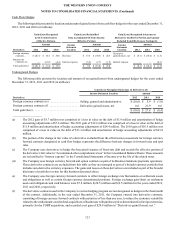

The Company’s outstanding borrowings consisted of the following (in millions):

December 31, 2012 December 31, 2011

Due in less than one year:

Commercial paper . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ 297.0

Floating rate notes (effective rate of 0.9%) due 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . 300.0 300.0

Due in greater than one year (a):

6.500% notes (effective rate of 5.6%) due 2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 500.0 500.0

2.375% notes (effective rate of 2.4%) due 2015 (b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 250.0 —

5.930% notes due 2016 (c). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,000.0 1,000.0

2.875% notes (effective rate of 3.0%) due 2017 (b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 500.0 —

3.650% notes (effective rate of 4.4%) due 2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 400.0 400.0

5.253% notes due 2020 (c). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 324.9 324.9

6.200% notes due 2036 (c). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 500.0 500.0

6.200% notes due 2040 (c). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 250.0 250.0

Other borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.8 8.8

Total borrowings at par value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,030.7 3,580.7

Fair value hedge accounting adjustments, net (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20.2 23.9

Unamortized discount, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (21.7)(21.4)

Total borrowings at carrying value (d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,029.2 $ 3,583.2

____________________

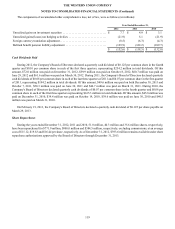

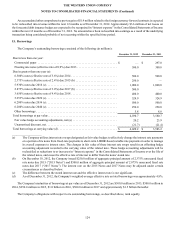

(a) The Company utilizes interest rate swaps designated as fair value hedges to effectively change the interest rate payments

on a portion of its notes from fixed-rate payments to short-term LIBOR-based variable rate payments in order to manage

its overall exposure to interest rates. The changes in fair value of these interest rate swaps result in an offsetting hedge

accounting adjustment recorded to the carrying value of the related note. These hedge accounting adjustments will be

reclassified as reductions to or increases in “Interest expense” in the Consolidated Statements of Income over the life of

the related notes, and cause the effective rate of interest to differ from the notes’ stated rate.

(b) On December 10, 2012, the Company issued $250.0 million of aggregate principal amount of 2.375% unsecured fixed

rate notes due 2015 (“2015 Notes”) and $500.0 million of aggregate principal amount of 2.875% unsecured fixed rate

notes due 2017 (“2017 Notes”). The interest rate on the 2015 Notes and 2017 Notes may be adjusted under certain

circumstances as described below.

(c) The difference between the stated interest rate and the effective interest rate is not significant.

(d) As of December 31, 2012, the Company's weighted-average effective rate on total borrowings was approximately 4.8%.

The Company's maturities of borrowings at par value as of December 31, 2012 are $300.0 million in 2013, $500.0 million in

2014, $250.0 million in 2015, $1.0 billion in 2016, $500.0 million in 2017 and approximately $1.5 billion thereafter.

The Company's obligations with respect to its outstanding borrowings, as described above, rank equally.